Welcome to the world of banking, where the plethora of options for bank accounts can sometimes seem overwhelming. Understanding the different types of bank accounts available is crucial in managing your finances effectively. From savings to checking, each type serves a unique purpose, catering to various financial needs and goals. Let’s delve into the different types of bank accounts and explore which one might suit you best.

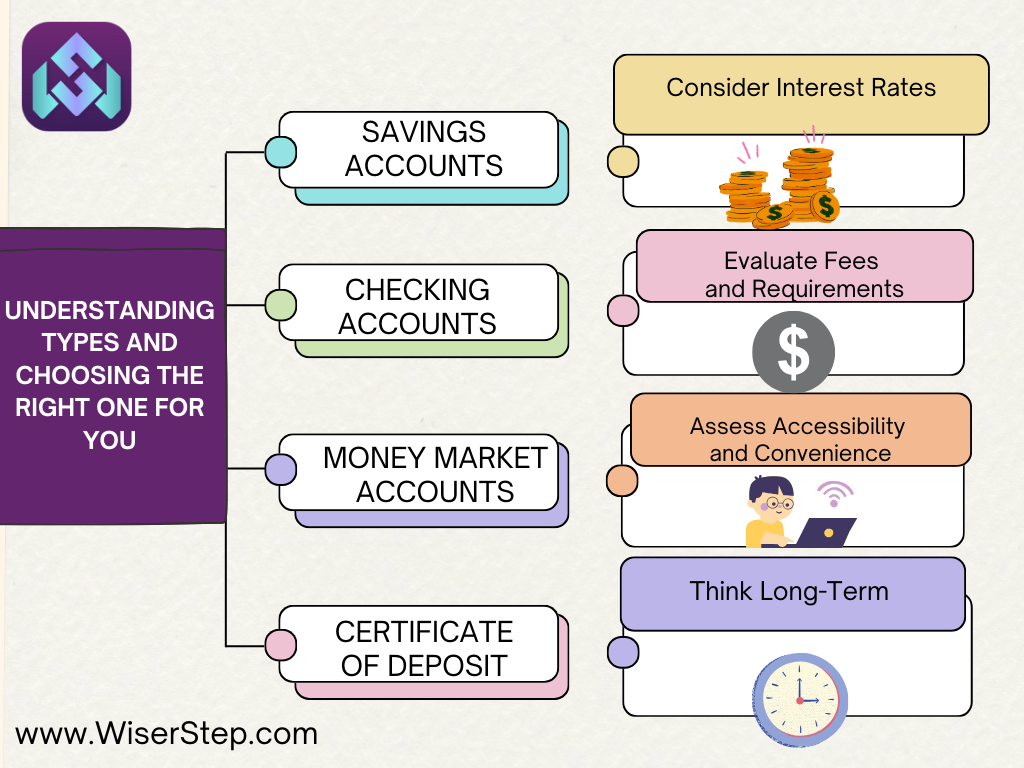

Types of Bank Accounts

Savings Accounts

Savings accounts are designed to help individuals save money over time while earning interest. These accounts usually have lower interest rates compared to other investment options but provide easy access to funds. They’re ideal for storing emergency funds or money for short-term goals.

Checking Accounts

Checking accounts are transactional accounts primarily used for everyday expenses. They offer features like check writing, ATM access, and debit card usage. While they may not accrue interest, they provide convenient access to funds for daily transactions.

Money Market Accounts

Money market accounts typically offer higher interest rates than regular savings accounts. They often have minimum balance requirements and limited check-writing abilities. These accounts are suitable for those looking to earn more interest while maintaining some liquidity.

Certificate of Deposit (CD)

CDs are time-bound savings accounts that offer fixed interest rates for a specific period. They usually provide higher interest rates than regular savings accounts but require you to lock in your money for a set duration, ranging from a few months to several years.

Individual Retirement Accounts (IRAs)

IRAs are designed to help individuals save for retirement. They offer tax advantages, and there are different types, including Traditional IRAs, Roth IRAs, and SEP IRAs. Each type has its own eligibility criteria, contribution limits, and tax implications.

Choosing the Right Bank Account

Identify Your Goals: Determine your financial objectives. Are you saving for short-term goals, building an emergency fund, or planning for retirement? Different accounts cater to different needs.

Consider Interest Rates

If you prioritize earning interest, compare the rates offered by various accounts. Money market accounts or CDs might be preferable if you seek higher yields with some restrictions on access.

Evaluate Fees and Requirements

Check for account fees, minimum balance requirements, and transaction limitations. Some accounts may waive fees based on specific conditions, such as maintaining a minimum balance or having direct deposits.

Assess Accessibility and Convenience

Consider your banking habits. If you need frequent access to funds for everyday transactions, a checking account might be more suitable. Ensure the bank has a robust online platform or mobile app for convenient banking.

Think Long-Term

For retirement planning, explore IRAs or long-term savings options that offer tax advantages and growth potential.

Conclusion

Selecting the right bank account involves understanding your financial goals, assessing the features offered by different account types, and matching them with your needs and preferences. Whether it’s for short-term savings, everyday transactions, or long-term financial security, choosing the right bank account is a vital step toward effective financial management. Evaluate the options available, consider your priorities, and make an informed decision to optimize your financial journey.