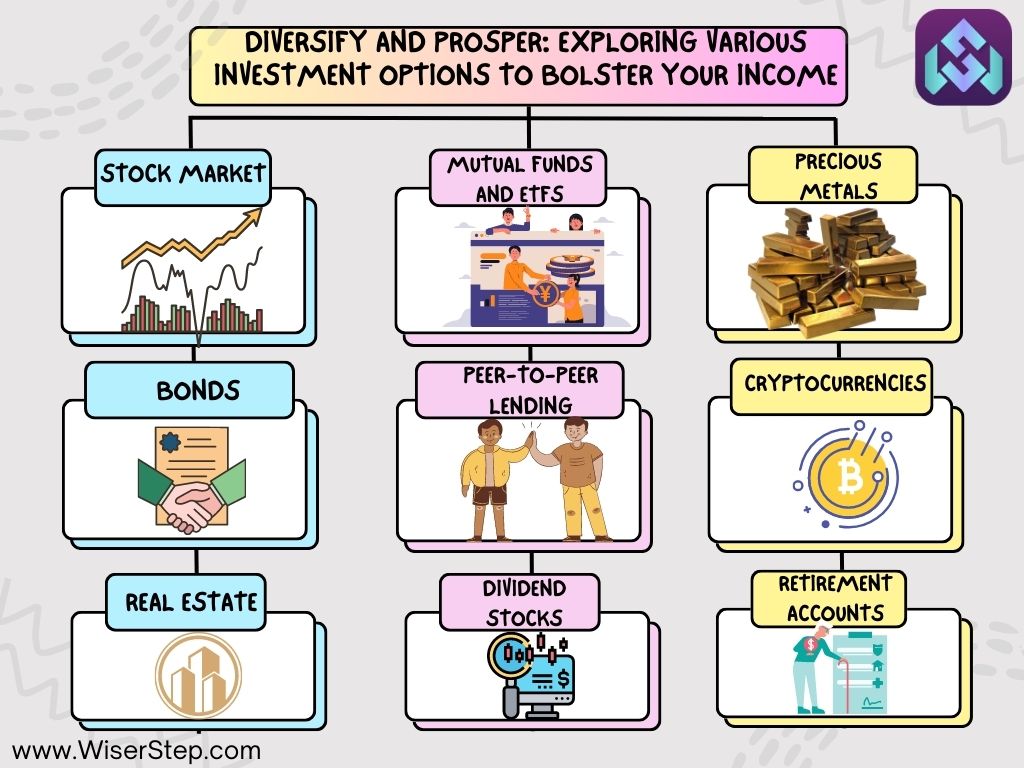

In today’s rapidly changing financial landscape, relying solely on a single source of income can be a risky endeavor. Economic uncertainties, market volatilities, and unforeseen life events can easily disrupt your financial stability. This is where the importance of diversifying your income through various investment options comes into play. Diversification not only shields you from potential losses but also opens the doors to increased financial growth. Let’s explore some of the top investment avenues that can help you fortify your income streams.

Stock Market

Investing in stocks is perhaps one of the most well-known methods of diversification. Stocks represent ownership in a company and can potentially offer significant returns over time. With access to various industries and sectors, you can spread your investments across different stocks, reducing the risk associated with a single company’s performance.

Bonds

Bonds are considered a more stable investment compared to stocks. When you invest in bonds, you’re essentially lending money to a government or a corporation in exchange for periodic interest payments and the return of your principal amount at maturity. Bonds can act as a buffer during stock market downturns, offering a steady income stream.

Real Estate

Investing in real estate, whether through direct ownership or Real Estate Investment Trusts (REITs), can provide both rental income and the potential for property value appreciation. Real estate often moves independently of traditional financial markets, making it a valuable addition to your diversified portfolio.

Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. These funds are managed by professionals, providing instant diversification even for those with limited investment knowledge.

Peer-to-Peer Lending

This digital-age investment option allows you to lend money to individuals or small businesses online, earning interest on your loans. While potentially offering attractive returns, it’s crucial to research platforms thoroughly and understand associated risks.

Dividend Stocks

Investing in dividend-paying stocks can provide you with a consistent income stream in the form of dividends, which are typically paid out quarterly. This is an effective way to generate passive income while benefiting from potential stock price appreciation.

Precious Metals

Assets like gold, silver, and other precious metals have historically been considered a safe haven during economic uncertainties. They can act as a hedge against inflation and currency devaluation, adding a layer of security to your portfolio.

Cryptocurrencies

While relatively new and inherently more volatile, cryptocurrencies offer an alternative investment avenue. Bitcoin and other established cryptocurrencies have gained attention as a potential store of value and a means of diversification for tech-savvy investors.

Retirement Accounts

Maximizing contributions to retirement accounts like 401(k)s and IRAs not only offers tax advantages but also enables you to diversify your investments within these accounts. This approach ensures that you’re prepared for the long term while enjoying tax benefits.

Startups and Angel Investing

For those willing to take on higher risk in pursuit of potentially high rewards, investing in startups and early-stage companies can be an option. Angel investing allows you to support innovative ventures while potentially earning substantial returns.

Diversification is the key to financial resilience and prosperity. By allocating your resources across a variety of investment options, you minimize risk while maximizing the potential for growth. It’s important to tailor your investment strategy to your financial goals, risk tolerance, and time horizon. A well-rounded portfolio that combines the aforementioned investment avenues can offer a robust foundation for creating and maintaining multiple income streams. Remember, while diversification can reduce risk, all investments come with inherent risks, so conducting thorough research and seeking professional advice is essential before making any financial decisions.