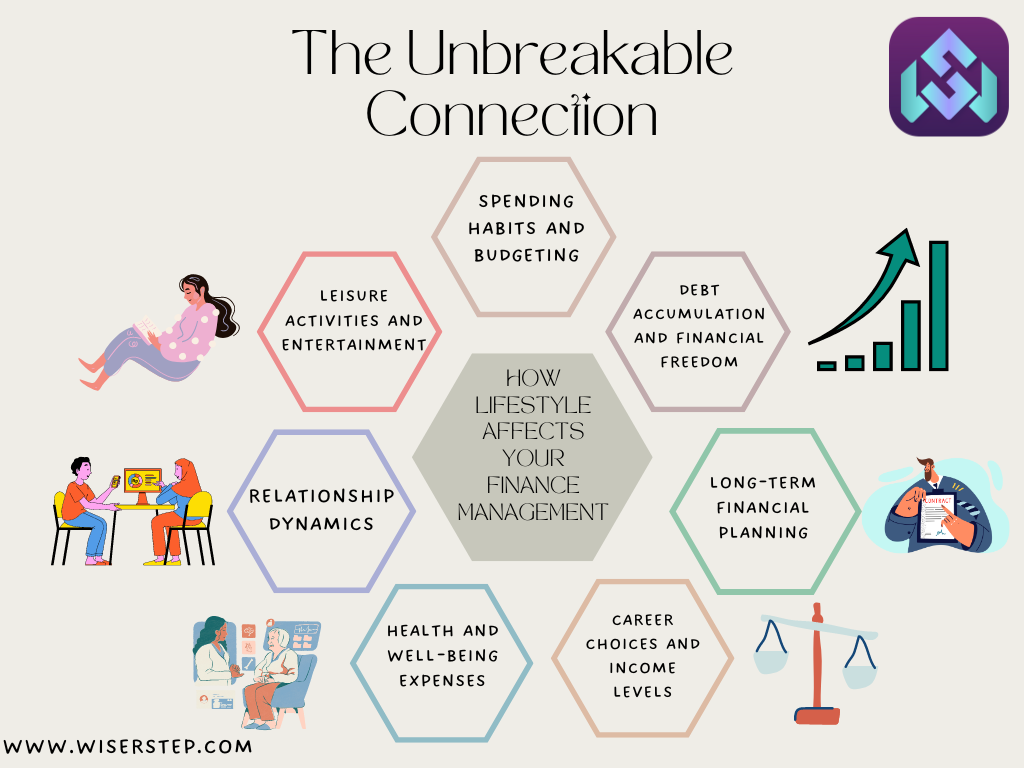

Your lifestyle and financial management are two intertwined aspects of your life. The way you choose to live, spend, and prioritize impacts your financial health, and conversely, the state of your finances influences the quality of your lifestyle. In this blog, we will explore the unbreakable connection between lifestyle choices and finance management, and how understanding this relationship can lead to a more prosperous and fulfilling life.

Spending Habits and Budgeting

Your spending habits play a significant role in your finance management. A lavish lifestyle with frequent splurges on non-essential items can quickly drain your finances, leading to debt and financial stress. On the other hand, adopting a frugal mindset and adhering to a well-crafted budget allows you to control your spending, save more, and invest wisely.

Debt Accumulation and Financial Freedom

The lifestyle choices you make can either lead to debt accumulation or financial freedom. Taking on excessive debt to maintain an extravagant lifestyle can hinder your ability to achieve long-term financial goals. Prioritizing debt reduction and living within your means empowers you to break free from the burden of debt and attain true financial independence.

Long-Term Financial Planning

Your lifestyle choices can influence your approach to long-term financial planning. A forward-thinking mindset encourages you to invest in retirement accounts, create emergency funds, and plan for major life events like buying a home or starting a family. Neglecting financial planning may leave you ill-prepared to face future challenges and opportunities.

Career Choices and Income Levels

The lifestyle you desire may necessitate a certain income level. Your career choices and professional development directly impact your earning potential. Pursuing a fulfilling career that aligns with your passions and skills can lead to higher income, allowing you to achieve your desired lifestyle without compromising your financial security.

Health and Well-being Expenses

Your lifestyle and health are closely intertwined. Adopting a healthy lifestyle with regular exercise and nutritious food choices can positively impact your overall well-being, leading to potential savings on medical expenses. Prioritizing health and well-being now can result in lower healthcare costs in the future.

Relationship Dynamics

Your relationships and family dynamics can significantly influence your finance management. Open communication and shared financial goals with your partner can lead to effective financial planning and collaboration. Conversely, financial conflicts within relationships can hinder financial progress and create stress.

Leisure Activities and Entertainment

Entertainment and leisure activities are essential for a balanced lifestyle, but excessive spending in this area can strain your finances. Embracing a mindful approach to leisure choices can help you strike a balance between enjoyment and responsible financial management.

Your lifestyle and finance management are intrinsically connected, with each aspect influencing the other in a perpetual cycle. Understanding this relationship is vital for achieving financial stability and enhancing your quality of life. By adopting prudent spending habits, managing debt responsibly, prioritizing long-term financial planning, making wise career choices, valuing health and well-being, fostering positive relationships, and balancing leisure activities, you can create a harmonious and prosperous life. Embrace the power of informed lifestyle choices and watch as your financial management transforms, unlocking a brighter and more fulfilling future. Remember, your journey towards financial success begins with mindful lifestyle choices and a commitment to building a secure and thriving financial foundation.