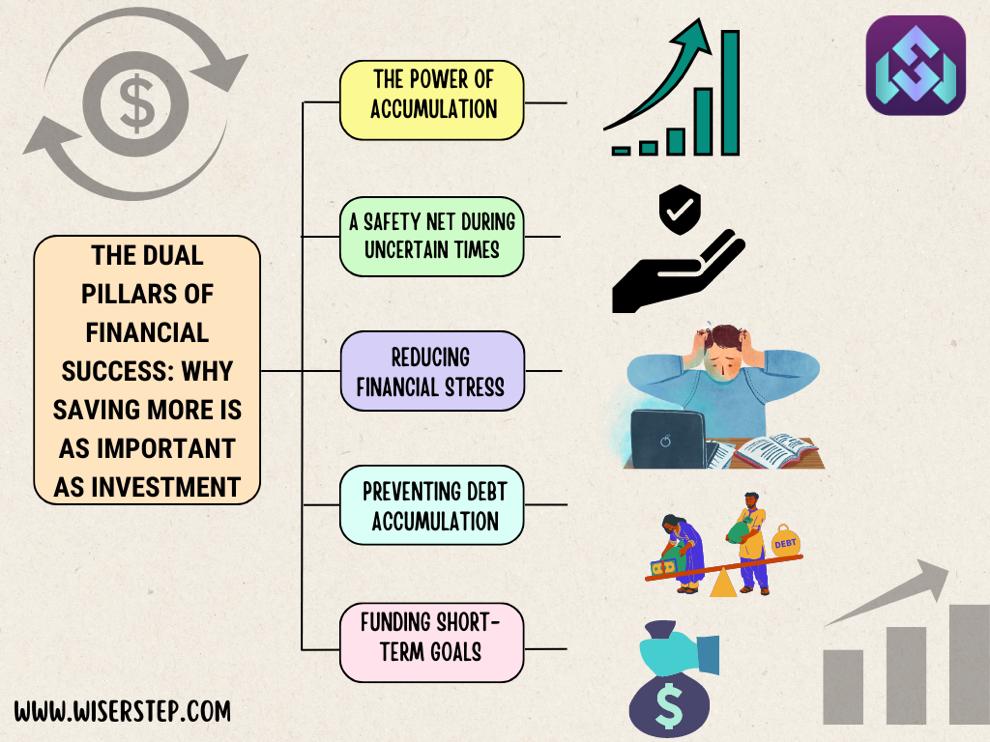

When it comes to building a strong financial foundation, the two fundamental pillars that play a pivotal role are saving and investing. Often, the spotlight shines brighter on investment strategies, but the truth is that saving more is equally indispensable. In this blog, we’ll delve into the reasons why saving more holds its own weight alongside investment, creating a balanced approach to achieving financial success.

The Power of Accumulation

Saving is the cornerstone of wealth accumulation. Without a consistent saving habit, even the most lucrative investment opportunities may fall flat. By diligently setting aside a portion of your income, you create a pool of funds that can be allocated for investments or emergencies. Saving provides you with the capital to embark on your investment journey and capitalize on opportunities when they arise.

A Safety Net During Uncertain Times

Life is inherently unpredictable, and unforeseen circumstances can strike at any moment. Whether it’s a medical emergency, job loss, or unexpected repairs, having a robust savings cushion acts as a safety net. Without sufficient savings, you might be forced to liquidate investments prematurely, potentially incurring losses or missing out on long-term gains.

Reducing Financial Stress

The mental and emotional relief that comes from having substantial savings cannot be overstated. Knowing that you have a financial buffer allows you to face challenges and uncertainties with confidence. This sense of security can lead to better decision-making, improved well-being, and reduced stress levels.

Preventing Debt Accumulation

Insufficient savings can lead to a cycle of debt. When unexpected expenses arise and you lack the funds to cover them, you might resort to credit cards or loans, ultimately leading to more debt. A healthy savings account acts as a buffer against this cycle, helping you avoid the pitfalls of high-interest debt.

Funding Short-Term Goals

Investments are generally considered a long-term strategy, while saving caters to short- and mid-term goals. Whether it’s a vacation, buying a car, or starting a business, having savings earmarked for these goals ensures you don’t have to disrupt your investment strategy to achieve them.

Seizing Investment Opportunities

Effective investing requires capital, and this is where saving comes into play. Having a stash of funds ready for investment enables you to capitalize on opportunities swiftly, without having to wait for a portion of your income to accumulate.

Building a Solid Financial Foundation

Consider saving as the solid foundation on which your investment skyscraper is built. While investments have the potential for higher returns, they also carry risks. Saving more allows you to manage risk effectively. By having a strong financial base, you can weather market downturns or unexpected events without jeopardizing your long-term goals.

The synergy between saving and investing is undeniable. While investing offers the potential for growth and wealth multiplication, saving serves as the bedrock that supports your financial aspirations. Both elements work in harmony to create a comprehensive strategy for achieving financial success. Saving more is not just about setting money aside; it’s about fostering discipline, building security, and providing yourself with the means to take advantage of opportunities and navigate the twists and turns of life. So, remember, while investments may lead to the stars, saving more paves the way to reaching them.