In the fast-paced world of personal finance, it’s easy to lose track of where your money goes. With expenses coming from all directions, from daily coffee runs to monthly utility bills and occasional splurges, managing your finances can become a daunting task. However, there’s a simple yet highly effective practice that can make a world of difference in your financial journey: noting down every financial transaction. In this blog, we’ll explore why meticulous transaction tracking is the key to successful finance management.

The Art of Financial Tracking

Financial tracking, often referred to as budgeting or expense tracking, is the practice of recording every financial transaction you make, no matter how small or large. This includes income, expenses, savings, investments, and even debts. It’s like keeping a financial diary that provides you with a clear, organized picture of your financial life.

Transparency and Awareness

One of the most significant advantages of diligent financial tracking is transparency. When you record every transaction, you gain an in-depth understanding of your spending habits. It’s like turning on a light in a dark room; suddenly, everything becomes visible. You can see exactly where your money is going, allowing you to make informed decisions.

Imagine you notice that a significant portion of your income is being spent on dining out. Without tracking, this might go unnoticed, leading to financial strain. However, when you record these expenses, you can see the impact on your budget and adjust your habits accordingly.

Setting Realistic Goals

Financial tracking is not just about recording transactions; it’s also about setting goals. With a clear record of your income and expenses, you can set realistic financial objectives. Whether it’s saving for a dream vacation, paying off student loans, or building an emergency fund, your financial diary becomes a roadmap to achieving these goals.

By analyzing your spending patterns, you can allocate funds more efficiently toward your objectives. For instance, if you notice that you’re spending too much on non-essential items, you can redirect that money towards your savings or debt payments.

Preventing Overspending

In today’s world of digital payments and credit cards, it’s easy to lose track of how much you’ve spent. Many people end up overspending simply because they don’t have a clear picture of their finances. However, when you record every transaction, you’re less likely to exceed your budget.

Knowing that every purchase will be documented can act as a deterrent against unnecessary spending. It encourages you to think twice before making impulse purchases and helps you stay accountable to your financial goals.

Building a Financial Safety Net

Another crucial aspect of financial tracking is building an emergency fund. Life is unpredictable, and unexpected expenses can arise at any time. By consistently tracking your finances and setting aside a portion of your income, you can build a financial safety net to cover these unforeseen costs.

Without a clear record of your income and expenses, it’s challenging to determine how much you can realistically save. Financial tracking provides the necessary insight to establish and maintain an emergency fund, ensuring you’re prepared for life’s curveballs.

Aiding in Tax Preparation

When tax season rolls around, having a detailed record of your financial transactions can save you time and money. Instead of scrambling to gather receipts and documents, you can easily access the information you need for tax filing.

Moreover, by tracking your expenses throughout the year, you may identify potential deductions or tax credits that can reduce your tax liability. This proactive approach to financial tracking can lead to significant savings during tax season.

The Digital Advantage

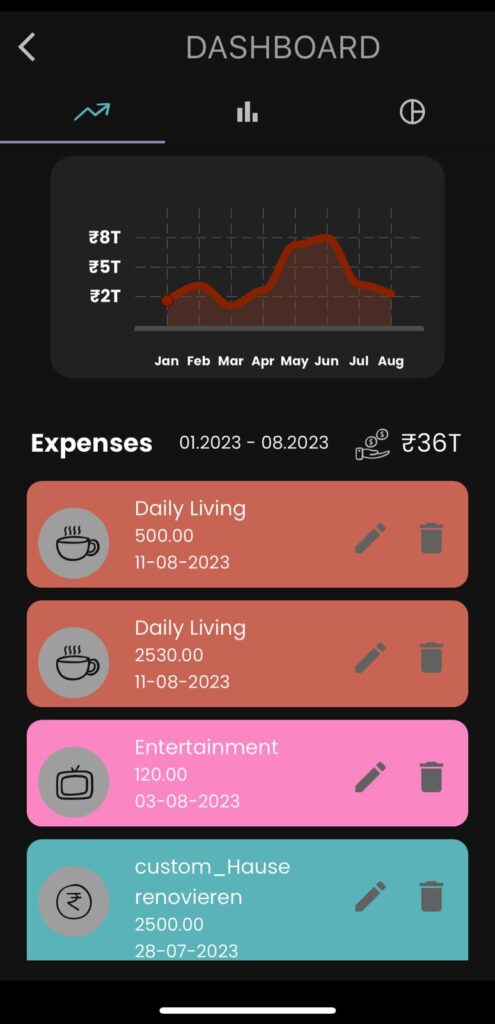

In today’s digital age, tracking your finances has never been easier. There are various apps and software tools available that can streamline the process. These tools often categorize your expenses automatically, providing you with valuable insights into your spending habits.

Additionally, many financial institutions offer online banking features that allow you to view and download transaction history. You can sync this data with your chosen budgeting app or software for a seamless tracking experience.

In the realm of personal finance, knowledge is power, and meticulous transaction tracking is the key to gaining that knowledge. By noting down every financial transaction, you create transparency, set realistic goals, prevent overspending, and build a financial safety net. This practice not only improves your day-to-day financial decisions but also empowers you to work toward long-term financial security and success.

Remember, it’s never too late to start tracking your finances. Whether you use a traditional ledger, a spreadsheet, or a modern budgeting app, the important thing is to get started. Your financial future will thank you for it. So, grab your financial diary and start noting down those transactions today!