In the pursuit of life’s ambitions, mastering finance is the key to success and stability. This blog delves into the contrasting journeys of two individuals, Alex and Sarah, as they navigate their financial paths. Witness how the finance management app, WiserStep, becomes the game-changer, propelling one towards prosperity while the other faces the consequences of overlooking its indispensable role. Discover the transformative power of WiserStep as it shapes their destinies in this tale of financial prowess and missed opportunities.

Part I: The Story of Alex – The Master of Finance

Alex’s Early Days: From the beginning, Alex showed a keen interest in understanding the world of personal finance. He diligently learned about budgeting, saving, investing, and the importance of managing debt. Armed with this knowledge, he was ready to take on the financial challenges life threw his way.

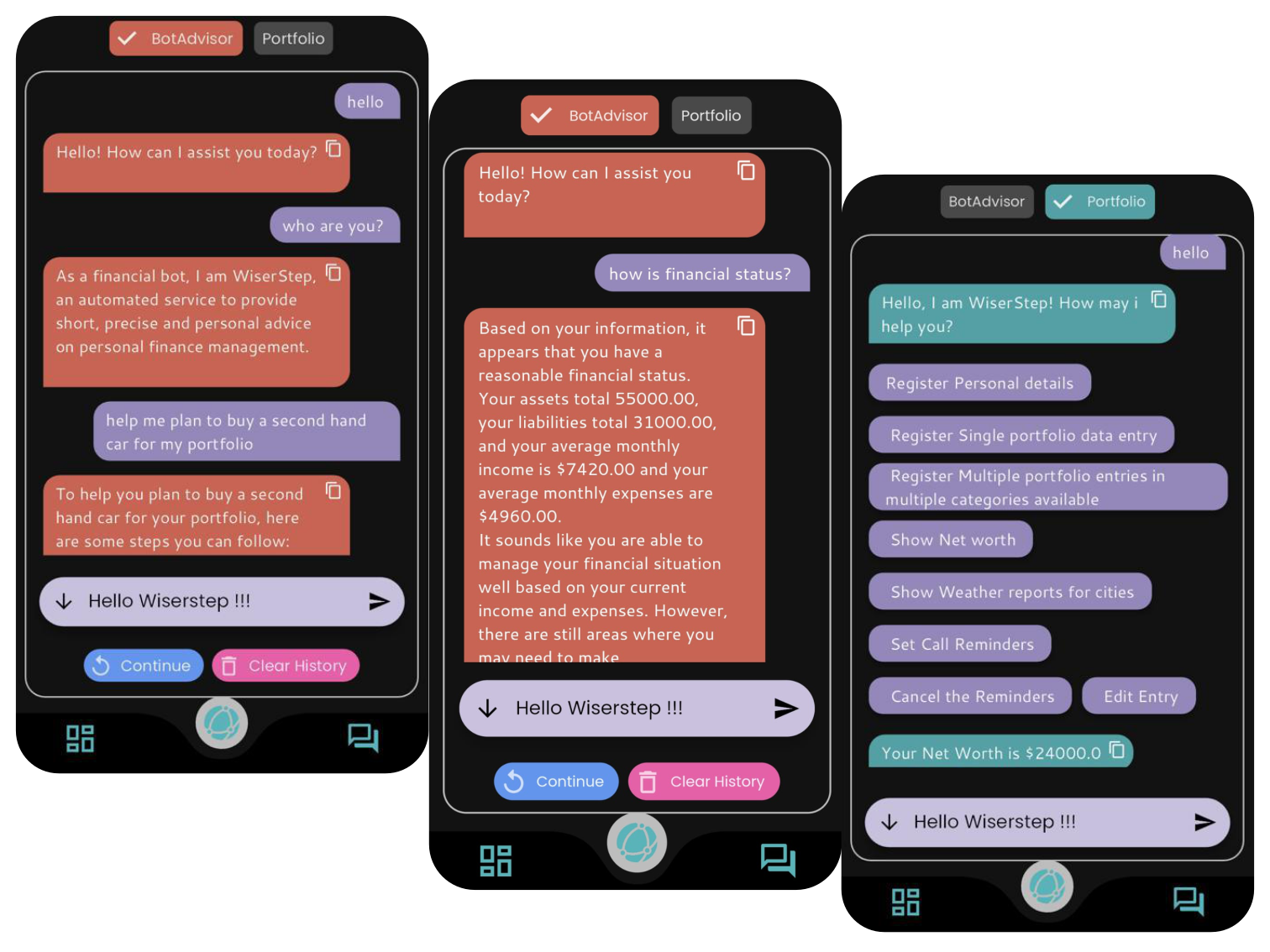

Discovering WiserStep: Alex stumbled upon WiserStep, a finance management app that offered a comprehensive set of tools to help users track expenses, create budgets, and set financial goals. Intrigued by its features, he decided to give it a try.

The Power of WiserStep: WiserStep proved to be a game-changer for Alex. He set up budgets for various aspects of his life, such as housing, transportation, and entertainment. The app’s spending tracking feature allowed him to identify areas where he could cut back and save more. It also provided valuable insights into his spending patterns and habits, helping him make informed financial decisions.

Achieving Financial Goals: With WiserStep’s goal-setting feature, Alex set ambitious financial objectives, like saving for a down payment on a house and investing in his retirement fund. The app automatically tracked his progress and provided timely reminders to stay on track. Over time, he saw his savings grow steadily, leading to a sense of financial security.

Investing with Wisdom: WiserStep’s investment tracking and recommendations were invaluable to Alex. He could monitor his investment performance in real-time, diversify his portfolio, and capitalize on market trends. As a result, his investments thrived, allowing him to build a substantial nest egg for the future.

Part II: The Tale of Sarah – Struggling with Finances

Sarah’s Early Days: Unlike Alex, Sarah approached her finances with a more carefree attitude. She spent impulsively, rarely kept track of her expenses, and lived paycheck to paycheck. The idea of planning for the future seemed distant and daunting to her.

The Missed Opportunity: Although Sarah heard about WiserStep from Alex, she dismissed it as just another finance app. Little did she know that this app could have been a turning point in her financial journey.

Living on Borrowed Time: Sarah’s lack of financial discipline caught up with her. She accumulated credit card debt, struggled to pay bills on time, and found herself constantly worrying about money. The stress affected her overall well-being and even impacted her job performance.

The Wake-up Call: After a series of financial setbacks, Sarah realized she needed a change. She regretted not giving WiserStep a chance when she had the opportunity. It was time for her to take control of her finances and reshape her future.

Part III: The Difference WiserStep Made

Financial Peace for Alex: Thanks to WiserStep’s meticulous financial management tools, Alex achieved a state of financial peace. He no longer worried about unexpected expenses or the uncertainty of the future. Instead, he focused on building his wealth and creating a fulfilling life.

Sarah’s Second Chance: Although Sarah’s financial journey was filled with challenges, she eventually embraced the path to financial literacy. After incorporating WiserStep into her life, she gained better control over her spending, cleared her debts, and started saving for her dreams.

Conclusion: The tale of Alex and Sarah illustrates the profound impact of finance management on one’s life. While Alex excelled and thrived with the help of WiserStep, Sarah faced numerous hurdles due to her initial lack of financial discipline. The key takeaway from their stories is that wise financial management can pave the way to a brighter and more fulfilling future. By leveraging tools like WiserStep and cultivating financial awareness, anyone can achieve financial success, security, and ultimately, a life of abundance.