Category: Financial Literacy

-

The Psychology of Money: Unraveling the Emotions that Shape Financial Decision-Making

Money isn’t just about numbers and transactions; it’s a complex tapestry woven with human emotions, beliefs, and behaviors. The field of behavioral economics has illuminated how our psychological factors play a pivotal role in our financial decision-making. In this blog, we’ll delve into the intriguing realm of the psychology of money and explore how our…

-

Building Financial Literacy: Top 10 Must-Read Books for Financial Empowerment

In a world driven by economic complexities and financial decisions, acquiring financial literacy is essential for making informed choices and securing one’s future. Books have long been a valuable source of knowledge, and there is no shortage of excellent literature on personal finance and money management. In this blog, we’ll explore the top 10 books…

-

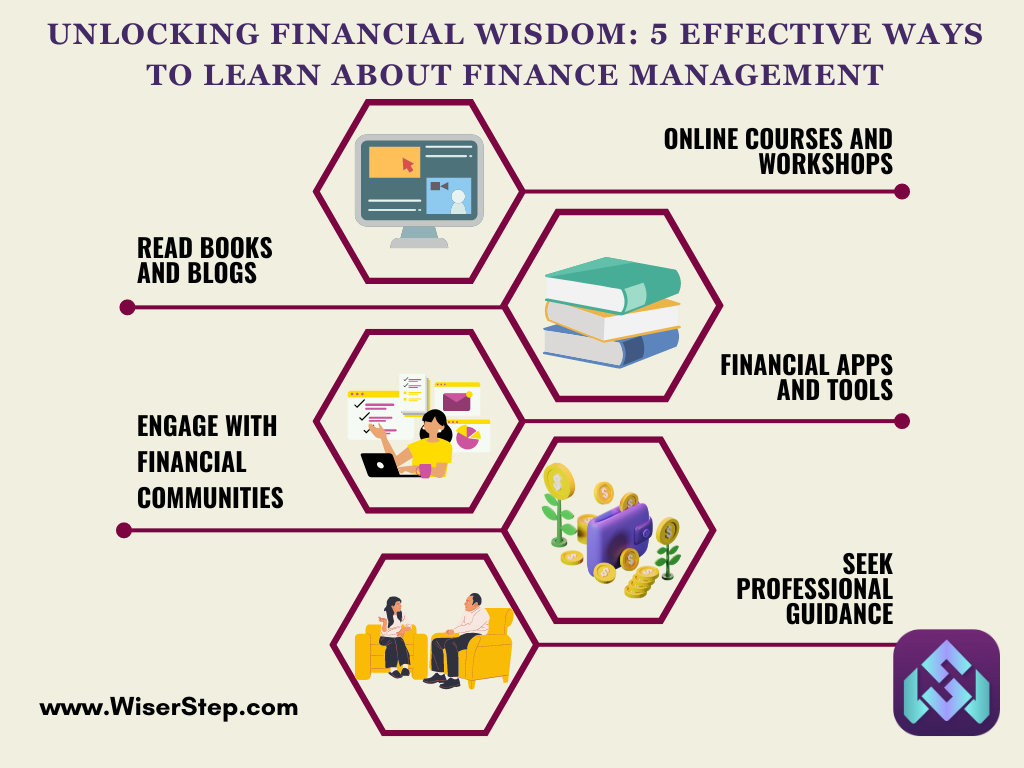

Unlocking Financial Wisdom: 5 Effective Ways to Learn About Finance Management

Are you tired of feeling like your finances are a puzzle missing a few crucial pieces? Or maybe you’re eager to take control of your financial destiny but don’t know where to start. Fear not! The world of finance management is vast, but there are plenty of resources and strategies to help you navigate it…

-

The North Star of Financial Success: The Importance of Setting Goals

In the grand tapestry of life, setting goals serves as a compass, guiding us toward the future we envision. When it comes to your financial well-being, having clear and defined goals is not just advisable; it’s a crucial element that can steer your financial journey in the right direction. In this blog, we’ll delve into…

-

The Dual Pillars of Financial Success: Why Saving More Is as Important as Investment

When it comes to building a strong financial foundation, the two fundamental pillars that play a pivotal role are saving and investing. Often, the spotlight shines brighter on investment strategies, but the truth is that saving more is equally indispensable. In this blog, we’ll delve into the reasons why saving more holds its own weight…

-

Navigating Inflation: Safeguarding Your Savings and Strategies to Save More

Inflation, the steady rise in prices of goods and services over time, can have a profound impact on your financial well-being, particularly your hard-earned savings. While a moderate level of inflation is a sign of a healthy economy, it can erode the purchasing power of your money if left unchecked. In this blog, we’ll delve…

-

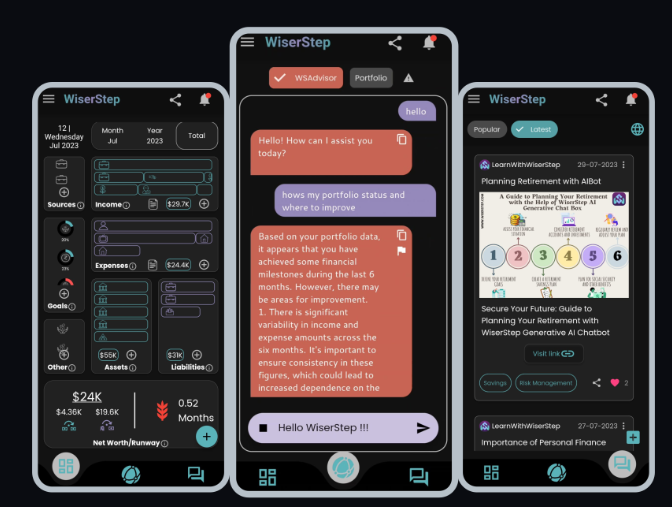

Discover Financial Peace with WiserStep: Your Ultimate Finance Management App

In the fast-paced world we live in today, managing our finances has become more critical than ever. Whether it’s keeping track of expenses, setting up budgets, or planning for future goals, maintaining a firm grip on our financial well-being can often be challenging. This is where the WiserStep finance management app steps in as your…

