As we progress in our careers and earn more money, it’s natural to want to enjoy the fruits of our labor. However, an often-overlooked financial pitfall awaits many individuals: lifestyle inflation. This phenomenon occurs when as our incomes increase, so do our expenses, leading to a continuous cycle of financial stagnation. In this blog, we’ll explore what lifestyle inflation is, why it’s a problem, and most importantly, how to keep it in check to achieve lasting financial freedom.

What is Lifestyle Inflation?

Lifestyle inflation, also known as lifestyle creep, refers to the gradual increase in one’s spending as their income rises. It’s the tendency to upgrade our lifestyle, from buying a fancier car to dining at more upscale restaurants, as our paychecks get larger. While it’s natural to reward ourselves for hard work and success, unchecked lifestyle inflation can lead to financial stress, hinder long-term goals, and jeopardize our financial security.

Why Lifestyle Inflation Is a Problem

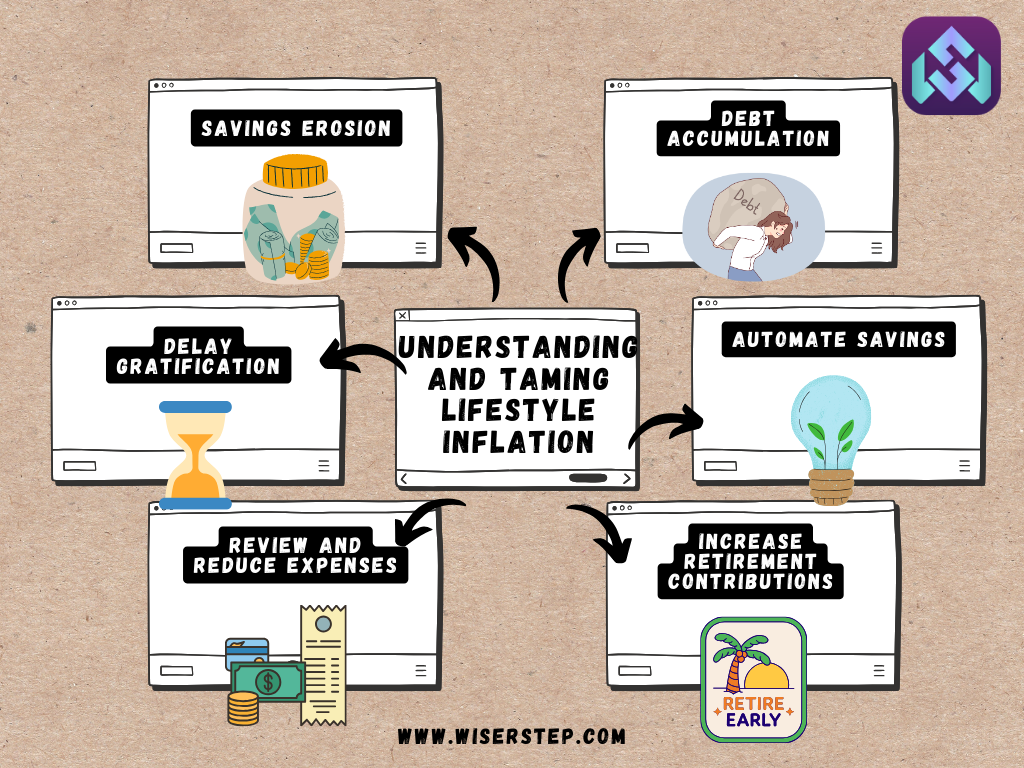

Lifestyle inflation can be insidious because it happens so gradually. You might not even notice the subtle shifts in spending habits until they accumulate into significant financial burdens. Here’s why it’s a problem

Savings Erosion

As you allocate more income to higher expenses, your ability to save and invest for future goals diminishes.

Debt Accumulation

Lifestyle inflation often leads to increased credit card debt and loans, as you finance new expenses.

Reduced Financial Security

With higher expenses, you’re less prepared for unexpected financial setbacks or emergencies.

Hindered Financial Goals

Lifestyle inflation can delay achieving major financial goals like homeownership or retirement savings.

How to Tame Lifestyle Inflation

Now that we understand the pitfalls of lifestyle inflation, let’s explore practical strategies to keep it in check

Create a Budget

Establishing a budget is the first step to understanding your spending patterns. Track your income and expenses to identify areas where lifestyle inflation might be occurring.

Differentiate Between Needs and Wants

Clearly distinguish between essential expenses (needs) and discretionary spending (wants). Prioritize your needs while carefully evaluating whether wants align with your long-term goals.

Set Financial Goals

Define your financial goals and create a plan to achieve them. Having specific objectives, such as saving for a down payment on a house or building an emergency fund, can help you resist unnecessary spending.

Automate Savings

Set up automated transfers to savings and investment accounts. This ensures that a portion of your income is saved before you have the chance to spend it on non-essential items.

Increase Retirement Contributions

Whenever you receive a raise or bonus, consider increasing your contributions to retirement accounts. This is a proactive way to put your extra income to work for your future.

Review and Reduce Expenses

Regularly evaluate your expenses to identify areas where you can cut back. Negotiate lower bills, cancel unused subscriptions, and make frugal choices when possible.

Delay Gratification

Instead of instantly upgrading your lifestyle with a new purchase, practice delayed gratification. Give yourself time to evaluate whether the expense aligns with your values and goals.

Save Windfalls

When you receive unexpected windfalls like tax refunds, bonuses, or gifts, resist the temptation to splurge. Allocate a portion of these funds towards your financial goals.

Track Your Net Worth

Monitor your net worth over time. This includes your assets (savings, investments, property) minus your debts. Aim to see consistent growth in your net worth.

Seek Accountability

Share your financial goals with a trusted friend or family member who can help keep you accountable to your financial plan.

Lifestyle inflation is a common financial trap that can undermine your financial stability and long-term goals. However, with awareness and deliberate actions, you can keep it in check. By creating a budget, setting clear financial goals, differentiating between needs and wants, and practicing delayed gratification, you can maintain a comfortable lifestyle while building a more secure financial future. Remember, the key to financial freedom is not just earning more, but managing your money wisely to make it work for you.