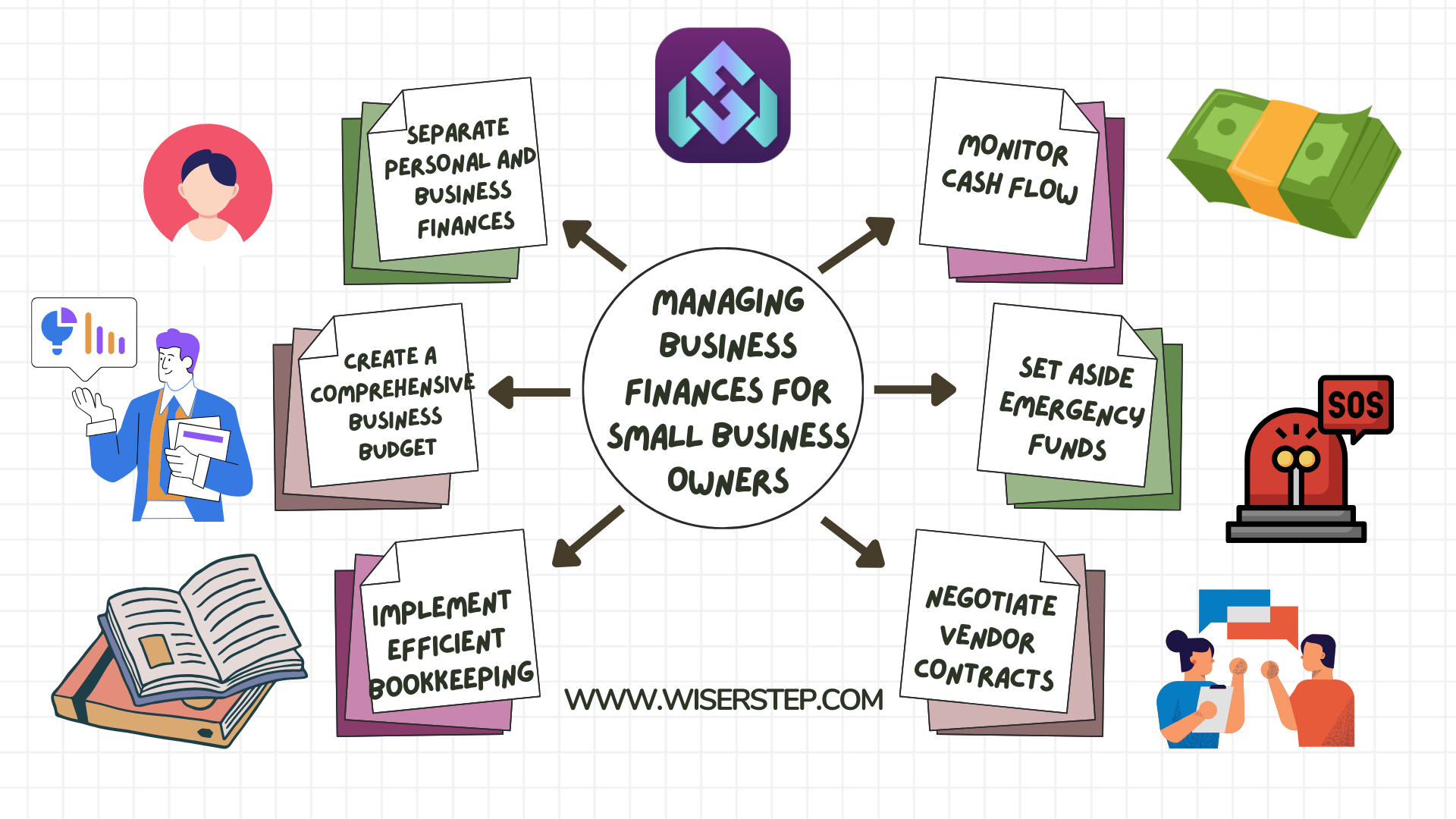

Starting your own business is an exhilarating journey filled with opportunities and challenges. One of the most critical aspects of entrepreneurship is managing your business finances effectively. Regardless of the size of your venture, sound financial management is key to its success and sustainability. In this blog, we will explore essential strategies for small business owners to navigate the complex world of entrepreneurship and finances.

