Retirement is a phase in life that demands careful financial planning. As we aim to maintain our lifestyle and ensure financial stability during our golden years, the role of finance apps becomes increasingly crucial. Among these, WiserStep stands out as an innovative tool designed to streamline and simplify retirement income planning.

Understanding the Importance of Retirement Income Planning

Retirement income planning involves creating a strategy to ensure a steady stream of income after retiring from work. It’s about securing financial stability, covering living expenses, and enjoying life without the regular paycheck. Traditional pension plans are becoming less common, making it even more vital to proactively manage retirement savings.

Challenges in Retirement Income Planning

One of the primary challenges in retirement income planning is estimating how much money will be needed post-retirement. It involves factoring in various expenses such as housing, healthcare, leisure activities, and unexpected costs. Moreover, the uncertainty of how long one will live adds complexity to this equation.

The Role of Finance Apps in Retirement Income Planning

Finance apps like WiserStep serve as invaluable tools in navigating these challenges. They provide features that enable users to create personalized retirement plans based on their financial goals, income sources, and expected expenses.

What WiserStep Offers

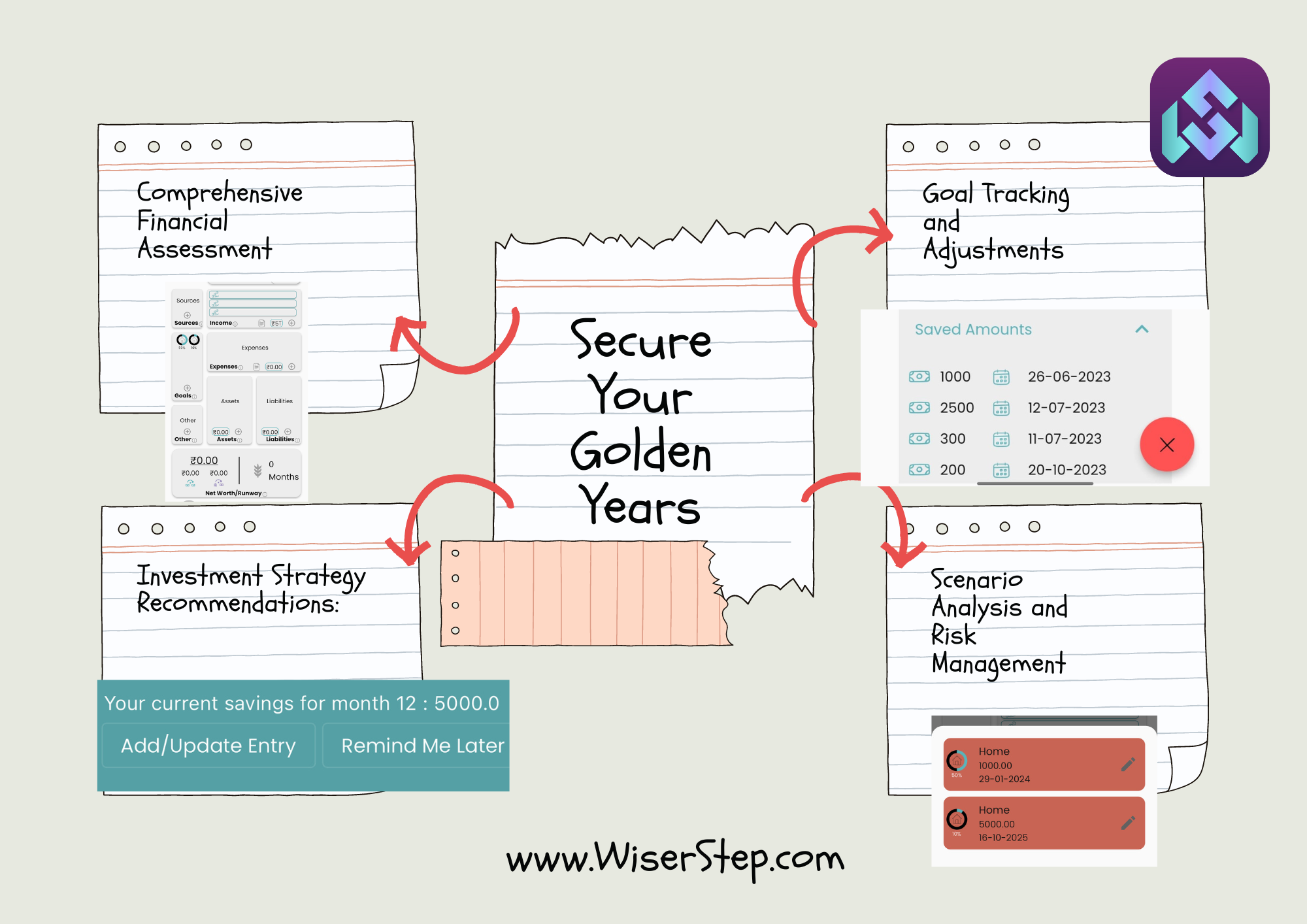

Comprehensive Financial Assessment

WiserStep allows users to input their financial information, including current savings, investment portfolios, expected retirement age, and desired lifestyle post-retirement. Using this data, the app generates a comprehensive overview of their financial standing and estimates the income needed during retirement.

Goal Tracking and Adjustments

Users can set specific retirement goals and track their progress over time. WiserStep’s interactive interface facilitates adjustments to contributions, retirement age, or investment strategies, enabling users to align their plans with changing circumstances.

Investment Strategy Recommendations

Based on individual risk tolerance and investment preferences, WiserStep suggests diversified investment strategies aimed at maximizing returns while managing risk. It educates users about potential investment options, helping them make informed decisions.

Scenario Analysis and Risk Management

The app provides scenario analysis tools that simulate various retirement scenarios, such as market downturns or unexpected expenses, allowing users to understand potential risks and make contingency plans.

How WiserStep Stands Out

WiserStep distinguishes itself with its user-friendly interface, robust analytical tools, and personalized recommendations. Its integration with real-time financial data ensures accurate projections, empowering users to make informed decisions about their retirement income planning.

Tips for Effective Retirement Income Planning Using WiserStep

Start Early: WiserStep emphasizes the importance of starting retirement planning early to benefit from compounding and ensure adequate savings

Regular Reviews: Periodically review and update your retirement plan on WiserStep to adapt to life changes or market fluctuations.

Diversification: Explore various investment options suggested by WiserStep to create a diversified portfolio that aligns with your risk tolerance.

Emergency Funds: Allocate funds for unforeseen circumstances, and WiserStep helps identify the optimal emergency fund size.

Retirement income planning is a critical aspect of financial well-being, and finance apps like WiserStep are empowering individuals to take control of their retirement finances. With its array of features and user-centric approach, WiserStep facilitates personalized and informed decision-making, ensuring a more secure and comfortable retirement.

In the journey towards financial security in retirement, leveraging the capabilities of finance apps like WiserStep can make a substantial difference. Start planning your retirement today and embrace a future that’s financially stable and fulfilling.