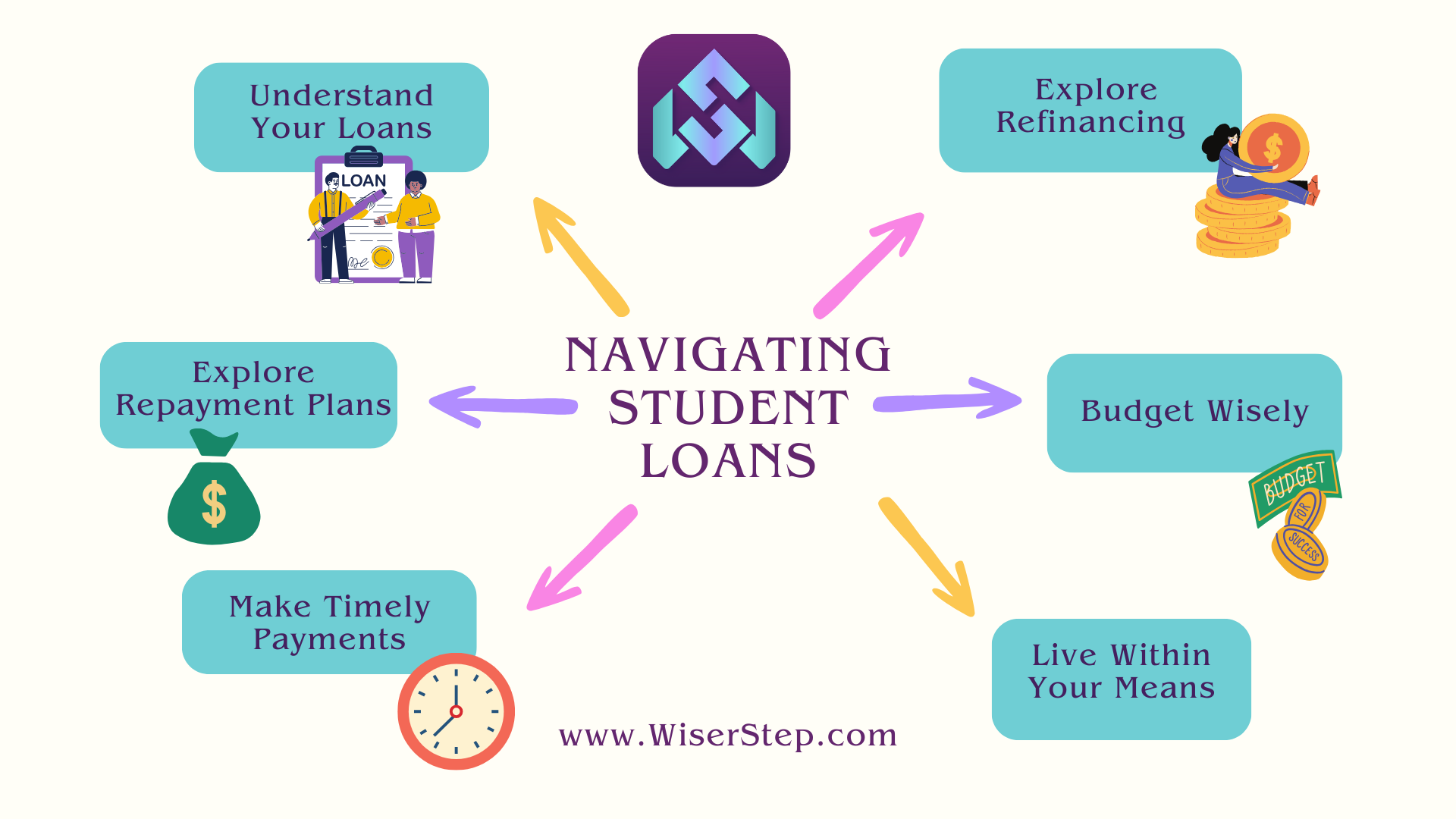

Graduating from college is a significant achievement, but it often comes with the daunting burden of student loans. Navigating the complex landscape of student loan repayment can be overwhelming, but understanding your options and planning strategically can make the process more manageable. In this blog, we will explore various repayment options, forgiveness programs, and provide valuable tips for graduates dealing with student loans.

Understand Your Loans

Start by comprehensively understanding your student loans. Know the type of loans you have, the interest rates, the total amount borrowed, and the repayment terms. Federal and private loans have different rules, so be aware of the specifics of each loan you owe.

Explore Repayment Plans

Federal student loans typically offer several repayment plans, including the Standard Repayment Plan, Graduated Repayment Plan, and Income-Driven Repayment Plans. Income-Driven Plans adjust your monthly payments based on your income and family size, making them more manageable, especially if you have a limited income after graduation.

Consider Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF) is a valuable option for graduates working in qualifying public service jobs. Under PSLF, after making 120 qualifying payments, the remaining loan balance is forgiven. Additionally, teachers, nurses, and other professions might be eligible for specific forgiveness programs tailored to their fields.

Make Timely Payments

Timely payments are crucial for maintaining a good credit score and avoiding penalties. Set up automatic payments to ensure you never miss a due date. Consistent, on-time payments also contribute positively to your credit history, which is essential for your financial future.

Explore Refinancing and Consolidation

Refinancing involves taking out a new loan with a private lender to pay off existing student loans. This can be a smart move if you have a good credit score and can secure a lower interest rate, potentially saving you money over the life of the loan. Consolidation combines multiple federal loans into one, simplifying payments. However, be cautious as you may lose certain benefits associated with federal loans by consolidating.

Budget Wisely

Creating a budget is essential after graduation. Allocate a specific portion of your income for student loan payments. While it might be tempting to channel extra income into lifestyle upgrades, dedicating additional funds to paying off your loans can expedite the repayment process and reduce the overall interest you pay.

Communicate with Your Loan Servicer

If you encounter financial difficulties and struggle to make payments, don’t ignore the problem. Reach out to your loan servicer immediately. They can help you explore options such as deferment, forbearance, or alternative repayment plans based on your financial situation.

Live Within Your Means

Post-graduation, it’s essential to live within your means. Avoid unnecessary expenses and focus on building your financial stability. Redirecting money you would spend on non-essential items towards your student loans can significantly impact your repayment progress.

Continue Your Education

Some forgiveness programs, particularly those related to teaching and public service, require ongoing education or certifications. Stay informed about the requirements and ensure you fulfill them to remain eligible for forgiveness programs.

Stay Informed

Student loan policies and forgiveness programs are subject to change. Stay informed about the latest updates and policy changes. Following reliable financial news sources and regularly checking official government websites will help you stay up-to-date with the most recent developments.

Navigating student loans might seem like a challenging task, but with informed decisions, strategic planning, and disciplined financial habits, you can effectively manage your student debt. Remember, seeking guidance from financial advisors and staying proactive about your repayment journey can alleviate stress and set you on the path to financial freedom. Stay focused, stay informed, and take control of your student loan repayment journey