Category: Personal Finance

-

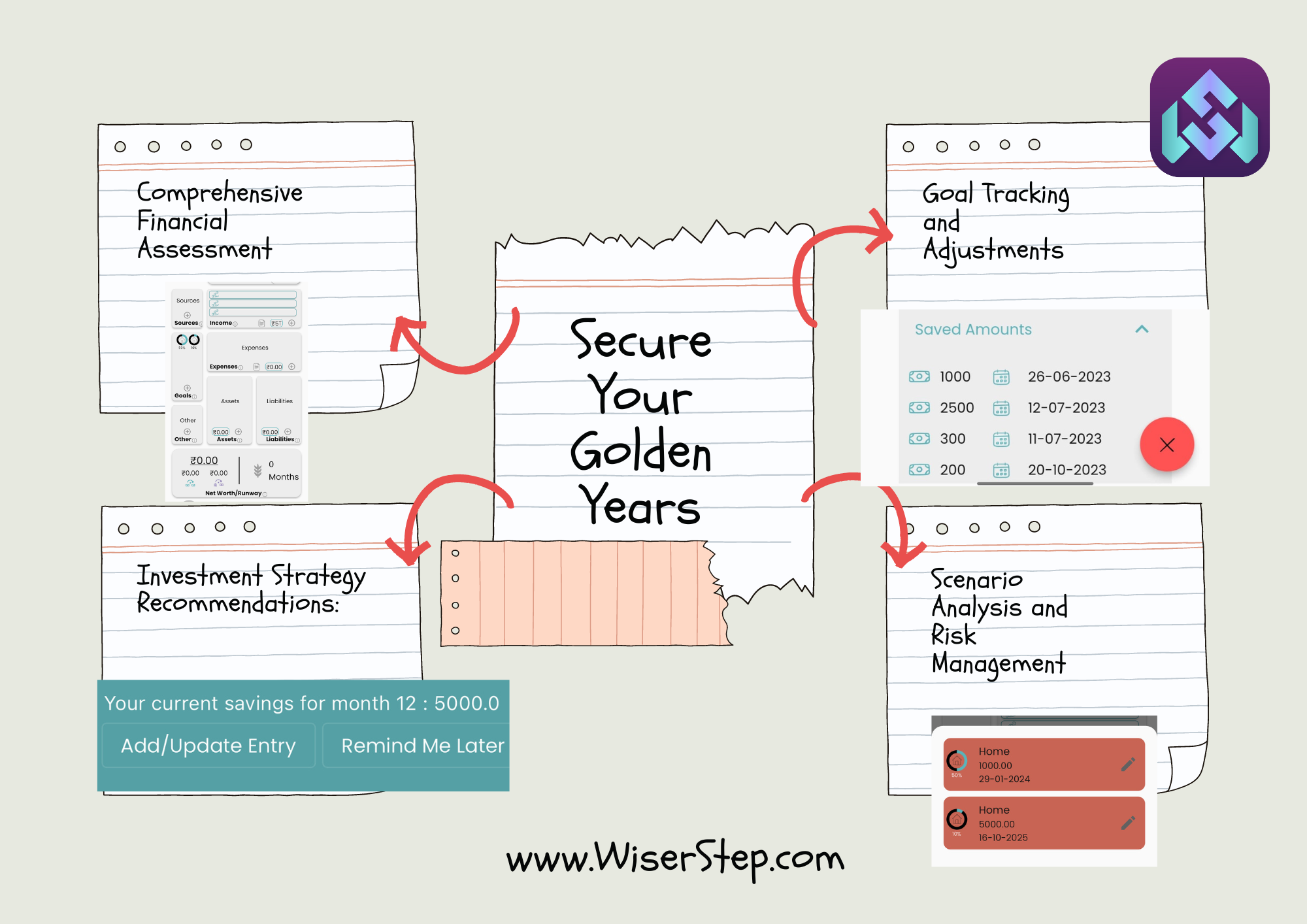

Secure Your Golden Years: How WiserStep and Finance Apps Simplify Retirement Income Planning

Retirement is a phase in life that demands careful financial planning. As we aim to maintain our lifestyle and ensure financial stability during our golden years, the role of finance apps becomes increasingly crucial. Among these, WiserStep stands out as an innovative tool designed to streamline and simplify retirement income planning. Understanding the Importance of

