Life is unpredictable. Unexpected emergencies such as medical expenses, car repairs, or sudden job loss can knock on your door unannounced, leaving you financially vulnerable. This is where the importance of having an emergency fund, often referred to as a financial safety net, comes into play. In this blog, we will delve into why having an emergency fund is crucial and how to build and maintain one, ensuring you have a cushion to fall back on during challenging times.

Understanding the Significance

An emergency fund acts as a buffer between you and financial disaster. It provides you with the ability to cover unforeseen expenses without resorting to high-interest credit cards or loans. Having this safety net not only reduces stress during emergencies but also prevents you from derailing your long-term financial goals.

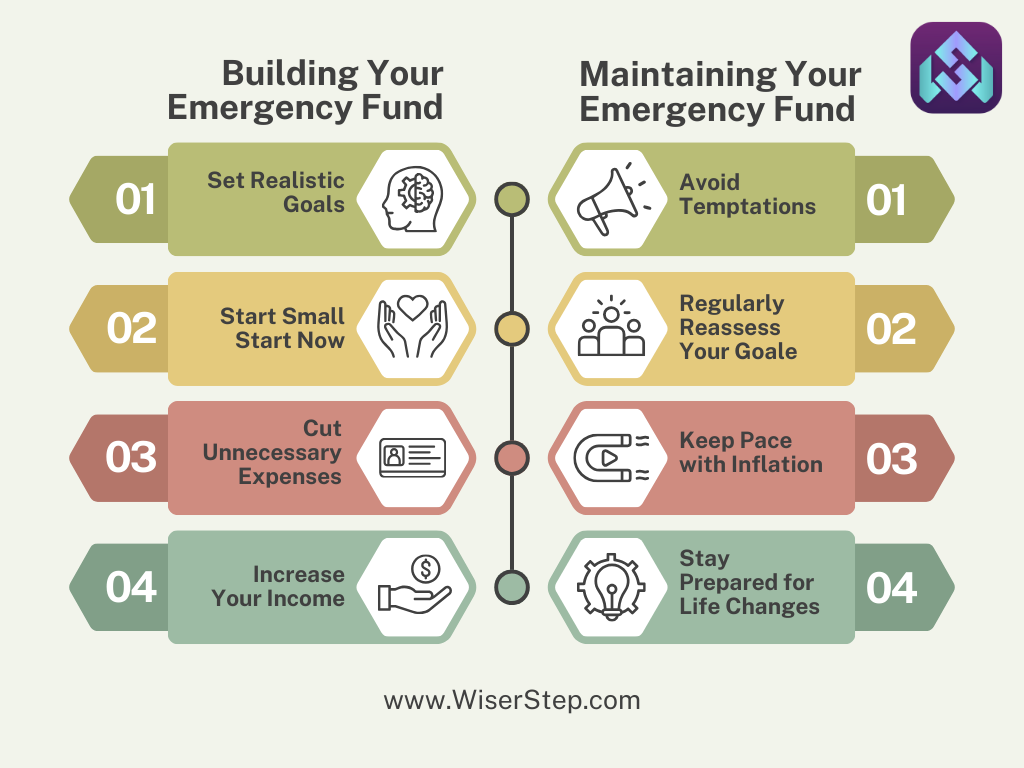

Building Your Emergency Fund

Set a Realistic Goal

Determine how much you need in your emergency fund. A common recommendation is to save at least three to six months’ worth of living expenses. Consider your monthly bills, groceries, insurance, and any debt payments. This amount forms the basis of your emergency fund goal.

Start Small, Start Now

If saving a substantial amount seems overwhelming, start small. Even putting aside a small percentage of your income regularly can add up over time. Consistency is key; set up an automatic transfer to your emergency fund account with each paycheck.

Cut Unnecessary Expenses

Evaluate your spending habits critically. Identify non-essential expenses that can be trimmed down or eliminated. Redirect the money saved from these cutbacks into your emergency fund. Sacrifices now can lead to financial security later.

Increase Your Income

Look for opportunities to boost your income, such as a part-time job, freelance work, or selling items you no longer need. The additional income can accelerate the growth of your emergency fund, bringing you closer to your goal faster.

Use Windfalls Wisely

Whenever you receive unexpected money, like tax refunds or bonuses, resist the temptation to splurge. Instead, allocate a portion of these windfalls to your emergency fund. This extra infusion of cash can significantly bolster your savings.

Maintaining Your Emergency Fund

Avoid Temptations

Once you’ve built your emergency fund, resist the urge to dip into it for non-emergencies. It’s easy to convince yourself that a want is a need, but disciplining yourself to use the fund only for genuine emergencies is crucial for its sustainability.

Regularly Reassess Your Goal

Life circumstances change. As your income, expenses, or family size changes, reevaluate your emergency fund goal. A larger family or higher expenses might necessitate a bigger safety net.

Keep Pace with Inflation

Inflation erodes the purchasing power of money over time. Ensure that your emergency fund keeps up with inflation rates. Periodically reassess your fund’s target to adjust for changes in the cost of living.

Stay Prepared for Life Changes

Major life events, such as marriage, having children, or buying a house, can alter your financial needs. Anticipate these changes and adjust your emergency fund accordingly to accommodate the increased responsibilities.

The Peace of Mind That Comes with Preparedness

Having a well-maintained emergency fund provides a profound sense of security. It means you can face unexpected challenges without the overwhelming stress of financial instability. Moreover, it allows you to handle emergencies without derailing your long-term financial goals, such as saving for a home, retirement, or your children’s education.

In conclusion, building and maintaining an emergency fund is not just a financial task; it’s an investment in your peace of mind and financial well-being. By taking the necessary steps to establish a robust safety net, you are equipping yourself with the resilience to face life’s uncertainties confidently. Start today, stay consistent, and enjoy the comfort that comes with being financially prepared for whatever life may throw your way