In the journey towards financial stability and success, setbacks are inevitable. Whether it’s a business venture that didn’t take off, a major investment that went awry, or unexpected financial hardships, facing failure is a universal experience. However, it’s not the failure itself that defines us, but how we respond and bounce back. Here’s a candid discussion about financial failure and effective strategies for moving forward.

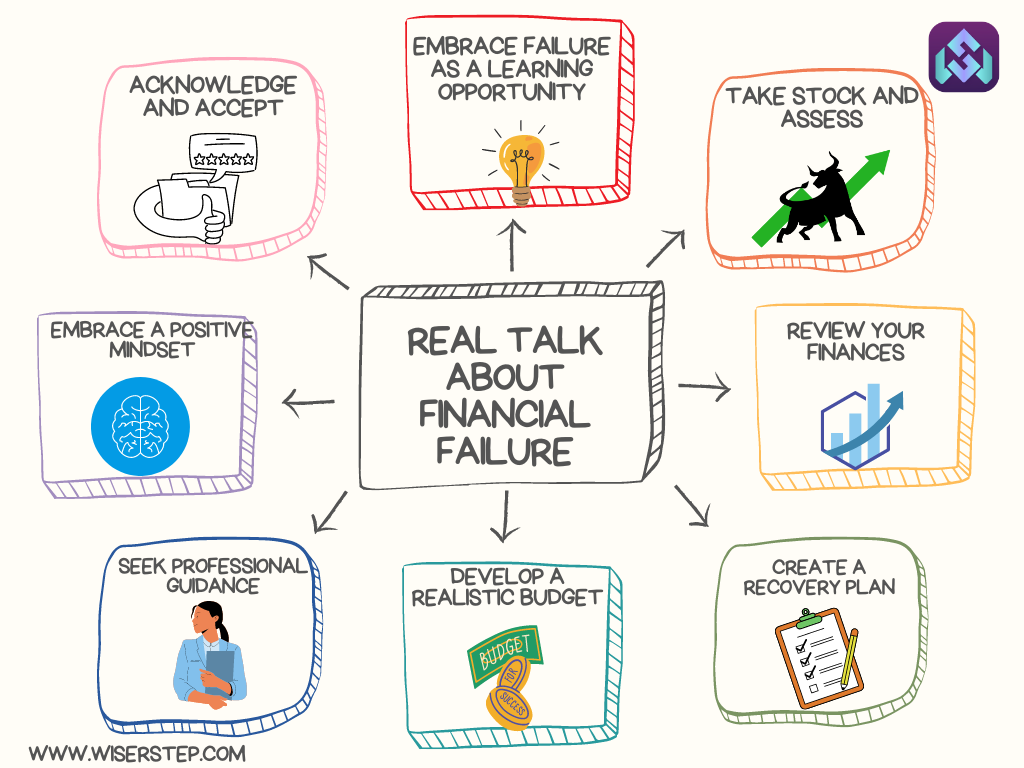

Acknowledge and Accept

Facing Reality

The first step towards recovery is acknowledging the situation. Avoid denial and confront the reality of the financial setback.

Embrace Failure as a Learning Opportunity

Understand that failure is not a permanent state but a part of the journey. Embrace it as an opportunity to learn valuable lessons about money management, investments, or business endeavors.

Take Stock and Assess

Assess the Situation

Evaluate the factors that led to the financial setback. Identify what went wrong, whether it was a risky investment, overspending, lack of contingency planning, or external factors beyond your control.

Review Your Finances

Take a detailed look at your financial situation. Assess assets, liabilities, income, and expenses. Create a realistic overview of your financial standing.

Create a Recovery Plan

Set Clear Goals

Define specific, achievable financial goals. Whether it’s paying off debts, rebuilding savings, or restarting a business, clarity in objectives is crucial.

Develop a Realistic Budget

Create a budget that aligns with your current financial situation. Cut unnecessary expenses, prioritize essential spending, and allocate funds towards debt repayment or savings.

Seek Professional Guidance

Consider consulting financial advisors or experts to help devise a strategic recovery plan. They can provide insights and guidance tailored to your circumstances.

Take Action

Prioritize Debt Repayment

If you have outstanding debts, prioritize repayment strategies. Consider debt consolidation, negotiating with creditors, or setting up structured repayment plans.

Rebuild Emergency Savings

Rebuilding an emergency fund is essential to cushion against unforeseen financial challenges in the future. Start small and gradually increase savings.

Explore New Opportunities

Consider alternative income sources or investment opportunities. Be cautious and conduct thorough research before committing to new ventures.

Embrace a Positive Mindset

Practice Self-Compassion

Avoid self-blame and negative self-talk. Recognize that setbacks are a natural part of life and not a reflection of your self-worth.

Stay Motivated

Surround yourself with positivity. Engage in activities that inspire and motivate you. Celebrate small victories on the path to financial recovery.

Learn and Grow

Reflect and Learn

Take time to reflect on the lessons learned from the experience. Use these insights to make informed financial decisions in the future.

Build Financial Resilience

Strengthen your financial literacy and resilience. Educate yourself about investment strategies, risk management, and building a more secure financial future.

Seek Support

Lean on Your Network

Don’t hesitate to seek advice or emotional support from trusted friends, family, or mentors. Sometimes, an outside perspective can offer valuable insights.

Consider Professional Support

If the setback has taken a toll on your mental health, seek professional help. Financial stress can impact overall well-being, and speaking with a therapist or counselor can be beneficial.

Recovering from financial failure is a process that requires patience, resilience, and a proactive approach. By acknowledging the situation, creating a recovery plan, embracing a positive mindset, and seeking support, you can navigate through the challenges and emerge stronger. Remember, it’s not the fall that defines you; it’s the courage to rise and rebuild that truly matters.