-

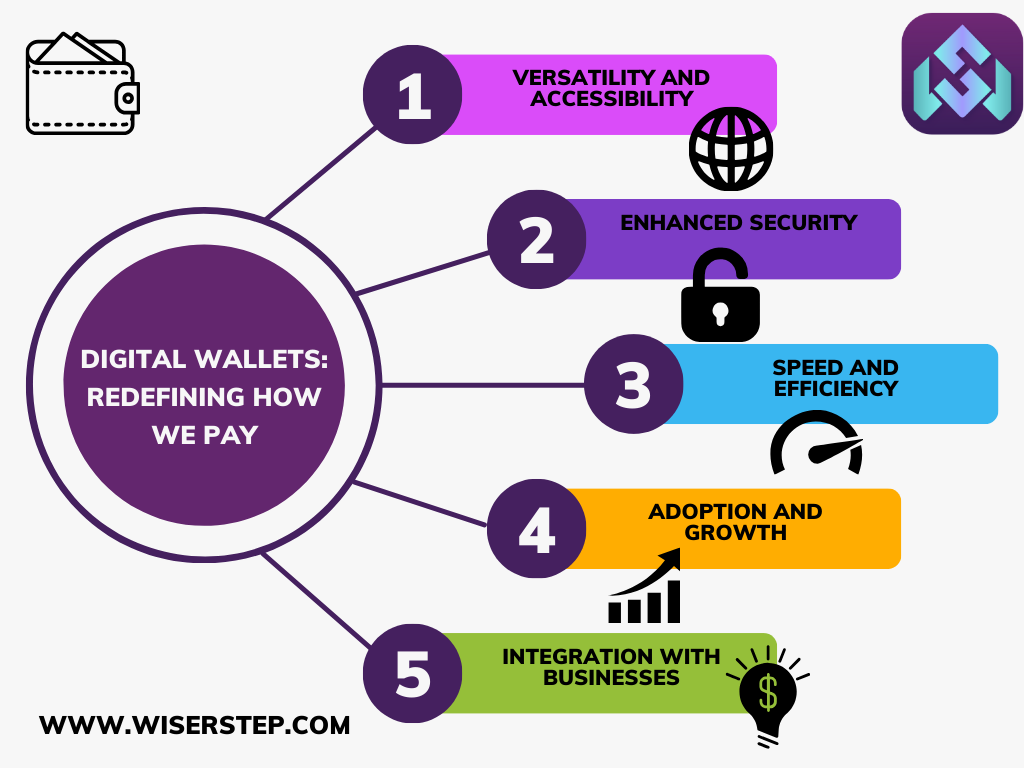

Digital Wallets: Redefining How We Pay our Expenses

In an era where convenience and speed are paramount, the evolution of payment methods has undergone a remarkable transformation. Digital wallets, also known as mobile wallets or e-wallets, have emerged as revolutionary tools redefining the way we handle transactions. These digital repositories for our payment methods have reshaped the entire payment landscape, offering convenience, security,

-

Investing in Their Future: Tips for Saving for Your Children’s Education with the WiserStep App

As parents, one of the greatest gifts we can give our children is a quality education. However, the rising costs of tuition and other educational expenses can be a daunting challenge for many families. The key to navigating this financial journey is strategic planning and disciplined saving. In this blog post, we’ll explore valuable tips

-

Millennials and Money: Navigating Unique Financial Challenges and Solutions

Millennials, often characterized by their tech-savvy nature and desire for experiences, face a set of financial challenges distinct from previous generations. In this blog, we’ll explore some of these challenges and offer practical solutions to help millennials secure their financial future. Student Loan Debt Millennials often carry a significant burden of student loan debt. Discuss

