As we bid farewell to the old year and welcome the new, it’s the perfect time to reflect on our financial habits and set meaningful resolutions for the year ahead. Embracing a fresh start, particularly in managing our finances, can pave the way for a more secure and prosperous future. Here are ten powerful resolutions to transform your financial landscape in the coming year

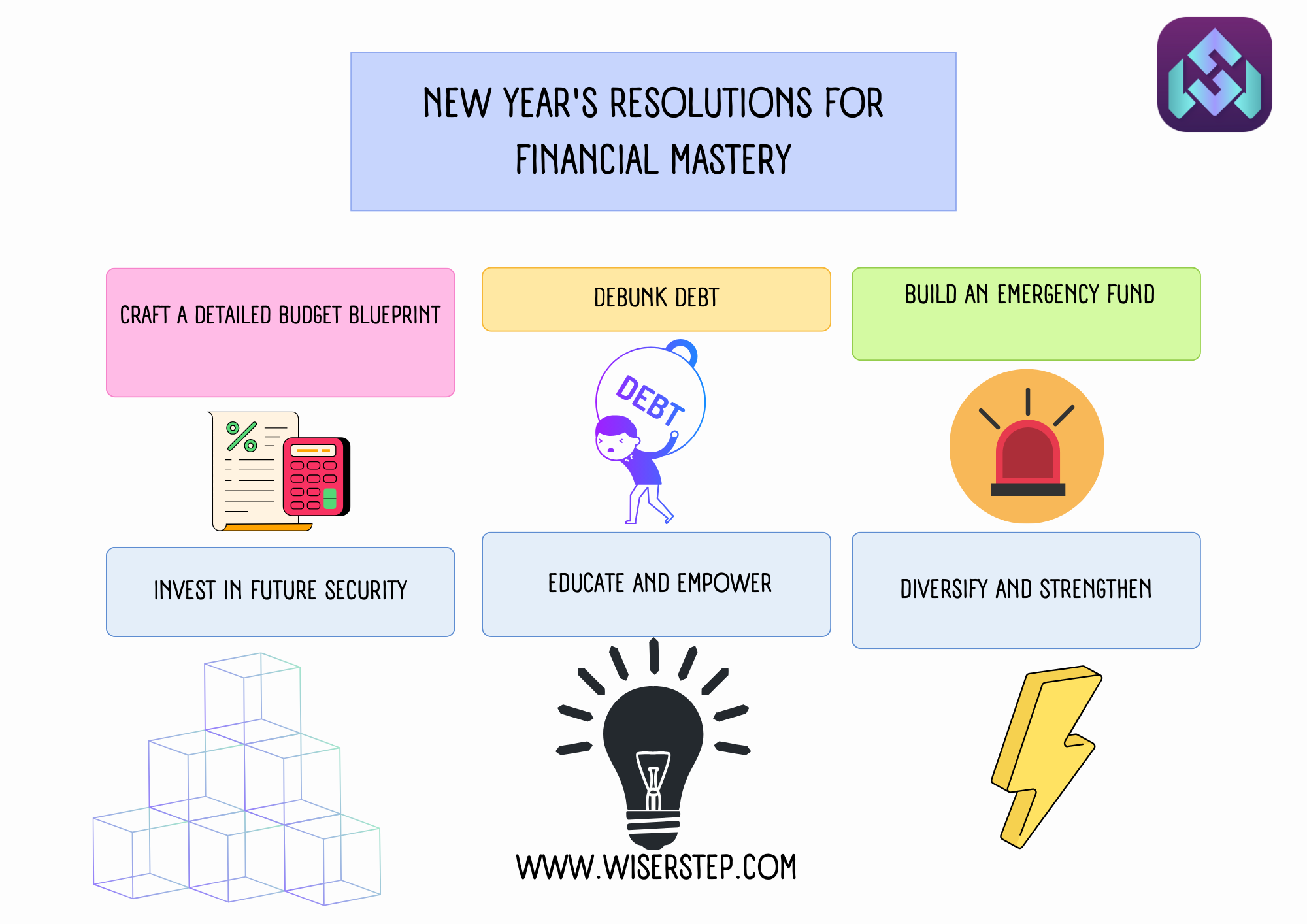

Craft a Detailed Budget Blueprint

Commit to creating a comprehensive budget that aligns with your financial goals. Track income, expenses, and savings meticulously using tools or apps to gain a clear understanding of where your money goes.

Debunk Debt: Prioritize Repayment

Make a resolution to tackle high-interest debts strategically. Employ methods like the debt snowball or avalanche to efficiently pay off debts and gain financial freedom sooner.

Foster the Safety Net: Build an Emergency Fund

Pledge to establish or reinforce your emergency fund. Saving three to six months’ worth of living expenses can shield you from unforeseen financial crises.

Invest in Future Security: Maximize Retirement Contributions

Make it a priority to contribute the maximum amount possible to your retirement accounts. Take advantage of employer matches and consider diversifying investments for long-term growth.

Educate and Empower: Enhance Financial Literacy

Set aside time to expand your financial knowledge. Engage in reading books, taking courses, or following credible financial resources to make informed decisions.

Trim the Expenditure Fat: Cut Unnecessary Costs

Identify and eliminate unnecessary expenses from your budget. Review subscriptions, dining out habits, and impulse purchases to save more effectively.

Dreams into Reality: Set Concrete Savings Goals

Define specific savings goals, whether for a house, a dream vacation, or education. Establishing clear objectives boosts motivation and keeps you on track.

Diversify and Strengthen: Broaden Investment Horizons

Evaluate your investment portfolio and diversify to mitigate risk. Explore various asset classes to create a well-balanced investment strategy.

Credit Quest: Monitor and Elevate Credit Score

Regularly monitor your credit score and work on improving it. Consistent bill payments, maintaining low credit card balances, and correcting errors can significantly enhance your creditworthiness.

Anticipate and Prepare: Plan for Significant Expenses

Anticipate large expenses such as home repairs or education costs. Incorporating these into your budget ensures you’re prepared for financial challenges ahead.

Embrace these resolutions as stepping stones toward financial success. Remember, small, consistent steps lead to significant progress. Stay committed, remain adaptable, and celebrate milestones achieved on this transformative financial journey in the new year. Cheers to a year of financial prosperity and empowerment!