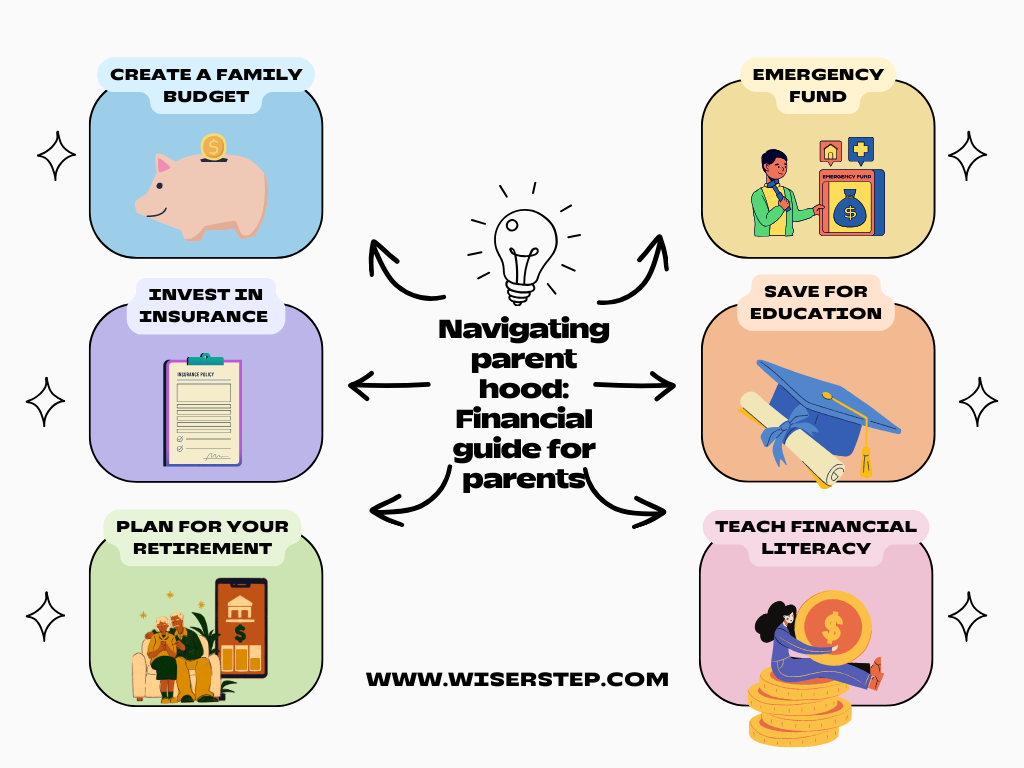

Becoming a parent is a life-altering experience, filled with love, joy, and endless responsibilities. One of the significant aspects of parenthood is managing your finances effectively to secure a stable future for both you and your child. Here’s a comprehensive guide outlining essential steps that parents should follow to ensure financial well-being while raising a family.

Create a Family Budget

Start by establishing a detailed budget that outlines your monthly income and all your expenses. Include essentials like housing, groceries, utilities, healthcare, and childcare. Allocate specific amounts for savings, emergency fund, and discretionary spending. Having a clear budget provides a roadmap for your financial decisions.

Emergency Fund

Building an emergency fund is crucial for unexpected expenses such as medical emergencies or car repairs. Aim to save at least three to six months’ worth of living expenses. Having this safety net ensures you can handle unforeseen circumstances without resorting to high-interest loans or credit card debt.

Invest in Insurance

Invest in comprehensive health insurance for your family. Additionally, consider life insurance policies to secure your child’s future in case of an unfortunate event. Research different plans and choose the ones that provide adequate coverage and align with your family’s needs.

Save for Education

Education costs are rising steadily. Start saving for your child’s education early to ease the financial burden when they enter college. Consider options like 529 savings plans or other investment accounts specifically designed for educational expenses.

Plan for Your Retirement

While it may seem distant, planning for your retirement is vital. Saving consistently in retirement accounts like 401(k) or IRAs ensures financial stability during your golden years. Balancing between saving for your child’s education and your retirement is crucial; prioritize your retirement savings while ensuring some funds are set aside for education.

Teach Financial Literacy

Instill good financial habits in your children from a young age. Teach them about budgeting, saving, and investing. Encourage them to manage their allowances and understand the value of money. Financial literacy equips them with essential life skills for a secure future.

Plan for Major Expenses

Anticipate significant expenses like buying a house, upgrading your car, or family vacations. Plan for these expenses well in advance, setting up dedicated savings accounts or investment funds. Avoid relying on credit for these purchases, as it can lead to debt accumulation.

Review and Update Your Will

Creating or updating your will is vital, especially for parents. Clearly outline guardianship for your child and how your assets should be distributed in case something happens to you and your partner. Regularly review and update your will to reflect any changes in your family situation or financial status.

Invest Wisely

Understand your risk tolerance and invest wisely in diversified portfolios. Consult a financial advisor to make informed investment decisions that align with your financial goals and timeline. Regularly review your investments to ensure they continue to meet your family’s needs.

Communication and Planning

Open communication with your partner is essential. Regularly discuss your financial goals, spending habits, and any concerns you might have. Collaborative financial planning ensures you both work towards shared objectives, fostering financial harmony within the family.

Parenthood brings immense joy and responsibility. By following these financial steps, you can navigate the challenges of raising a family while securing a stable and prosperous future for both you and your children. Remember, financial planning is an ongoing process; stay proactive, adapt to changing circumstances, and always prioritize your family’s well-being