Debentures are a widely used financial instrument that often puzzles potential investors. In this detailed blog, we will unravel the world of debentures, exploring what they are, the various types available, and most importantly, whether you should consider adding them to your investment portfolio.

What Are Debentures?

Debentures are essentially a form of debt instrument issued by corporations, governments, or financial institutions to raise capital. When you invest in a debenture, you are essentially lending money to the issuer. In return, you receive periodic interest payments, often semi-annually or annually, along with the promise of the principal amount being repaid at maturity.

Types of Debentures

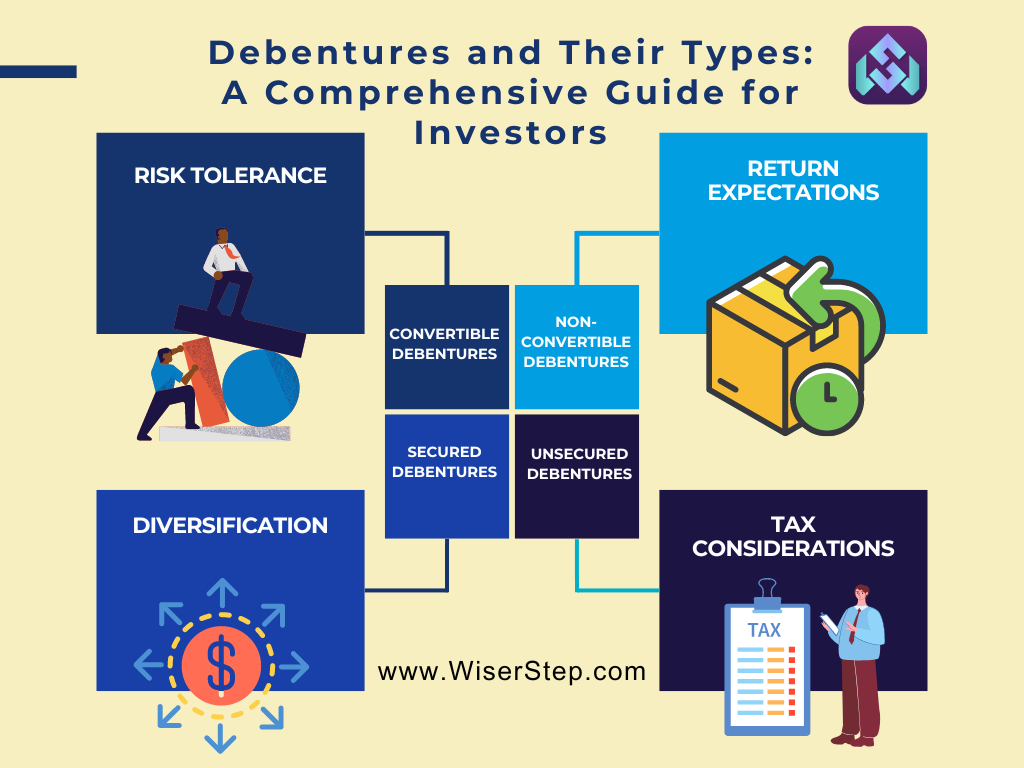

Debentures come in various types, each tailored to meet different investment goals and risk appetites. Here are the most common types.

Convertible Debentures

Convertible debentures give you the option to convert your debt investment into equity shares of the issuing company. This feature provides the potential for capital appreciation if the company’s stock price rises.

Investors who believe in the long-term growth prospects of the company often find convertible debentures appealing.

Non-Convertible Debentures (NCDs)

NCDs are straightforward debt instruments that do not carry the option of conversion into equity. They offer fixed interest rates and are generally considered safer than their convertible counterparts.

These are suitable for risk-averse investors looking for predictable income.

Secured Debentures

Secured debentures are backed by specific assets or collateral, such as property or assets of the issuing company. This collateral provides a safety net for investors in case of issuer default.

While they offer lower risk, they may yield lower returns compared to unsecured debentures.

Unsecured Debentures

Also known as “naked debentures,” these are not backed by any collateral. Consequently, they typically offer higher interest rates to compensate for the increased risk.

Investors seeking higher returns but willing to take on more risk may consider unsecured debentures.

Callable Debentures

Callable debentures grant the issuer the option to redeem the debt before the scheduled maturity date. This introduces reinvestment risk to investors.

It’s essential to consider the issuer’s likelihood of exercising this option when investing in callable debentures.

Perpetual Debentures

Perpetual debentures, as the name suggests, have no fixed maturity date. They pay interest indefinitely, making them a unique option.

While they offer the benefit of ongoing income, they are less common and may provide lower interest rates compared to other debenture types

Should You Invest in Debentures?

Now that you’re familiar with the types of debentures, the question remains: should you invest in them? The answer depends on several factors:

Risk Tolerance: Your willingness and capacity to take on risk play a crucial role. If you prefer lower risk, consider non-convertible, secured debentures or government bonds. For higher risk tolerance, explore convertible or unsecured debentures.

Return Expectations: Debentures can offer varying levels of returns. Evaluate your income and growth objectives. If you seek stability and consistent income, non-convertible debentures might be suitable. If you aim for potential capital appreciation, consider convertible debentures.

Diversification: Including debentures in your investment portfolio can enhance diversification, spreading risk across different asset classes. This can be particularly beneficial in managing risk.

Investment Horizon: Consider your investment time frame. Some debentures have long maturity periods, which may not align with your financial goals.

Tax Considerations: Understand the tax implications of debenture interest income in your jurisdiction. Tax treatment can impact your overall returns.

Creditworthiness: Thoroughly research and assess the financial health and creditworthiness of the debenture issuer. Higher-rated issuers are generally safer investments.

Debentures are versatile financial instruments that offer investors a range of options to fit their unique goals and risk tolerance. Deciding whether to invest in debentures should be a well-informed choice. Consider the type of debenture, the issuer’s creditworthiness, your risk profile, and your investment horizon. Consult with a financial advisor to ensure your investment decisions align with your overall financial strategy, helping you achieve your financial objectives.