The pursuit of financial independence and early retirement has gained significant traction in recent years, with an increasing number of individuals embracing the FIRE movement. FIRE, which stands for Financial Independence, Retire Early, is a lifestyle and financial strategy that aims to achieve financial independence and retire well before the traditional retirement age. In this blog post, we will delve into the core principles of the FIRE movement, its benefits, challenges, and practical steps for those considering embarking on this journey.

Understanding the FIRE Movement

At its essence, the FIRE movement is about achieving financial freedom and having the flexibility to retire early to pursue one’s passions and interests. The movement emphasizes saving aggressively, investing wisely, and minimizing unnecessary expenses to build a sufficient nest egg that can sustain a comfortable lifestyle without the need for traditional employment.

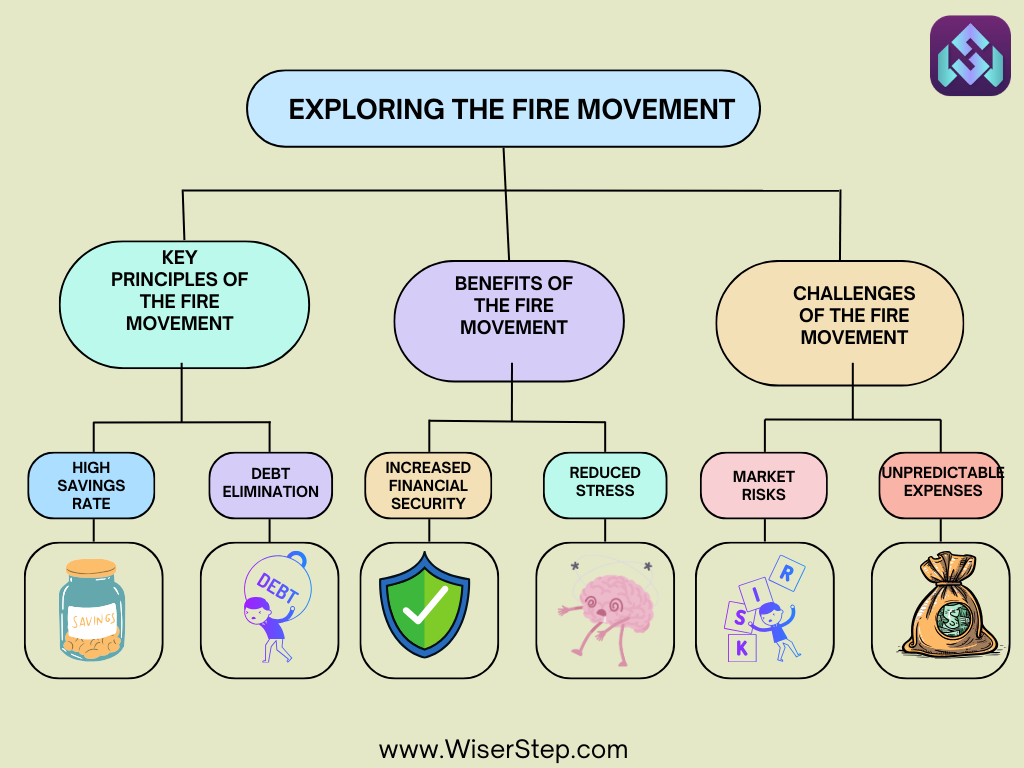

Key Principles of the FIRE Movement

High Savings Rate

The cornerstone of the FIRE movement is a commitment to saving a significant portion of one’s income. Advocates often target a savings rate of 50% or more, allocating the bulk of their earnings towards investments and wealth-building rather than discretionary spending.

Investing for Passive Income

FIRE enthusiasts focus on creating passive income streams through investments. This commonly involves a mix of stocks, bonds, real estate, and other income-generating assets. The goal is to generate enough passive income to cover living expenses without relying on a traditional job.

Frugality and Minimalism

Living a frugal lifestyle is integral to the FIRE philosophy. Adopting minimalism and being mindful of unnecessary expenses allow individuals to redirect more of their income towards savings and investments.

Debt Elimination

The FIRE movement places a strong emphasis on eliminating debt, particularly high-interest consumer debt. By freeing themselves from financial liabilities, individuals can accelerate their journey towards financial independence.

Benefits of the FIRE Movement

Early Retirement

Perhaps the most apparent benefit is the ability to retire early and enjoy a more extended period of leisure or pursue alternative passions and interests.

Increased Financial Security

Achieving financial independence provides a sense of security, knowing that one is not solely reliant on employment income and can weather unexpected financial challenges.

Flexible Lifestyle

FIRE allows for greater flexibility in lifestyle choices. Whether it’s traveling the world, starting a small business, or dedicating time to philanthropy, early retirees have the freedom to shape their lives according to their values.

Reduced Stress

Breaking free from the paycheck-to-paycheck cycle and financial worries can significantly reduce stress levels, contributing to overall well-being.

Challenges of the FIRE Movement

Stringent Budgeting

The high savings rate required by the FIRE movement often involves strict budgeting, which may limit discretionary spending on non-essential items.

Market Risks

Relying on investments to generate passive income comes with inherent market risks. Economic downturns can impact portfolio values, potentially affecting the sustainability of early retirement plans.

Unpredictable Expenses

Unexpected expenses, such as healthcare costs or major home repairs, can pose challenges to the financial plans of those pursuing FIRE.

Social Implications

Early retirees may face social challenges, as their lifestyle choices may differ significantly from societal norms. Balancing financial goals with social connections is an ongoing consideration.

Practical Steps for FIRE Aspirants

Calculate Your FIRE Number

Determine the amount of money needed to achieve financial independence and cover living expenses without relying on employment income. This is commonly referred to as the “FIRE number.”

Maximize Savings and Investments

Aim to save a substantial portion of your income and invest wisely. Consider tax-efficient investment strategies and diversify your portfolio to mitigate risks.

Eliminate Debt

Prioritize debt elimination, especially high-interest debt, to accelerate your journey towards financial independence.

Embrace Frugality

Adopt a frugal lifestyle by scrutinizing expenses and identifying areas where you can cut costs without sacrificing essential needs.

Build Multiple Income Streams

Diversify your income streams by exploring side hustles or alternative sources of revenue. This can provide additional financial security and speed up the path to FIRE.

The FIRE movement represents a unique approach to personal finance, emphasizing financial independence and early retirement through intentional living, high savings rates, and strategic investing. While it comes with its set of challenges, the potential benefits, including increased financial security, lifestyle flexibility, and reduced stress, make it an intriguing option for those willing to commit to its principles. As with any financial strategy, careful planning, adaptability, and a realistic assessment of individual circumstances are crucial to the successful pursuit of FIRE.