In the fast-paced world we live in today, managing personal finances can often feel like navigating a complex labyrinth. Bills, expenses, savings, investments – the list goes on. However, there’s a beacon of hope for those seeking financial clarity and control: finance management apps. In this blog, we’ll explore the transformative power of these apps, with a spotlight on WiserStep.

The Challenge of Financial Management

Before delving into the specifics of WiserStep, let’s acknowledge the challenges many individuals face in managing their finances. With multiple income streams, diverse expenses, and varying financial goals, it’s easy to feel overwhelmed. Traditional methods of budgeting and tracking expenditures on paper or spreadsheets can be cumbersome and prone to error.

The Rise of Finance Management Apps

Enter finance management apps, designed to simplify and streamline the entire process. These applications leverage cutting-edge technology to offer users a comprehensive overview of their financial landscape. From budgeting and expense tracking to investment management, these apps are a one-stop solution for individuals seeking financial empowerment.

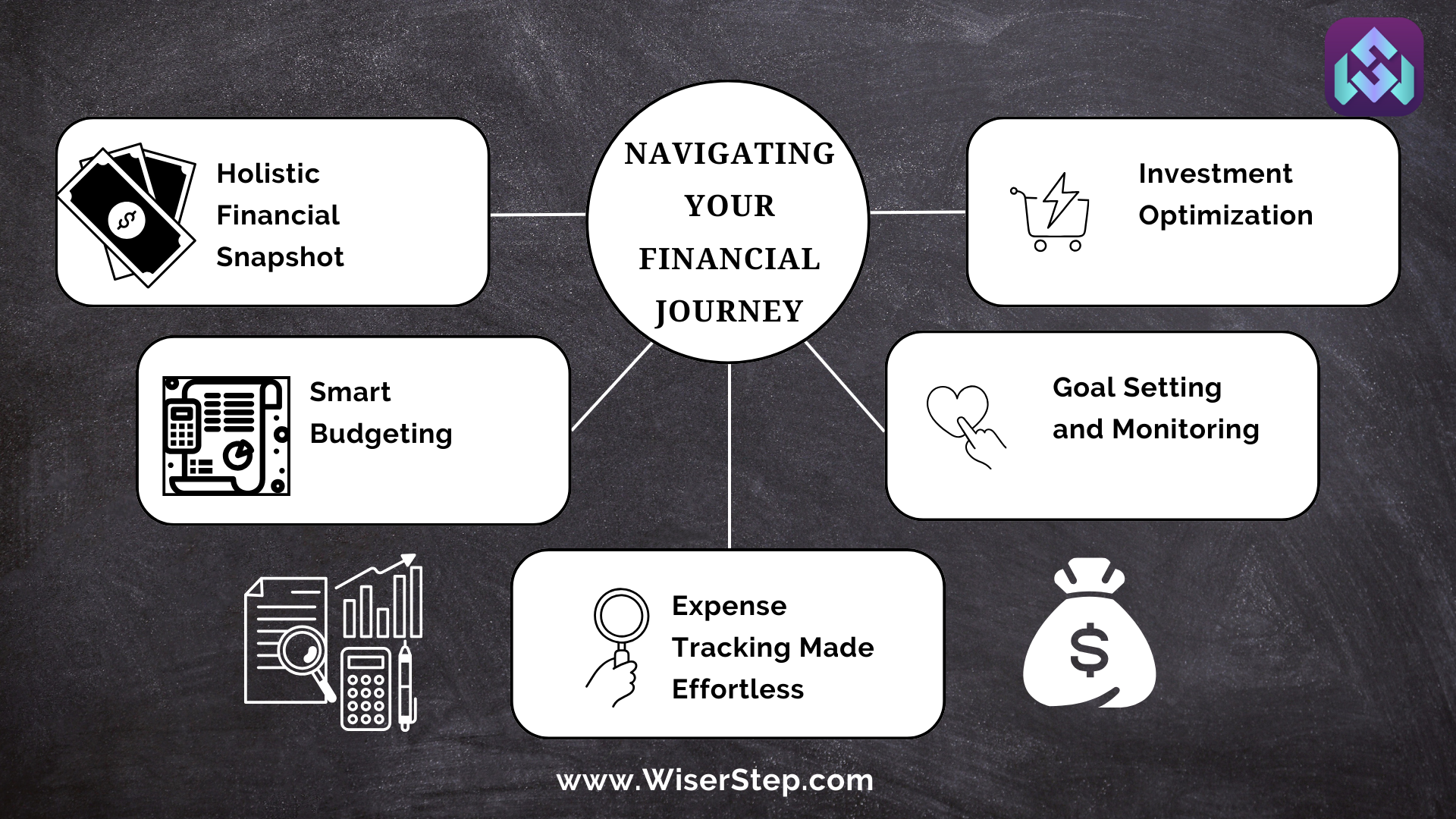

WiserStep: Navigating Your Financial Journey

WiserStep stands out among the myriad of finance management apps, offering a user-friendly interface coupled with powerful features. Let’s explore how WiserStep can transform your money game

Holistic Financial Snapshot

WiserStep provides a 360-degree view of your financial situation. Users can link their bank accounts, credit cards, and investment portfolios to get a real-time snapshot of their financial health. This holistic approach enables informed decision-making.

Smart Budgeting

Creating and sticking to a budget is a cornerstone of financial success. WiserStep takes budgeting to the next level with intelligent algorithms that analyze spending patterns. Users receive personalized budget recommendations, helping them allocate funds efficiently.

Expense Tracking Made Effortless

Manually logging every expense is a thing of the past. WiserStep automatically categorizes transactions, providing users with a clear breakdown of where their money is going. This feature is invaluable for identifying areas where expenses can be trimmed.

Goal Setting and Monitoring

Whether it’s saving for a dream vacation or building an emergency fund, WiserStep allows users to set and track financial goals. Progress indicators and reminders keep individuals motivated and on track to achieve their objectives.

Investment Optimization

WiserStep goes beyond budgeting and expense tracking by offering insights into investment portfolios. Users can analyze the performance of their investments, receive market updates, and make informed decisions to optimize their investment strategy.

Security and Privacy

Recognizing the sensitivity of financial data, WiserStep prioritizes security. With robust encryption and authentication measures, users can trust that their financial information is kept confidential and secure.

The Transformative Impact

The integration of WiserStep into your financial routine can be truly transformative. By harnessing the power of technology, this app not only simplifies financial management but also empowers users to make informed decisions, paving the way towards financial freedom.

In a world where time is a precious commodity, leveraging technology to manage finances is a logical and efficient choice. Finance management apps like WiserStep act as personal financial assistants, guiding users towards their goals with precision and ease. By embracing these tools, individuals can take charge of their financial destinies, unlocking a future of financial freedom and security.