In today’s complex financial landscape, financial literacy has become an indispensable skill for individuals of all ages. Understanding the fundamentals of personal finance enables individuals to make informed decisions, effectively manage their money, and work towards achieving their financial goals. In this article, we will explore the importance of financial literacy and how the WiserStep app’s AI Chatbox provides personalized advice to empower users in the field of finance.

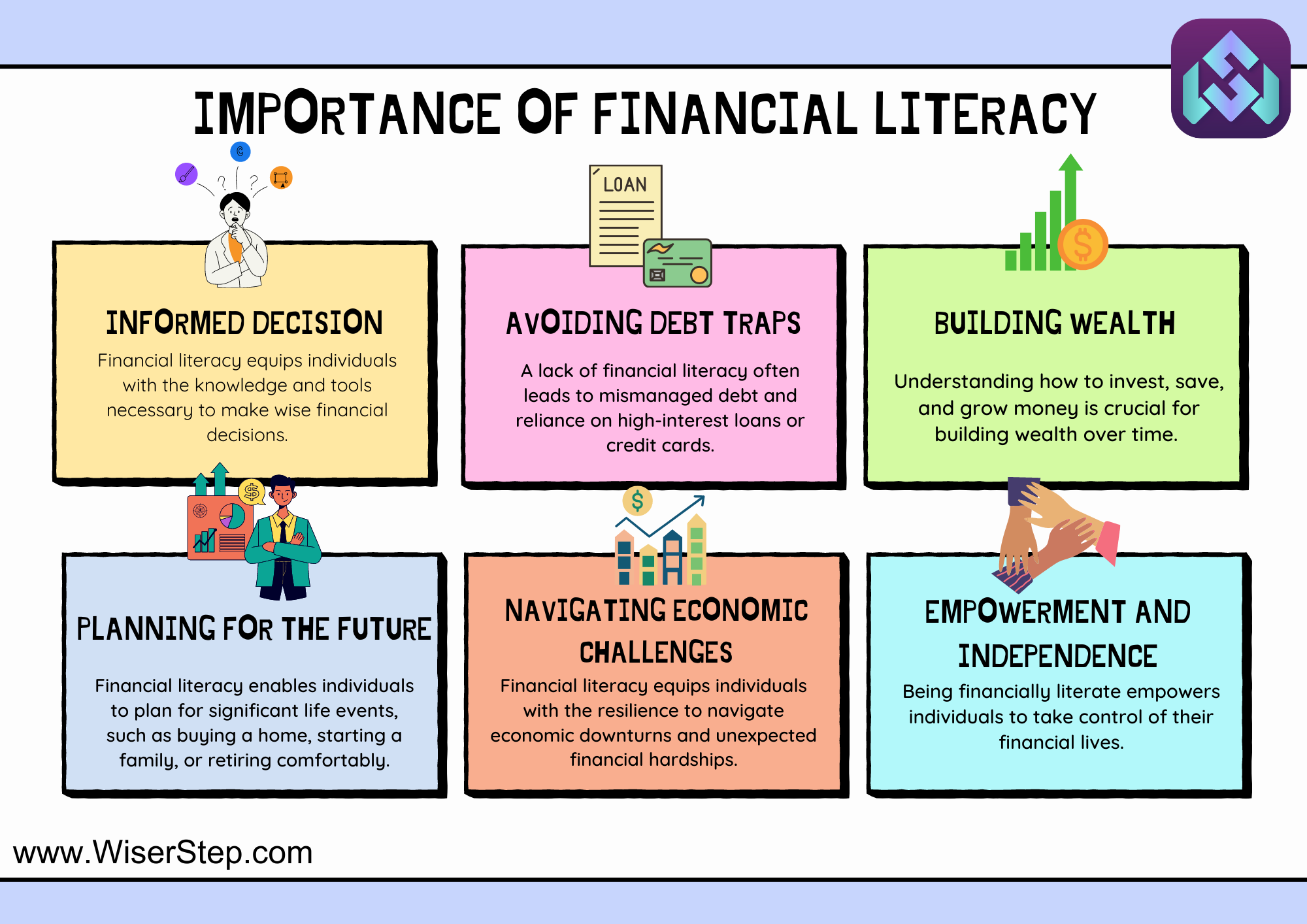

The Importance of Financial Literacy

- Informed Decision-Making: Financial literacy equips individuals with the knowledge and tools necessary to make wise financial decisions. It enables them to assess various financial products, understand their risks and benefits, and choose the options that align with their goals and risk tolerance.

