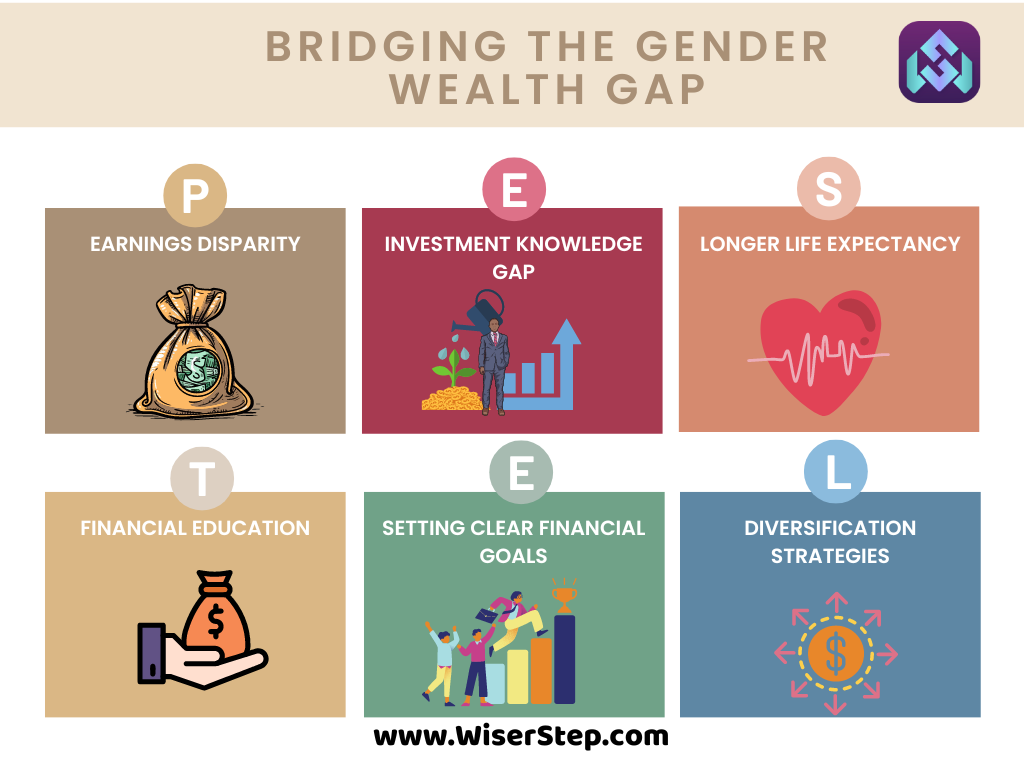

The gender wealth gap remains a persistent issue, with women often facing unique challenges when it comes to building financial security through investing. In this blog, we will delve into the factors contributing to the gap and explore strategies for women to empower themselves financially through investment.

Understanding the Gender Wealth Gap

Earnings Disparity

Women, on average, earn less than their male counterparts. This wage gap directly impacts the ability to invest, as a smaller income means less available for saving and investing. Addressing workplace inequality is crucial for narrowing this financial divide.

Investment Knowledge Gap

Studies show that women tend to be less confident in their investment knowledge compared to men. This lack of confidence can lead to hesitancy in entering the investment arena. Encouraging financial education for women is key to boosting their confidence and competence in investment decisions.

Longer Life Expectancy

Women typically live longer than men, requiring a more extended period of financial support in retirement. This longevity amplifies the importance of building a robust investment portfolio to sustain financial well-being throughout retirement.

Strategies for Closing the Gender Wealth Gap through Investing

Financial Education and Empowerment

Bridging the investment knowledge gap begins with comprehensive financial education. Encourage women to attend workshops, webinars, and seminars focused on investment basics. Empowerment comes through knowledge and understanding.

Setting Clear Financial Goals

Establishing clear financial goals is crucial for any investor, and women are no exception. Encourage women to define short-term and long-term financial objectives, whether it be homeownership, education, or retirement. Having goals provides a roadmap for investment strategies.

Diversification Strategies

Diversifying an investment portfolio helps manage risk. Explain the concept of diversification and the importance of spreading investments across various asset classes. Discuss the potential benefits of stocks, bonds, and other investment vehicles.

The Power of Compounding

Emphasize the power of compounding, particularly considering women’s longer life expectancies. Showcasing how starting to invest early can significantly impact wealth accumulation over time reinforces the importance of taking action now.

Utilizing Tax-Advantaged Accounts

Explain the benefits of tax-advantaged accounts like IRAs and 401(k)s. These accounts offer tax benefits and can be powerful tools in building retirement savings. Encourage women to take advantage of employer-sponsored retirement plans.

Overcoming Risk Aversion

Address the tendency for women to be more risk-averse than men when it comes to investing. Educate them on different risk levels associated with various investments and emphasize the importance of finding a balance that aligns with their comfort level and financial goals.

Networking and Mentorship

Establishing connections with experienced investors and seeking mentorship can provide valuable insights and guidance. Encourage women to join investment clubs, attend networking events, and actively seek mentorship opportunities within the financial community.

Impact Investing

Highlight the rise of impact investing, where individuals align their investments with social and environmental causes. Women, often more attuned to social issues, can leverage impact investing to align their values with their financial decisions.

Taking Control of Financial Planning

Encourage women to actively participate in financial planning. Whether managing investments independently or working with a financial advisor, taking control of one’s financial future is empowering and critical for closing the gender wealth gap.

Closing the gender wealth gap in investing requires a multifaceted approach. By addressing income disparities, boosting financial education, and empowering women to take control of their financial destinies, we can work towards creating a more equitable financial landscape. As women embrace the opportunities within the world of investing, they not only secure their own financial future but contribute to dismantling the barriers that perpetuate the gender wealth gap.