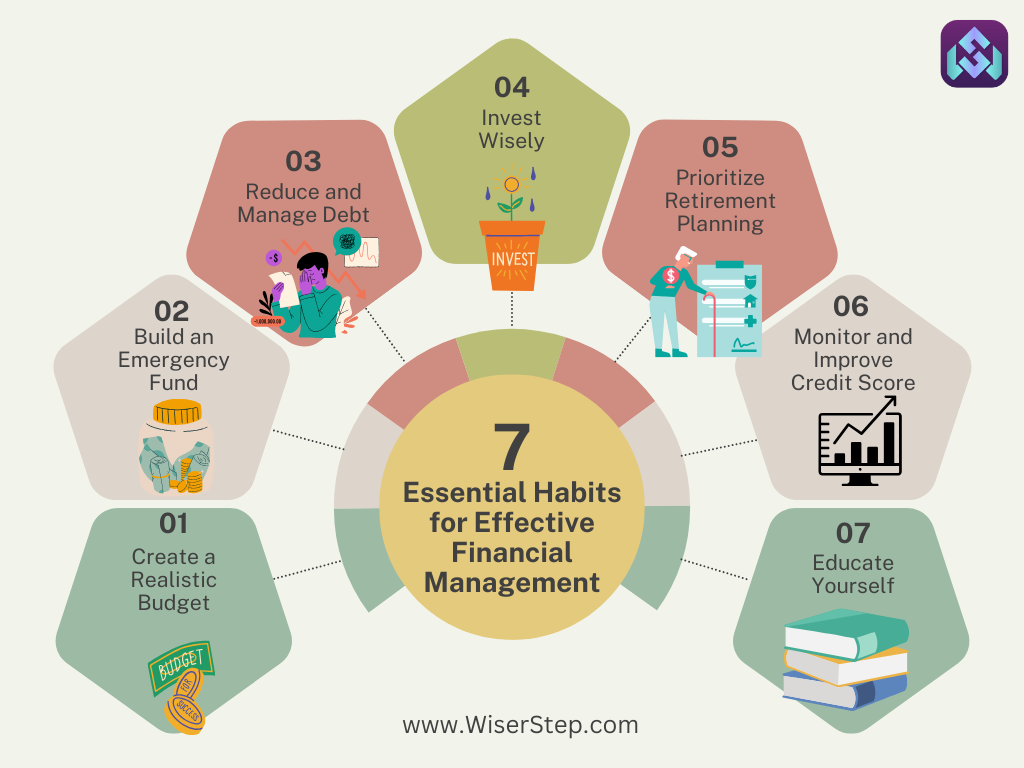

In today’s fast-paced world, managing finances has become a critical skill for individuals and families alike. From budgeting to saving and investing, adopting healthy financial habits is crucial for long-term financial stability. In this blog, we will explore seven key things you can do to keep your finances well-managed and thriving.

Create a Realistic Budget

The cornerstone of effective financial management is a well-thought-out budget. Begin by tracking your monthly income and fixed expenses, such as rent or mortgage, utilities, and insurance. Once you’ve identified your essential expenses, allocate a portion of your income towards savings and discretionary spending. Be realistic about your financial goals and adjust your budget accordingly. Regularly review and update your budget to accommodate changes in income or expenses.

Build an Emergency Fund

Life is unpredictable, and unexpected expenses can arise at any time. Building an emergency fund is a crucial step in financial planning. Aim to set aside three to six months’ worth of living expenses in a separate savings account. This fund acts as a financial safety net, providing peace of mind in the face of unforeseen circumstances like medical emergencies, car repairs, or job loss. Prioritize this fund to ensure you are prepared for the uncertainties that life may throw your way.

Reduce and Manage Debt

High-interest debt can quickly become a financial burden, hindering your ability to achieve your long-term goals. Take proactive steps to reduce and manage your debt effectively. Start by prioritizing high-interest debts and creating a repayment plan. Explore debt consolidation options or negotiate with creditors to secure lower interest rates. Commit to making consistent, timely payments to gradually eliminate outstanding balances. As you pay off debts, redirect those funds towards your savings or investments.

Invest Wisely

Investing is a powerful tool for wealth accumulation and financial growth. Explore various investment options based on your risk tolerance, financial goals, and timeline. Consider diversifying your investment portfolio to spread risk across different assets. Consult with a financial advisor to create a well-balanced investment strategy tailored to your unique circumstances. Regularly review and adjust your investment portfolio as your financial situation and market conditions evolve.

Prioritize Retirement Planning

Planning for retirement is a long-term financial goal that requires early and consistent attention. Take advantage of employer-sponsored retirement plans, such as 401(k) or pension schemes, and contribute regularly. If your employer offers a matching contribution, make sure to maximize this benefit. Additionally, explore individual retirement accounts (IRAs) and other retirement savings vehicles to supplement your employer-sponsored plans. The earlier you start saving for retirement, the more time your investments have to grow, thanks to the power of compounding.

Monitor and Improve Credit Score

Your credit score plays a significant role in determining your access to credit, interest rates, and overall financial health. Regularly monitor your credit report for inaccuracies or suspicious activities. Pay bills on time and in full to maintain a positive credit history. If you have existing debt, focus on reducing outstanding balances to improve your credit utilization ratio. A higher credit score can result in lower interest rates on loans and better financial opportunities in the future.

Educate Yourself

Financial literacy is a key component of effective financial management. Take the time to educate yourself about personal finance, investment strategies, and economic trends. Attend workshops, read books, and follow reputable financial news sources to stay informed. The more you understand about managing money, the better equipped you’ll be to make informed decisions that align with your financial goals.

Effectively managing your finances requires a combination of discipline, planning, and ongoing education. By adopting these seven key habits – creating a realistic budget, building an emergency fund, managing debt, investing wisely, prioritizing retirement planning, monitoring your credit score, and continuing to educate yourself – you can set yourself on a path to financial success and security. Remember that financial management is a lifelong journey, and consistency in these habits will lead to long-term financial well-being.