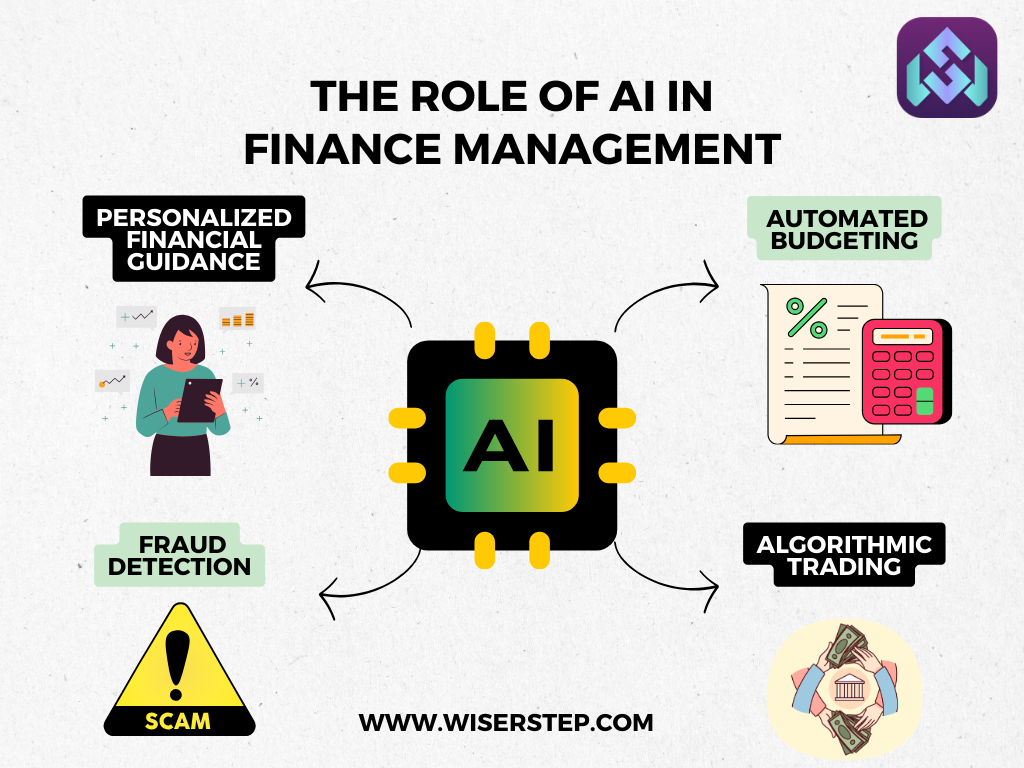

In the ever-evolving landscape of the 21st century, technology is not just transforming the way we live but also revolutionizing the way we manage our finances. One of the most significant contributors to this financial revolution is Artificial Intelligence (AI). From personalized budgeting to complex investment strategies, AI is reshaping the future of finance management. In this blog, we’ll explore the key ways AI is making a profound impact on how individuals and businesses navigate their financial journeys.

The Rise of AI in Finance

Personalized Financial Guidance

AI-driven financial apps and platforms are providing users with personalized financial guidance. These systems analyze individual spending patterns, income, and financial goals to offer tailored advice on budgeting, saving, and investing. This level of personalization ensures that financial strategies align with the unique needs and aspirations of users.

Automated Budgeting and Expense Tracking

Gone are the days of manual expense tracking and spreadsheet management. AI-powered tools automate the budgeting process, categorize expenses, and provide real-time insights into spending habits. This automation not only saves time but also minimizes the risk of human error, allowing for more accurate financial tracking.

Fraud Detection and Security

AI plays a crucial role in enhancing the security of financial transactions. Machine learning algorithms analyze vast amounts of data to detect unusual patterns and potential fraud in real-time. This proactive approach helps prevent unauthorized transactions, ensuring the safety of users’ financial information.

Revolutionizing Investment Strategies

Algorithmic Trading

In the realm of investment, AI is driving the growth of algorithmic trading. Advanced algorithms analyze market trends, news, and historical data to make split-second trading decisions. This automated approach not only improves the efficiency of trading but also eliminates emotional biases, often associated with human decision-making.

Robo-Advisors

Robo-advisors, powered by AI, have emerged as a popular choice for individuals seeking automated and cost-effective investment advice. These platforms use algorithms to assess risk tolerance, financial goals, and market conditions to recommend diversified investment portfolios. The result is a democratization of wealth management, making sophisticated investment strategies accessible to a broader audience.

Shaping the Future of Financial Services

Customer Service and Interaction

AI-driven chatbots and virtual assistants are transforming customer interactions in the financial sector. These intelligent systems provide instant responses to queries, guide users through financial processes, and enhance overall customer experience. As AI continues to evolve, we can expect even more seamless and personalized interactions with financial institutions.

Predictive Analytics for Financial Planning

AI utilizes predictive analytics to forecast future financial scenarios based on historical data and current trends. This capability enables individuals and businesses to make informed decisions, plan for contingencies, and optimize their financial strategies for long-term success.

As we navigate the complexities of the 21st-century financial landscape, the integration of AI in finance management stands out as a transformative force. From streamlining day-to-day budgeting to revolutionizing investment practices, AI is empowering individuals and businesses with tools that were once only accessible to financial experts. Embracing these technological advancements not only enhances financial efficiency but also positions us to thrive in a world where adaptability and innovation are the keys to financial success. As AI continues to evolve, the future of finance management promises to be more personalized, secure, and efficient than ever before