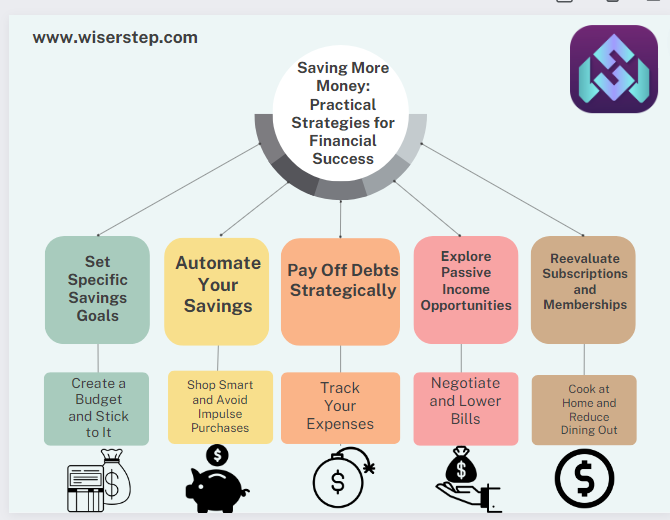

Saving money is not only a responsible financial habit but also a crucial step towards achieving financial freedom. Whether you’re looking to build an emergency fund, pay off debts, or invest for the future, saving more money can pave the way to financial security and open doors to various opportunities. In this blog, we will explore practical and effective strategies to help you save more money and take charge of your financial journey.

Create a Budget and Stick to It

The first step towards saving more money is to create a detailed budget. List all your sources of income and categorize your expenses into essential (e.g., rent, utilities, groceries) and discretionary (e.g., entertainment, dining out) categories. Be realistic with your budgeting and avoid underestimating expenses. Once you have a budget in place, make a commitment to stick to it diligently.

Track Your Expenses

Monitoring your expenses is crucial to understanding where your money goes. Keep track of every single purchase, whether big or small. You can use expense tracking apps like WiserStep to simplify this process. Identifying spending patterns will enable you to make informed decisions and cut back on unnecessary expenditures.

Set Specific Savings Goals

Set clear and achievable savings goals. Define the purpose of your savings, such as creating an emergency fund, saving for a down payment on a house, or funding a dream vacation. Specific goals provide motivation and focus, making it easier to allocate funds to each objective.

Automate Your Savings

Automating your savings is a powerful way to save more money consistently. Set up automatic transfers from your checking account to a separate savings account each time you receive your paycheck. By making savings a priority, you’re less likely to spend that money impulsively.

Shop Smart and Avoid Impulse Purchases

Practice mindful shopping to avoid unnecessary expenses. Before making a purchase, ask yourself if it’s a want or a need. Delaying gratification on non-essential items can lead to significant savings over time. Look for deals, discounts, and loyalty programs that can help stretch your dollars.

Cook at Home and Reduce Dining Out

Eating out frequently can be expensive. Cooking at home not only saves money but also allows you to control the ingredients and make healthier choices. Consider preparing meals in batches and bringing homemade lunches to work to cut dining out expenses.

Negotiate and Lower Bills

Negotiate with service providers to get better deals on monthly bills. Whether it’s your cable, internet, or insurance provider, a simple phone call to inquire about promotions or discounts can lead to significant savings.

Pay Off Debts Strategically

High-interest debts can weigh you down financially. Prioritize paying off debts with the highest interest rates first, while making minimum payments on other debts. As you eliminate debts, redirect the funds towards additional savings.

Explore Passive Income Opportunities

Consider exploring passive income streams to boost your savings. This could include investing in dividend-paying stocks, real estate properties, or starting a side business. Passive income can accelerate your savings growth and create financial independence.

Reevaluate Subscriptions and Memberships

Take a closer look at your subscriptions and memberships. Cancel those that you don’t use frequently or don’t add significant value to your life. Redirect the saved money towards your savings goals.

Conclusion

Saving more money is an achievable goal with discipline, determination, and smart financial strategies. By creating a budget, tracking expenses, setting specific savings goals, automating savings, and making mindful financial choices, you can build a strong financial foundation for yourself and your future. Remember that every small step towards saving counts, and consistency is the key to long-term financial success. Take charge of your finances today, and watch your savings grow, opening up a world of possibilities for a brighter financial future.’