-

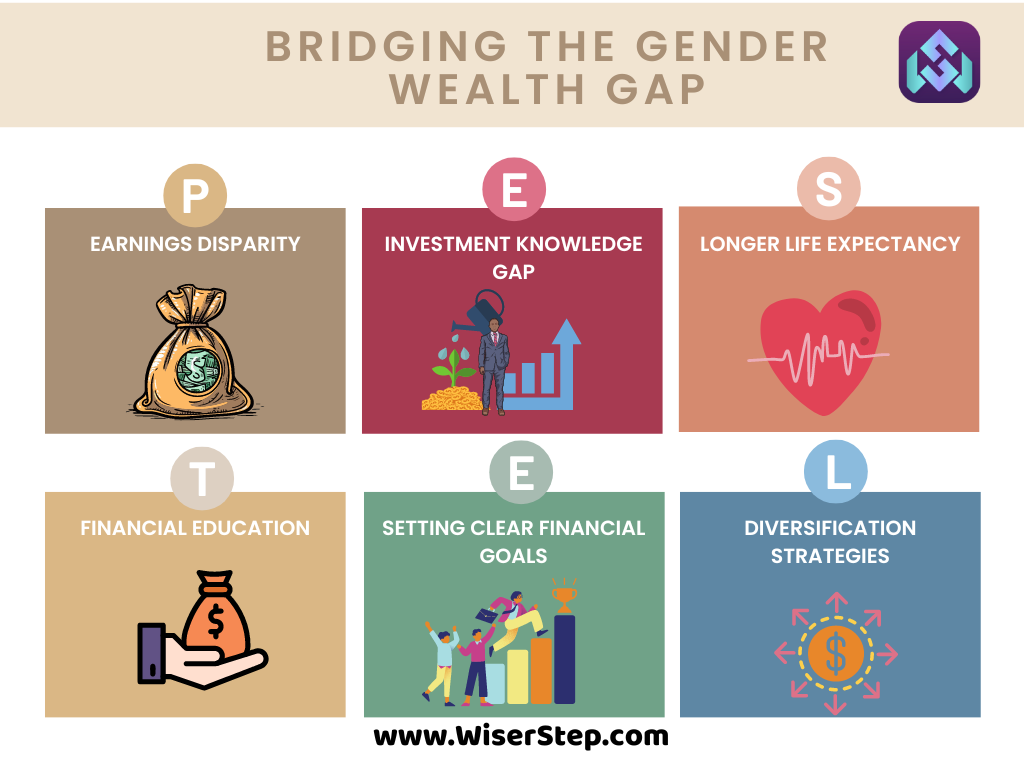

Women and Investing: Bridging the Gender Wealth Gap

The gender wealth gap remains a persistent issue, with women often facing unique challenges when it comes to building financial security through investing. In this blog, we will delve into the factors contributing to the gap and explore strategies for women to empower themselves financially through investment. Understanding the Gender Wealth Gap Earnings Disparity Women,

-

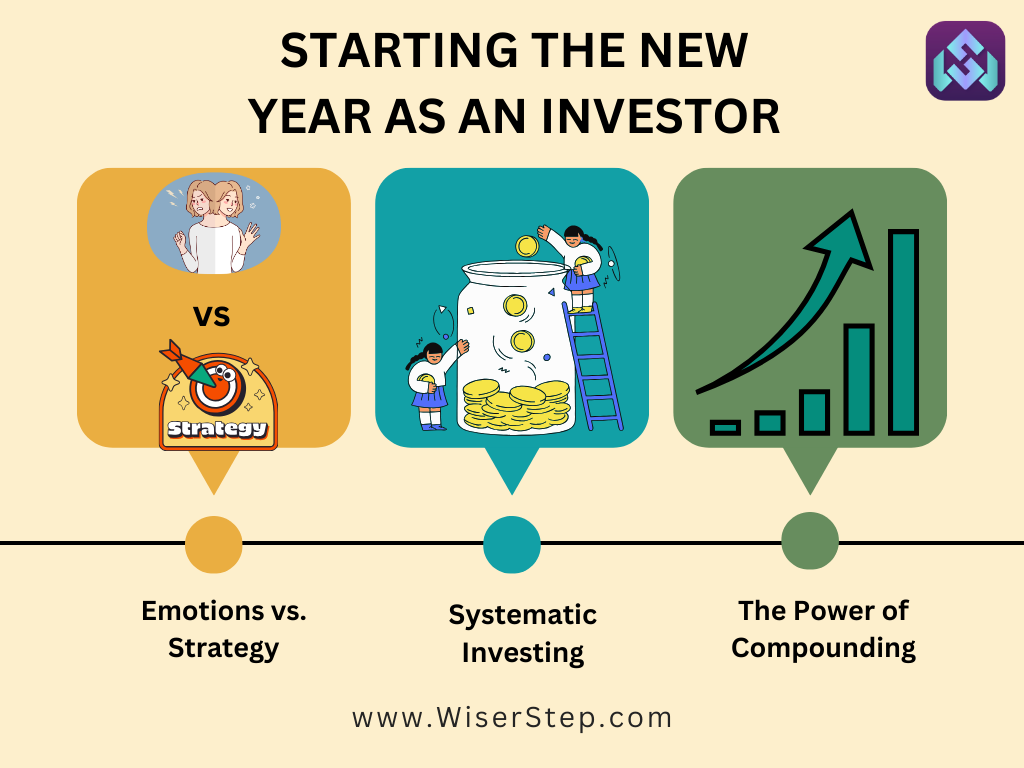

Starting the New Year as an Investor: Embracing Consistency

As the New Year unfolds, it’s customary to set resolutions and goals, and for investors, this time offers an opportunity to reflect on strategies and aspirations for the year ahead. Amidst the ever-changing landscape of markets and financial climates, one of the most crucial aspects an investor can embrace is consistency. Consistency isn’t just a

-

Empowering Your Financial Future: How a Finance App Can Revolutionize Your Money Management

In today’s fast-paced world, managing finances has become increasingly complex. With multiple income streams, diverse expenditures, and an abundance of financial goals, individuals often find it challenging to maintain a clear and organized overview of their financial health. Thankfully, the advent of technology has brought about revolutionary solutions, and finance apps have emerged as powerful

