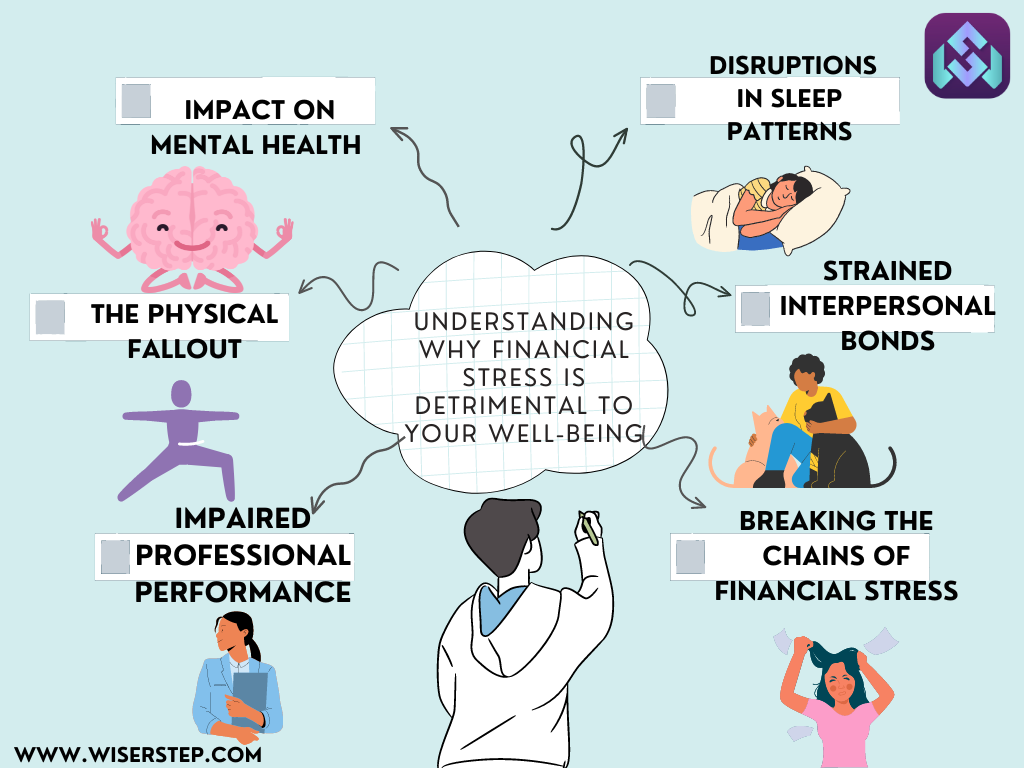

In the intricate dance of life, few partners are as uninvited and burdensome as financial stress. Whether it’s the relentless pressure of mounting debt, the anxiety of living paycheck to paycheck, or the uncertainty of an unpredictable financial future, the toll that financial stress takes on our well-being is both profound and pervasive.

The Silent Aggressor: Impact on Mental Health

Financial stress is a silent aggressor that infiltrates our thoughts, seeping into the very fabric of our mental well-being. The constant worry about bills, debt, and financial stability can lead to heightened anxiety and, in some cases, clinical depression. The mind, burdened by financial stress, may struggle to find respite, impacting its ability to focus, make sound decisions, and experience joy in everyday life.

Research consistently shows a strong correlation between financial stress and mental health issues. Individuals grappling with financial difficulties are more likely to report symptoms of depression and anxiety, creating a vicious cycle where mental health challenges exacerbate financial stress, and vice versa.

The Sleep Thief: Disruptions in Sleep Patterns

One of the first casualties of financial stress is often a good night’s sleep. The relentless worry and anxiety associated with financial concerns can lead to insomnia, difficulty falling asleep, or disrupted sleep patterns. Quality sleep is essential for overall well-being, affecting cognitive function, emotional regulation, and physical health.

Chronic sleep disruptions can contribute to a host of health problems, including a weakened immune system, increased susceptibility to illnesses, and heightened stress levels during waking hours. In essence, financial stress not only robs us of our peace of mind but also steals the vital restoration and rejuvenation that sleep should provide.

The Physical Fallout: Aches, Pains, and More

The impact of financial stress extends beyond the realm of the mind, manifesting itself in various physical ailments. Headaches, muscle tension, digestive problems, and other stress-related physical symptoms often become unwelcome companions for those navigating financial difficulties

Stress triggers the release of hormones like cortisol, which, when consistently elevated, can lead to inflammation and a range of health issues. From tension headaches caused by the clenching of jaw muscles to digestive discomfort linked to stress-induced changes in gut function, the physical toll of financial stress is a palpable reminder of the interconnectedness of mind and body.

The Relationship Dilemma: Strained Interpersonal Bonds

Financial stress has the power to strain even the most robust of interpersonal relationships. Couples, families, and friendships may find themselves navigating uncharted territories as the weight of financial worries takes center stage. Arguments over money, differing financial priorities, and the strain of shared financial responsibilities can erode the foundation of relationships.

The emotional toll of financial stress can create a wedge between partners, leading to communication breakdowns, feelings of resentment, and a sense of isolation. When financial concerns become a constant presence, individuals may find themselves grappling not only with personal stress but also with the added burden of strained relationships.

The Productivity Paradox: Impaired Professional Performance

Financial stress doesn’t clock out when you enter the workplace; it follows you, often casting a shadow over professional pursuits. The preoccupation with financial concerns can impair cognitive function, decision-making abilities, and overall job performance.

Employees dealing with financial stress may struggle to concentrate on tasks, experience decreased job satisfaction, and grapple with absenteeism or presenteeism—being physically present but mentally preoccupied. The productivity paradox of financial stress is a reminder that the toll it takes goes beyond the personal realm, extending its reach into professional spheres.

Breaking the Chains of Financial Stress

Understanding the multifaceted impact of financial stress is the first step towards breaking free from its chains. Recognizing the interconnectedness of mental, physical, and interpersonal well-being underscores the importance of addressing financial stress proactively.

Financial literacy, strategic budgeting, seeking professional advice, and fostering open communication about financial matters are powerful tools in mitigating financial stress. Developing a sustainable financial plan, setting realistic goals, and embracing a mindset of financial wellness can gradually shift the narrative from stress and worry to empowerment and security.

In the symphony of life, financial stress need not be a dominating note. By acknowledging its detrimental effects and taking intentional steps towards financial well-being, individuals can reclaim control over their lives, allowing for a harmonious blend of financial stability and overall well-being. After all, true wealth encompasses more than just the numbers in a bank account; it extends to the richness of a life well-lived, free from the shackles of financial stress