-

How Saving Habits Define Finance Management: Insights from Rich and Poor Individuals

Financial management is a crucial aspect of everyone’s life, irrespective of their economic status. However, the way people handle their finances can vary significantly depending on their saving habits and mindset. This blog delves into the differences between the saving habits of rich and poor individuals and how these habits play a vital role in…

-

Stay Ahead with Smart Finance Management: Unleashing the Power of an App

In a world filled with opportunities and challenges, mastering the art of finance management can be the key to gaining a competitive edge. Sound financial practices not only secure your present but also propel you toward a more prosperous future. In this blog, we will explore how good finance management can set you apart from…

-

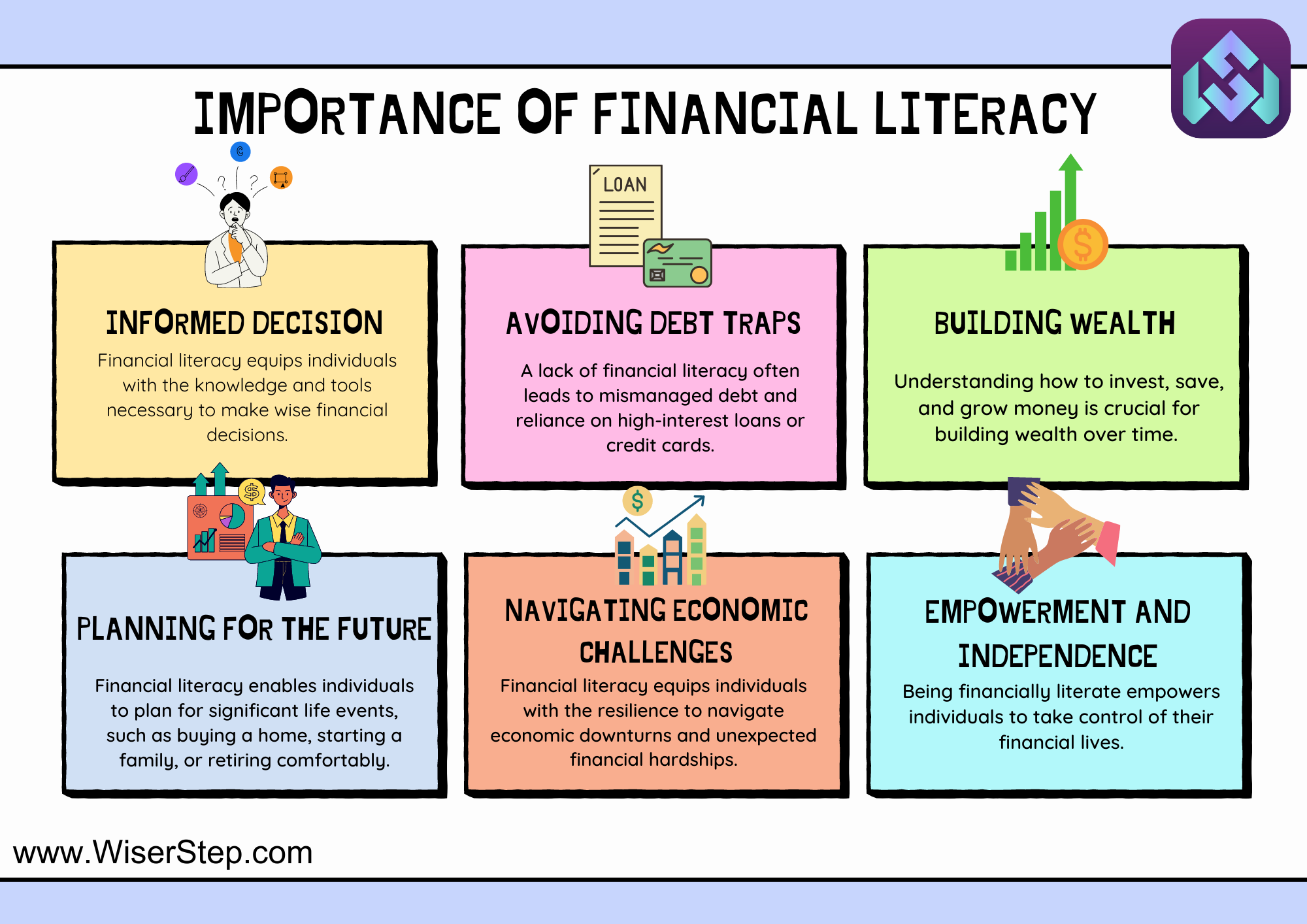

The Significance of Financial Literacy and How WiserStep App’s AI Chatbox Empowers Personalized Financial Advice

In today’s complex financial landscape, financial literacy has become an indispensable skill for individuals of all ages. Understanding the fundamentals of personal finance enables individuals to make informed decisions, effectively manage their money, and work towards achieving their financial goals. In this article, we will explore the importance of financial literacy and how the WiserStep…