In an era where convenience and speed are paramount, the evolution of payment methods has undergone a remarkable transformation. Digital wallets, also known as mobile wallets or e-wallets, have emerged as revolutionary tools redefining the way we handle transactions. These digital repositories for our payment methods have reshaped the entire payment landscape, offering convenience, security, and versatility like never before.

The Evolution of Payments

Traditionally, cash and physical cards were the primary modes of payment. However, the rise of digitalization and the omnipresence of smartphones have paved the way for a shift toward digital wallets. These wallets allow users to store various payment methods, such as credit/debit card information, bank account details, and even cryptocurrencies, securely on their devices.

Understanding Digital Wallet

What Are Digital Wallets?

Digital wallets are software-based systems that securely store payment information and facilitate electronic transactions. They utilize encryption and authentication protocols to safeguard sensitive financial data.

Types of Digital Wallets

Closed Wallets: Tied to a specific merchant or service, such as Starbucks or Amazon Pay.

Semi-Closed Wallets: Used for transactions within a group of merchants, like Google Pay or Apple Pay.

Open Wallets: Offered by banks or financial institutions, allowing transactions across multiple merchants, such as PayPal or Samsung Pay.

How Digital Wallets Work

Registration and Setup

Users typically download an app, register, and link their preferred payment methods. The app may require additional security measures like PINs, passwords, or biometric authentication (fingerprint or face recognition).

Making Payments

To complete a transaction, users select the digital wallet as their payment method and authorize the payment through their device, often using NFC (Near Field Communication) or QR codes.

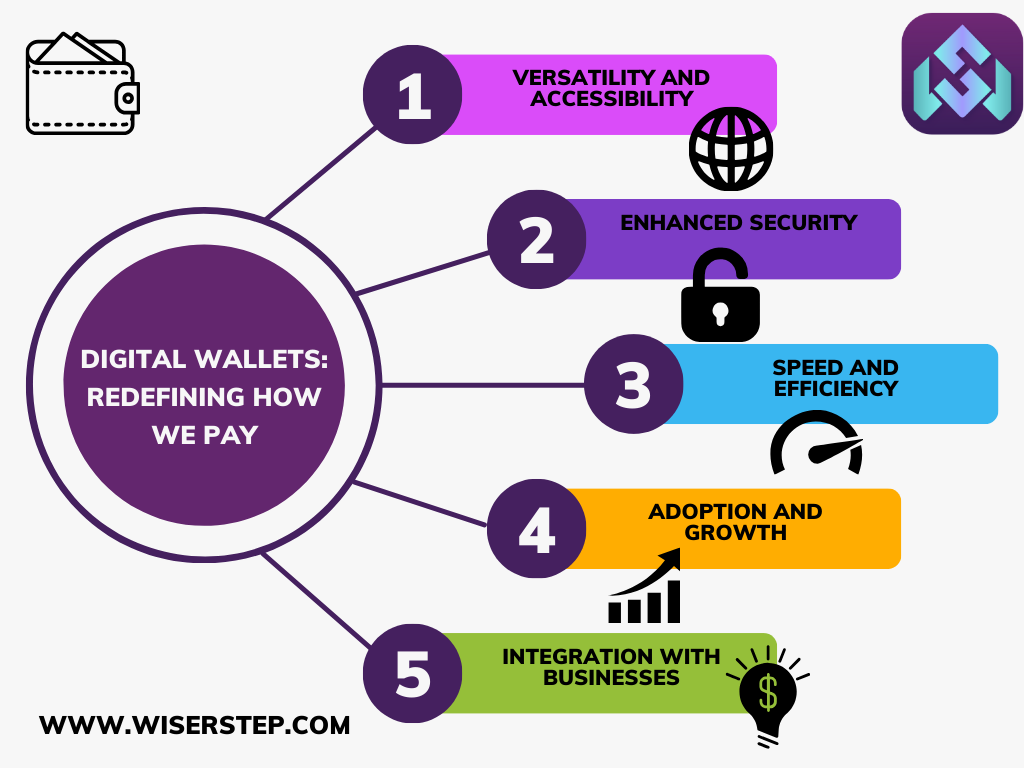

Versatility and Accessibility

Digital wallets are not limited to in-store payments; they facilitate online purchases, bill payments, peer-to-peer transfers, and even public transportation payments in some instances.

Advantages of Digital Wallets

Convenience

Gone are the days of rummaging through wallets or carrying multiple cards. With digital wallets, users have all their payment methods accessible through a single app on their smartphones.

Enhanced Security

Digital wallets employ robust security measures like tokenization, encryption, and biometric authentication, reducing the risk of fraud and theft associated with physical cards.

Speed and Efficiency

Transactions with digital wallets are swift, often requiring just a tap or scan. This expediency is especially beneficial in busy retail environments or for online purchases.

Organized and Detailed Records

Users can easily track their transactions through digital wallets, providing a comprehensive record of expenses and simplifying budget management.

Adoption and Growth

Global Acceptance

Digital wallets have gained widespread acceptance globally, with different regions witnessing significant adoption rates driven by the convenience they offer.

Integration with Businesses

Businesses are increasingly integrating digital wallet options into their payment systems, recognizing the demand for this convenient payment method among consumers.

Challenges and Future Prospects

Interoperability

Achieving interoperability among different digital wallet platforms remains a challenge, limiting seamless transactions across various systems.

Security Concerns

While digital wallets offer enhanced security, cyber threats persist, requiring continuous advancements in security protocols to protect user data.

Future Innovations

The future of digital wallets holds promising innovations, including improved integration with IoT (Internet of Things) devices and advancements in contactless payment technology.

Digital wallets have transformed how we perceive and conduct financial transactions. Their convenience, security features, and versatility have made them an integral part of modern-day payments. As technology continues to evolve, digital wallets are poised to play an even more significant role in shaping the future of finance and commerce.

Embracing these innovative payment methods not only simplifies our daily transactions but also contributes to the ongoing digital revolution, redefining the very essence of how we pay and interact in an increasingly connected world. As we move forward, digital wallets will undoubtedly continue to revolutionize and streamline the way we handle our finances.