Separate Personal and Business Finances

One of the first steps for any entrepreneur is to establish a clear boundary between personal and business finances. Open a separate business bank account to keep your business transactions distinct from personal expenses. This separation simplifies bookkeeping, tax filing, and financial analysis.

Create a Comprehensive Business Budget

A well-planned budget is the cornerstone of financial stability for your business. Outline all your expected revenues and expenses, including operational costs, employee salaries, marketing, and any loan repayments. Regularly monitor your budget, adjusting it as necessary to accommodate changing circumstances.

Implement Efficient Bookkeeping

Accurate and up-to-date financial records are essential for making informed business decisions. Consider using accounting software to streamline bookkeeping processes. Regularly reconcile your accounts, categorize transactions, and maintain a record of all invoices and receipts. This meticulous bookkeeping ensures you have a clear picture of your financial health.

Monitor Cash Flow

Cash flow is the lifeblood of any business. Keep a close eye on your cash flow statement, tracking money coming in and going out. Delayed payments from clients and unexpected expenses can disrupt your cash flow. Having reserves or a line of credit can help you manage temporary cash flow gaps effectively.

Set Aside Emergency Funds

Just like personal finances, businesses need emergency funds. Unforeseen events like equipment breakdowns or sudden market shifts can strain your finances. Having a financial cushion ensures your business can weather such storms without jeopardizing operations or growth plans.

Negotiate Vendor Contracts

As a small business owner, negotiating favorable terms with your suppliers can significantly impact your bottom line. Seek discounts for bulk purchases, timely payments, or long-term contracts. Efficient vendor management can help reduce costs, contributing to your overall financial stability.

Regularly Review and Adjust Pricing

Pricing your products or services is a delicate balance between covering costs and remaining competitive. Regularly review your pricing strategy, factoring in production costs, overheads, and desired profit margins. Adjust your prices as necessary to maintain profitability and competitiveness in the market.

Invest in Financial Education

Financial literacy is a valuable asset for any business owner. Invest time in educating yourself about various financial aspects of entrepreneurship, including taxes, investments, and financial analysis. Attend workshops, read books, or consult with financial experts to enhance your understanding.

Plan for Taxes

Taxes are a significant consideration for businesses. Familiarize yourself with tax regulations relevant to your business type and location. Set aside a portion of your revenue for taxes, ensuring you won’t be caught off guard when tax season arrives. Consider consulting with a tax professional to optimize your tax strategy.

Explore Small Business Financing Options

While bootstrapping is commendable, there may be times when your business requires additional capital. Explore small business loans, lines of credit, or crowdfunding options to fuel growth initiatives or manage unexpected expenses. Evaluate the terms carefully to choose the most suitable option for your business.

Embrace Technology for Financial Management

Leverage technology to streamline your financial processes. From digital payment systems to cloud-based accounting software, technology offers efficient solutions for managing finances. Automation not only saves time but also reduces the risk of human error.

Regular Financial Health Check-ups

Conduct regular financial health assessments for your business. Analyze your profit and loss statements, balance sheets, and cash flow reports. Identify trends, strengths, and areas for improvement. Regular financial check-ups empower you to make data-driven decisions that contribute to the growth and stability of your business.

In conclusion, effective financial management is fundamental to the success of any entrepreneurial venture. By implementing these strategies and staying vigilant about your business finances, you can navigate challenges, seize opportunities, and build a thriving and sustainable enterprise. Remember, the key lies in meticulous planning, continuous learning, and adaptability. As you master the art of managing your business finances, you pave the way for long-term success and financial prosperity.