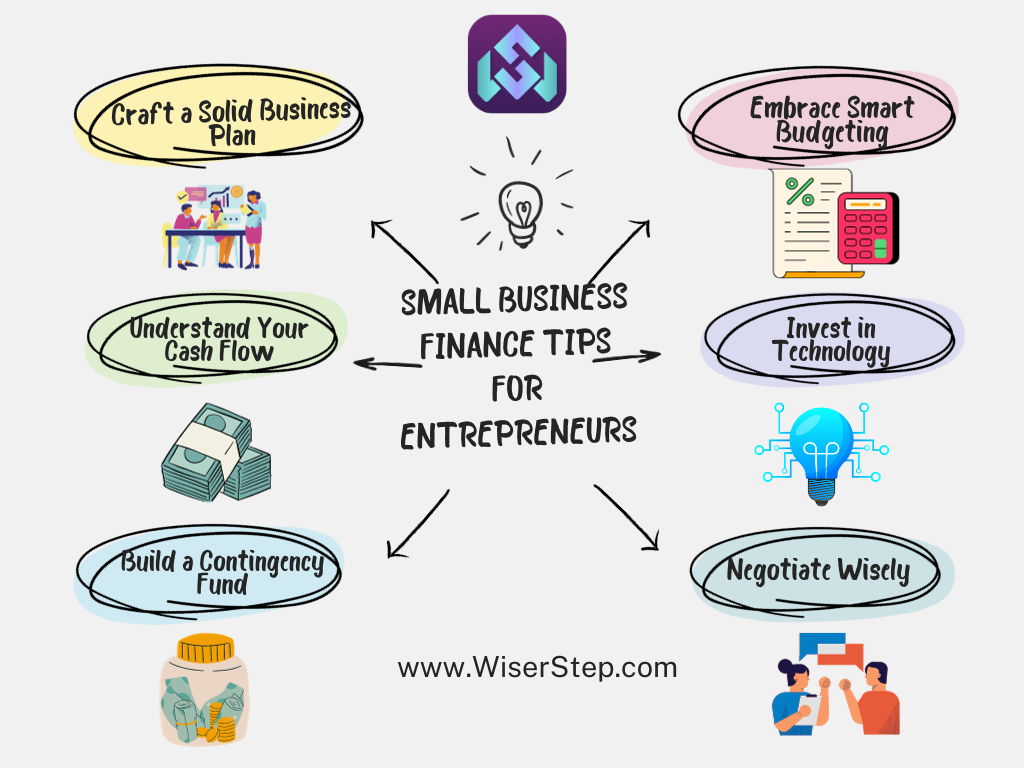

Starting a small business is an exhilarating journey filled with passion, ambition, and the thrill of turning a dream into reality. However, as any entrepreneur knows, financial challenges can be a daunting aspect of this venture. Effective small business finance management is crucial for survival and growth. In this blog, we’ll explore key tips to help entrepreneurs navigate the financial seas and steer their businesses toward success.

Craft a Solid Business Plan

A well-thought-out business plan serves as your financial compass. Outline your business goals, target market, revenue projections, and financial forecasts. This document not only provides direction but also becomes essential when seeking funding or partnerships.

Separate Personal and Business Finances

Establish distinct bank accounts for personal and business use. This separation simplifies accounting, enhances financial transparency, and ensures that personal expenses don’t blur the lines of your business budget.

Understand Your Cash Flow

Cash flow is the lifeblood of any small business. Regularly monitor your cash inflows and outflows to anticipate potential challenges. A clear understanding of your cash flow allows you to make informed decisions, especially during lean periods.

Build a Contingency Fund

Prepare for unforeseen circumstances by setting aside a contingency fund. Whether facing unexpected expenses or a temporary downturn, having a financial safety net can help your business weather storms without jeopardizing long-term stability.

Embrace Smart Budgeting

Create a detailed budget that accounts for all aspects of your business, from operating costs to marketing expenses. Regularly revisit and adjust your budget as your business evolves, ensuring it remains a relevant and effective tool for financial management.

Invest in Technology

Leverage accounting software and financial tools to streamline your processes. Automation not only reduces the risk of errors but also frees up valuable time that you can dedicate to growing your business.

Negotiate Wisely

Negotiation is a powerful tool in managing costs. Whether dealing with suppliers, landlords, or service providers, hone your negotiation skills to secure favorable terms and minimize expenses.

Explore Funding Options

Investigate various funding avenues, including small business loans, grants, or investors. Assess the pros and cons of each option, considering factors such as interest rates, repayment terms, and the impact on your business’s equity.

Monitor and Manage Debt

While taking on debt is sometimes necessary, it’s crucial to manage it wisely. Keep a close eye on interest rates and repayment schedules to avoid falling into a debt trap that could hinder your business’s growth.

Invest in Marketing Strategically

Marketing is essential for business growth, but it’s important to allocate your budget strategically. Focus on marketing channels that resonate with your target audience, and measure the return on investment to ensure your marketing efforts are effective.

Stay Tax Compliant

Familiarize yourself with local tax regulations and ensure your business remains tax compliant. Work with a professional accountant to maximize deductions and optimize your tax strategy

Diversify Revenue Stream

Reduce business vulnerability by diversifying your revenue streams. This not only increases overall income but also provides a buffer against market fluctuations that may impact a single revenue source.

Regular Financial Health Checkups

Conduct regular financial checkups to assess the overall health of your business. Analyze financial statements, review key performance indicators, and adjust your strategy accordingly.

Invest in Professional Advice

Don’t underestimate the value of professional advice. Consult with accountants, financial advisors, and legal experts to ensure your business is on solid financial ground and compliant with relevant regulations.

Cultivate Financial Literacy

Continuously educate yourself on financial best practices and industry trends. A solid understanding of financial principles empowers you to make informed decisions and adapt to changing economic landscapes.

In conclusion, the success of a small business hinges on effective financial management. By implementing these tips and remaining vigilant in your financial strategy, you can navigate the challenges of entrepreneurship with confidence, steering your business toward sustained growth and prosperity.