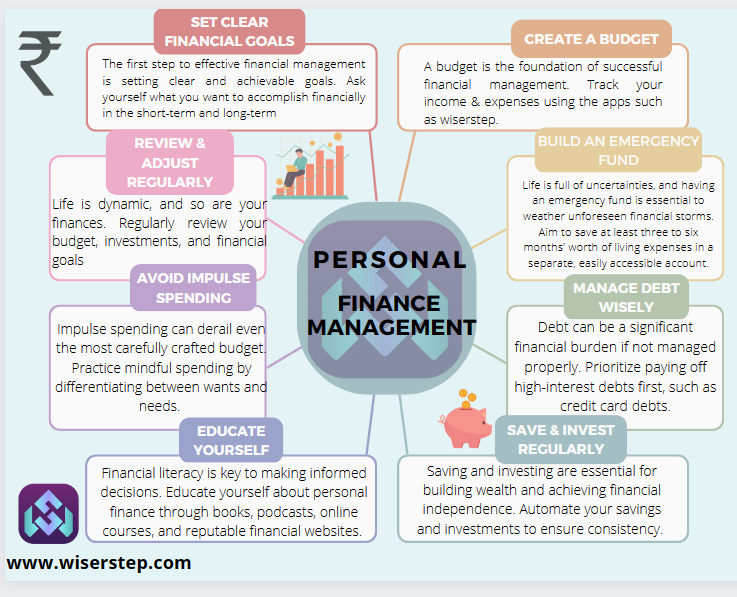

Managing personal finances is a skill that plays a pivotal role in achieving financial stability and success. Whether you’re saving for a dream vacation, planning for retirement, or getting rid of debt, effective personal finance management is essential. In this blog, we’ll explore valuable finance advice and how the WiserStep app can be your trusted companion on the journey to financial well-being.

Start with Clear Financial Goals

A fundamental piece of personal finance advice is to set clear and achievable financial goals. Whether it’s creating an emergency fund, buying a home, or retiring comfortably, well-defined goals give you direction and motivation. Use the WiserStep app to jot down your financial objectives and monitor your progress regularly.

Create a Realistic Budget

A budget acts as the cornerstone of personal finance management. It allows you to track your income and expenses, identify spending patterns, and allocate funds to various categories wisely.

Track Expenses Religiously

Tracking your expenses diligently is vital to understanding where your money goes. The WiserStep app simplifies expense tracking, categorizing your spending automatically and presenting it in easy-to-read graphs. By knowing your spending habits, you can make informed decisions to cut unnecessary expenses and save more.

Stay on Top of Debt Management

Debts can impede your financial progress. WiserStep assists you in managing your debts by organizing all your liabilities in one place. Keep a close eye on your debt payments and make strategic decisions to pay off high-interest debts first.

Stay Informed with Financial Insights

WiserStep keeps you informed with financial insights and trends. You can access educational resources, articles, and tips on the app and on WiserStep.com to expand your financial knowledge and make informed decisions.