Managing finances can often feel like navigating a complex maze. From tracking expenses to budgeting, saving, and investing, the world of personal finance is multifaceted and can easily overwhelm even the most organized individuals. However, in today’s digital age, technology has introduced innovative solutions, and finance management apps have emerged as a boon for those seeking a stress-free approach to handling their money matters.

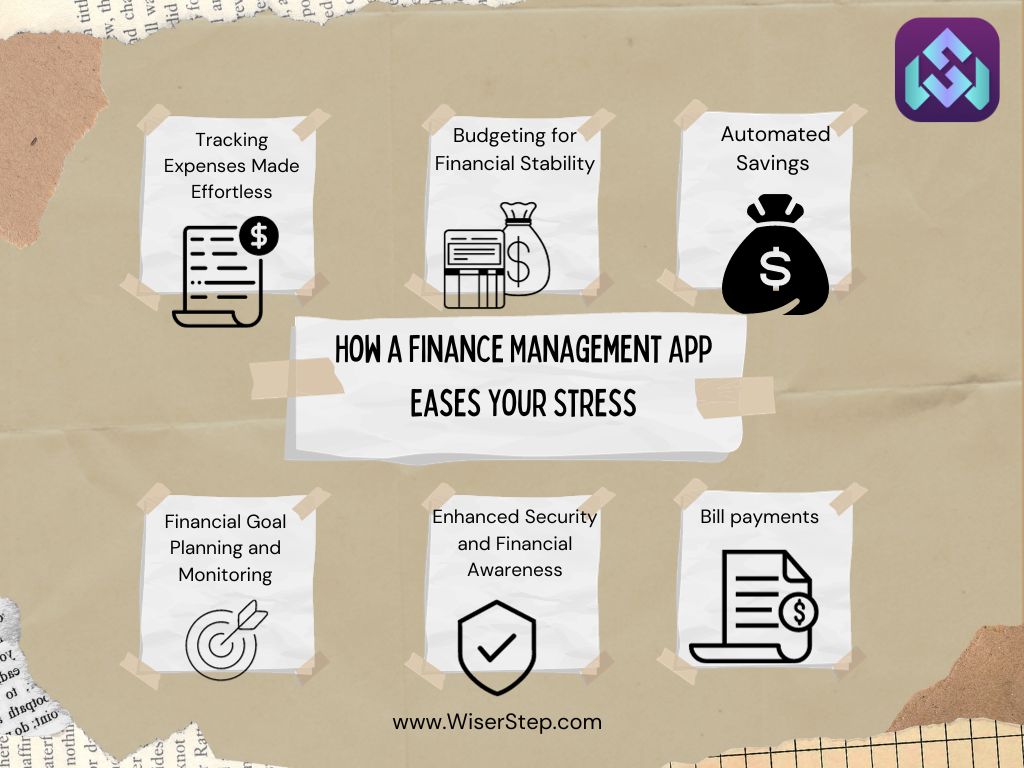

Tracking Expenses Made Effortless

One of the primary stress points in finance management is tracking expenses. Traditional methods involving spreadsheets or manual jotting down of expenses are time-consuming and prone to errors. Finance management apps streamline this process by allowing users to link their bank accounts and credit cards, automatically categorizing transactions. This feature eliminates the hassle of manual entry and provides real-time insights into spending habits.

Budgeting for Financial Stability

Setting and sticking to a budget is fundamental to financial health. However, the mere idea of creating a budget can be overwhelming. Finance management apps simplify this process by offering customizable budgeting tools. Users can set spending limits for various categories, receive notifications when nearing the limit, and visualize their spending patterns through intuitive graphs and charts. This visual representation helps in making informed decisions and adjustments to achieve financial goals.

Automated Savings and Bill Payments

Remembering to pay bills on time or setting aside money for savings can be a source of significant stress. Finance management apps come to the rescue by offering automated features. Users can set up automatic bill payments, ensuring bills are paid promptly, thereby avoiding late fees. Additionally, these apps often provide options for automated savings by rounding up purchases or scheduling regular transfers to savings accounts or investment portfolios, fostering a habit of saving without conscious effort.

Financial Goal Planning and Monitoring

Whether it’s saving for a vacation, buying a house, or planning for retirement, setting and achieving financial goals is key to a secure future. Finance management apps enable users to set specific goals, track progress, and even suggest personalized strategies to reach these milestones. These features provide a sense of direction and motivation, reducing the stress associated with uncertainty about the future.

Enhanced Security and Financial Awareness

Security concerns regarding personal financial information are valid. Top finance management apps prioritize data security, employing encryption and authentication measures to protect sensitive information. Moreover, these apps often provide educational resources, articles, and tips on financial literacy, empowering users to make informed financial decisions and reducing stress stemming from uncertainty or lack of knowledge.

In conclusion, finance management apps have revolutionized the way individuals approach their finances. By automating tasks, providing insights, and offering user-friendly interfaces, these apps mitigate the stress associated with managing finances. However, while these tools are incredibly beneficial, it’s crucial to choose a reputable app, understand its features thoroughly, and complement its use with sound financial habits and decision-making.

Embracing technology in the realm of personal finance can indeed pave the way for a more organized, informed, and stress-free financial journey.