- Avoiding Debt Traps: A lack of financial literacy often leads to mismanaged debt and reliance on high-interest loans or credit cards. With financial literacy, individuals can better manage debt, avoid unnecessary interest payments, and prevent falling into debt traps.

- Building Wealth: Understanding how to invest, save, and grow money is crucial for building wealth over time. Financial literacy empowers individuals to explore investment options, comprehend market trends, and develop a diversified portfolio that aligns with their financial objectives.

- Planning for the Future: Financial literacy enables individuals to plan for significant life events, such as buying a home, starting a family, or retiring comfortably. By understanding long-term financial planning, individuals can secure their financial future and achieve their aspirations.

- Navigating Economic Challenges: Financial literacy equips individuals with the resilience to navigate economic downturns and unexpected financial hardships. Knowledgeable individuals are more likely to have emergency funds, insurance coverage, and contingency plans in place.

- Empowerment and Independence: Being financially literate empowers individuals to take control of their financial lives and reduces reliance on external financial advisors, making them more independent and self-reliant.

WiserStep App’s AI Chatbox for Personalized Finance Advice

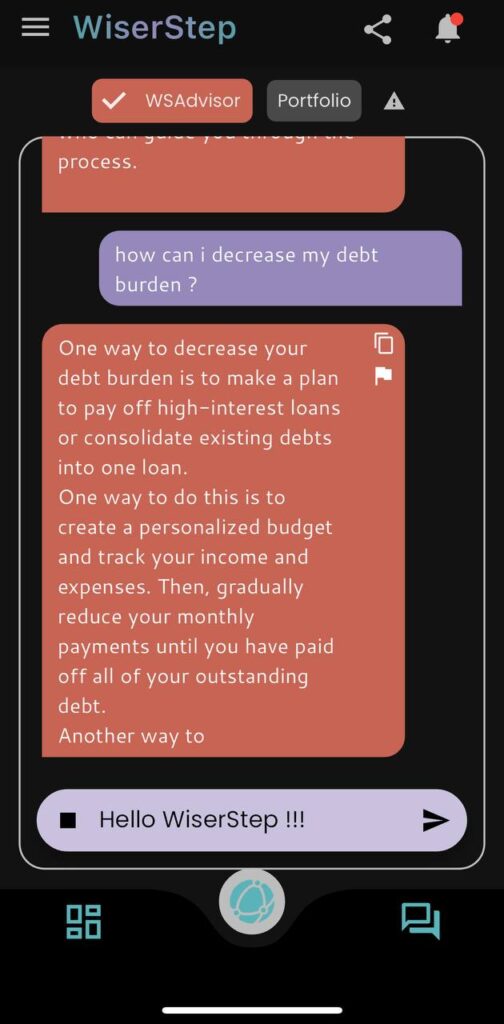

Tailored to Individual Needs

The WiserStep app’s AI Chatbox uses advanced algorithms and machine learning to provide personalized financial advice based on individual financial situations, goals, and risk profiles. It understands each user’s unique circumstances and tailors recommendations accordingly.

Real-Time Assistance

The AI Chatbox offers real-time assistance, ensuring that users can access financial guidance whenever they need it. Whether it’s a quick question about budgeting or a complex investment decision, the AI Chatbox is readily available to provide support.

Continuous Learning

WiserStep’s AI Chatbox continually learns from user interactions and feedback, improving its advice over time. It adapts to changing market conditions and user preferences, ensuring that the guidance remains relevant and up to date.

Non-Judgmental Environment

Some individuals may feel uncomfortable discussing financial matters with friends or family due to fear of judgment. The AI Chatbox provides a non-judgmental and confidential space for users to seek advice without hesitation.

Comprehensive Financial Topics:

From basic budgeting to retirement planning and investing strategies, the WiserStep app’s AI Chatbox covers a wide range of financial topics, catering to users at different stages of their financial journey.

Financial literacy is essential for individuals seeking financial security, independence, and the ability to achieve their financial goals. The WiserStep app’s AI Chatbox complements this need by providing personalized financial advice tailored to individual circumstances. By leveraging advanced AI technology, the WiserStep app empowers users to make well-informed financial decisions, paving the way for a brighter financial future. Embracing financial literacy and utilizing technology like the WiserStep app can lead to greater financial confidence and success in the long run.