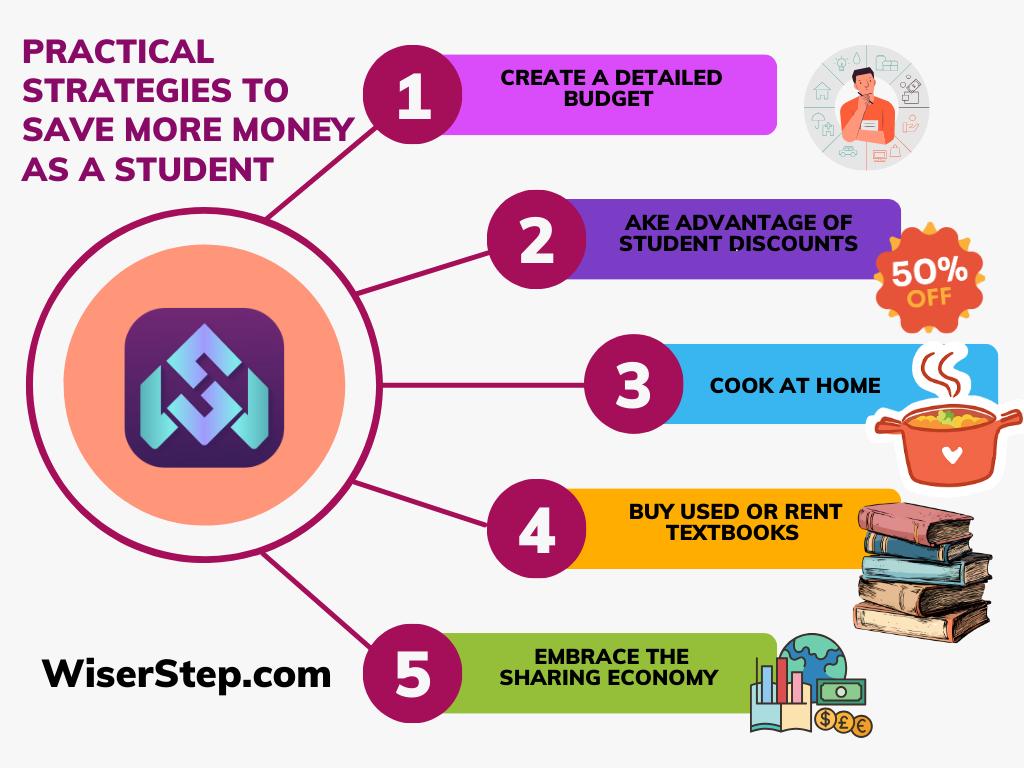

Being a student often means living on a tight budget, but that doesn’t mean you can’t save money. With a little financial savvy and discipline, you can start building your savings even while studying. In this blog post, we’ll explore five practical ways to save more as a student. By implementing these strategies, you can ease financial stress and set yourself up for a more secure future.

Create a Detailed Budget

The first step in saving money as a student is to create a comprehensive budget. Begin by calculating your total monthly income, including any financial aid, part-time job earnings, or allowances from family. Then, list all your monthly expenses, such as rent, utilities, groceries, transportation, and discretionary spending. This will give you a clear picture of your financial inflows and outflows.

Once you have a budget in place, it’s easier to identify areas where you can cut back. Allocate a portion of your income for savings and make it a non-negotiable expense, just like rent or utilities. Budgeting apps and tools can help you track your spending and stay on top of your financial goals.

Take Advantage of Student Discounts

As a student, you’re entitled to various discounts and special offers. These discounts can significantly reduce your expenses if you take full advantage of them. Whether you’re shopping for textbooks, clothing, or enjoying a night out, always inquire about student discounts. Many retailers, theaters, museums, and public transportation systems offer reduced rates for students. Keep your student ID handy and explore student-specific discount websites or apps to find even more savings opportunities.

Cook at Home

Eating out can be a major drain on your finances. Consider making cooking at home a regular habit. Plan your meals, create a shopping list, and buy groceries in bulk to save money in the long run. Cooking at home not only saves you money but also allows you to make healthier food choices. Experiment with affordable and easy-to-cook recipes, and you might discover a newfound passion for cooking. This skill will serve you well beyond your student years.

Buy Used or Rent Textbooks

Textbooks can be a significant expense for students. Instead of buying brand new books at full price, explore cost-effective alternatives. Many online platforms and campus bookstores offer used textbooks or rental options at a fraction of the cost. You can also consider sharing textbooks with classmates or using digital versions when available. Be proactive and plan your textbook purchases in advance to take advantage of these money-saving opportunities.

Embrace the Sharing Economy

The sharing economy has revolutionized the way we access goods and services, making it easier to save money as a student. Instead of owning a car, consider using ride-sharing services or public transportation, especially if you live on or near campus. When traveling, explore affordable accommodations through platforms like Airbnb or opt for hostels. Additionally, you can share streaming subscriptions with friends or roommates to split the cost and enjoy entertainment without breaking the bank.

As a student, managing your finances wisely is a crucial skill that will serve you well throughout your life. By following these five practical strategies—creating a detailed budget, leveraging student discounts, cooking at home, buying used or renting textbooks, and embracing the sharing economy—you can save more money while pursuing your education. Remember, small changes in your financial habits today can lead to significant savings and financial security in the future. Start implementing these tips now, and you’ll be on your way to building a more stable financial future as a student