-

Charitable Giving: Financial and Social Impact

In a world facing diverse challenges, the act of charitable giving stands as a beacon of hope, not just for the recipients but also for the givers themselves. Beyond the immediate aid it provides, charitable giving carries profound financial and social impacts that reverberate through communities, shaping a brighter future for all. Financial Impact of

-

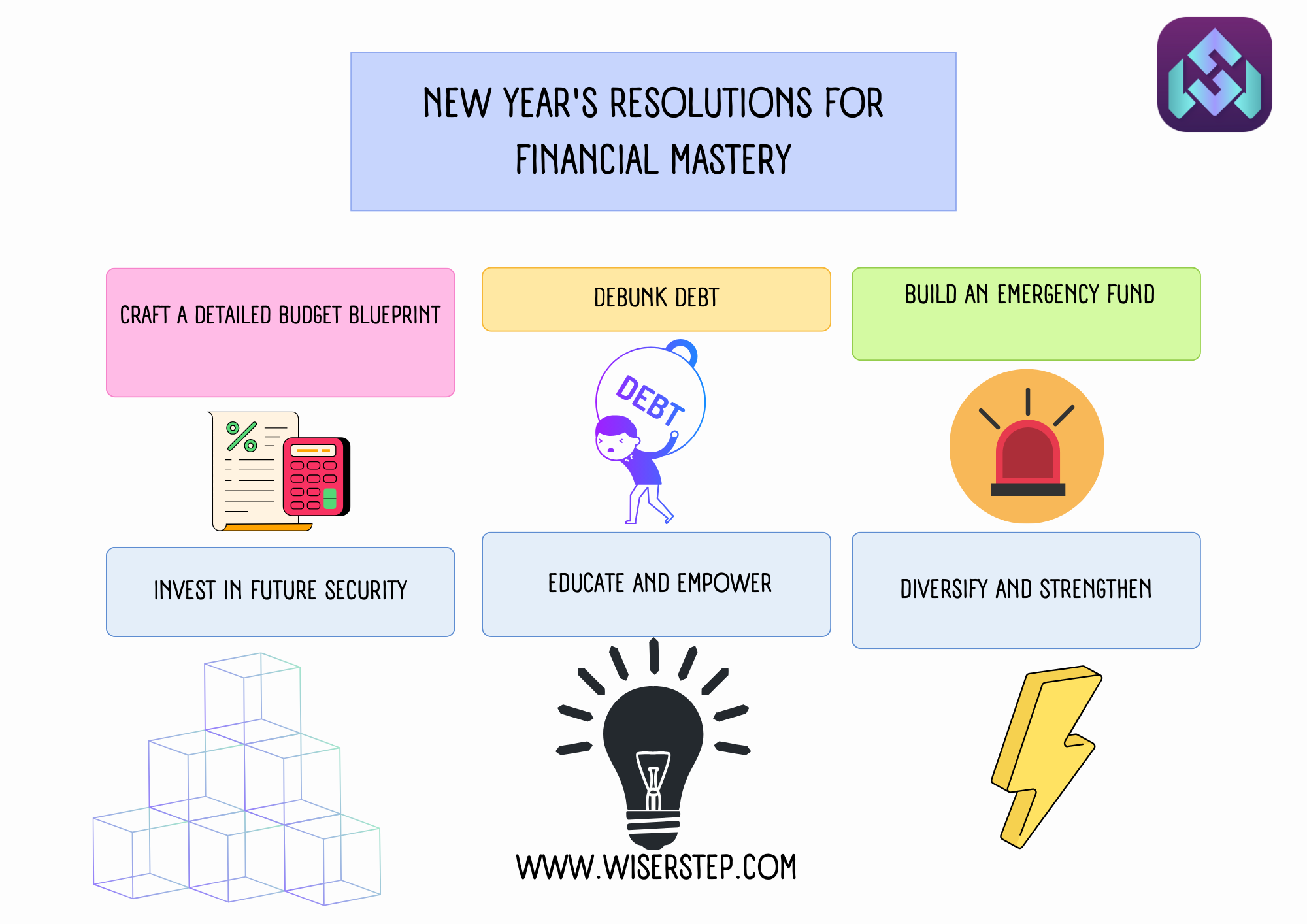

Revolutionize Your Finances: 10 New Year’s Resolutions for Financial Mastery

As we bid farewell to the old year and welcome the new, it’s the perfect time to reflect on our financial habits and set meaningful resolutions for the year ahead. Embracing a fresh start, particularly in managing our finances, can pave the way for a more secure and prosperous future. Here are ten powerful resolutions

-

Mastering Your Money: 2024 Financial Resolutions for Success

As the New Year approaches, it’s a perfect time to reflect on your financial habits and set impactful resolutions for the coming year. Managing your finances effectively can bring stability, security, and opportunities for growth. Whether you aim to save more, invest wisely, or reduce debt, here are several powerful resolutions to consider for a