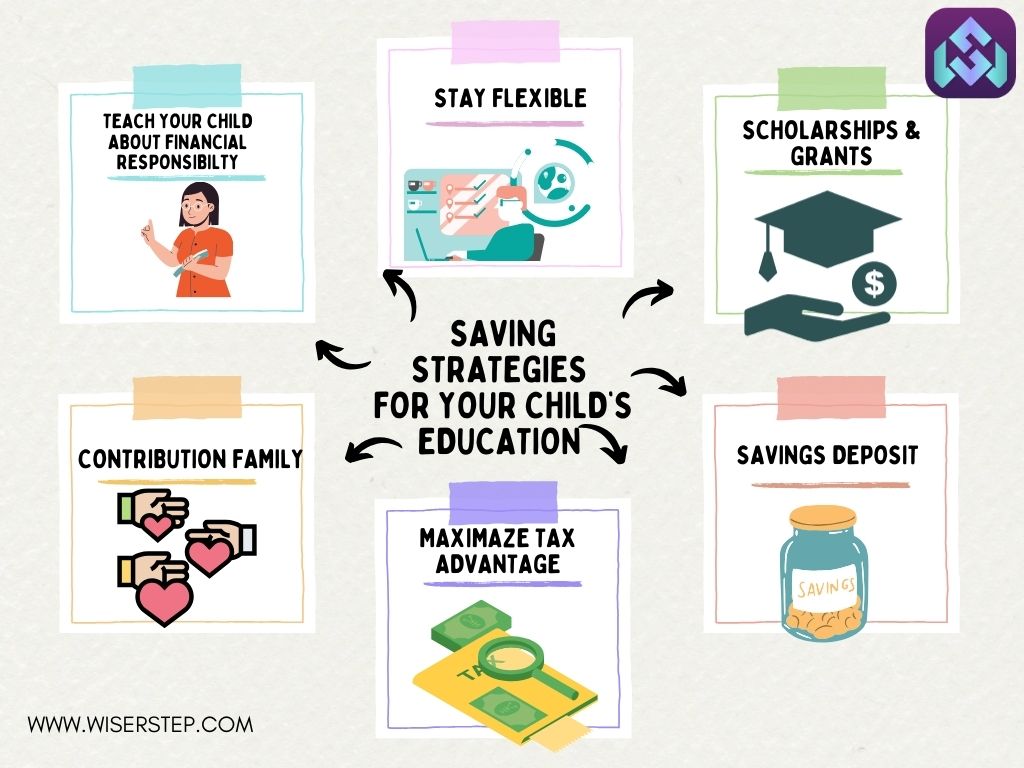

As a parent, you want the best for your child, and that often includes providing them with quality education. However, the rising costs of education can be daunting. Whether your child dreams of attending college or pursuing specialized training, early financial planning can make their educational aspirations a reality. Here are some effective strategies to start saving for your child’s education

Start Early, Benefit Longer

The adage “time is money” holds especially true in education savings. Begin saving as early as possible to benefit from the power of compounding. Even small contributions made consistently over time can grow significantly, thanks to compound interest.

Explore Education-Specific Savings Accounts

Consider accounts specifically designed for education savings, such as 529 plans or Education Savings Accounts (ESAs). These accounts offer tax advantages, allowing your contributions to grow tax-deferred and, in some cases, withdrawals for qualified education expenses to be tax-free.

Set Clear Goals and Budget Accordingly

Estimate the future cost of education by considering factors like tuition fees, accommodation, books, and other expenses. Having a clear goal in mind will help you determine how much to save regularly. Creating a budget specifically earmarked for education savings ensures you stay on track.

Automated Savings and Direct Deposits

Automate your savings by setting up regular contributions directly from your paycheck or bank account into your designated education savings account. This ensures consistency and removes the temptation to spend those funds elsewhere.

Maximize Tax-Advantaged Investments

Explore investment options that offer tax advantages, such as certain mutual funds or bonds. These investments might have tax benefits and could potentially yield higher returns compared to traditional savings accounts.

Encourage Contributions from Family and Friends

Consider suggesting educational contributions as gifts for birthdays, holidays, or special occasions. Grandparents and relatives might appreciate the opportunity to contribute to a child’s education fund instead of traditional gifts.

Leverage Scholarships, Grants, and Aid

While saving is crucial, also explore potential scholarship opportunities, grants, and financial aid programs available when your child is ready for higher education. These can significantly reduce the financial burden.

Stay Flexible and Review Periodically

Life circumstances can change, so it’s important to review and adjust your savings strategy periodically. If necessary, adapt your savings plan based on your evolving financial situation.

Teach Your Child About Financial Responsibility

As your child grows, involve them in discussions about the value of money and the importance of saving for their education. This not only instills good financial habits but also helps them understand the effort and commitment required for their education.

Seek Professional Advice

Consult a financial advisor or planner specializing in education savings. They can offer personalized guidance based on your financial situation and help you navigate various savings options and investment strategies.

Final Thoughts

Saving for your child’s education requires dedication, planning, and consistent effort. By starting early, exploring various savings avenues, and staying committed to your financial goals, you can provide your child with the gift of education without burdening them or yourself with excessive debt.

Remember, every contribution you make towards their education fund brings them one step closer to achieving their dreams. Invest not just money but also time and effort into securing a bright future for your child through education.