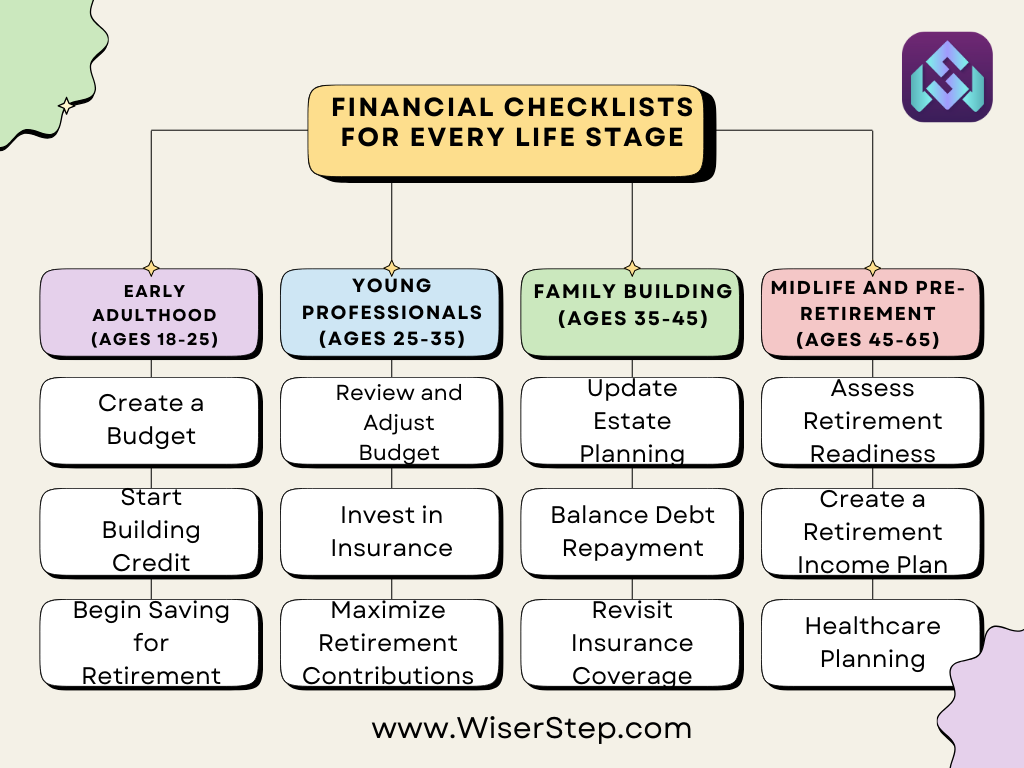

Financial planning is a lifelong journey that evolves with each stage of life. Whether you’re just starting out in your career, raising a family, or preparing for retirement, having a tailored financial checklist can guide you toward making informed decisions and securing your financial future. Here’s a comprehensive guide to financial checklists for every significant life stage.

Early Adulthood (Ages 18-25)

Establish Financial Goals

Define short-term and long-term financial goals, such as building an emergency fund, paying off student loans, or saving for future investments.

Create a Budget

Develop a budget that accounts for expenses, debt repayments, and savings. Track spending habits to ensure financial discipline.

Start Building Credit

Open a credit card or take out a small loan to establish a credit history. Focus on responsible credit usage and timely payments.

Begin Saving for Retirement: Even small contributions to a retirement account, can have a significant impact due to compounding interest over time.

Young Professionals (Ages 25-35)

Increase Emergency Savings

Aim to have at least three to six months’ worth of living expenses saved in an easily accessible account.

Review and Adjust Budget

As income and expenses change, revisit the budget regularly. Allocate more funds towards savings and investments as income grows.

Invest in Insurance

Consider health insurance, life insurance, and disability insurance to protect against unexpected events that could derail financial stability.

Maximize Retirement Contributions

Take advantage of employer-sponsored retirement plans and contribute enough to receive the full employer match, if available.

Family Building (Ages 35-45)

Plan for Major Expenses

Prepare for significant life events like buying a home, funding children’s education, and planning for growing family needs.

Update Estate Planning

Consider creating or updating a will, establishing trusts, and assigning guardianship for minor children to secure assets and protect loved ones.

Balance Debt Repayment and Savings

Prioritize debt repayment while continuing to save for retirement and other future goals.

Revisit Insurance Coverage

Evaluate insurance needs and adjust coverage to align with family requirements, considering life changes and growing responsibilities.

Midlife and Pre-Retirement (Ages 45-65)

Maximize Retirement Contributions

As retirement approaches, increase contributions to retirement accounts and catch-up contributions, if available.

Assess Retirement Readiness

Evaluate retirement savings, investment portfolios, and anticipated expenses to ensure alignment with retirement goals.

Create a Retirement Income Plan

Explore different retirement income sources, such as pensions, Social Security, and investment income. Consider annuities or other strategies for income stability.

Healthcare Planning

Research healthcare options and consider long-term care insurance or other strategies to cover potential healthcare expenses in retirement.

Retirement (65+)

Review Retirement Income Strategies

Regularly assess retirement income sources and adjust spending habits based on investment performance and financial needs.

Estate and Legacy Planning

Continuously update estate plans, wills, and beneficiaries to ensure assets are distributed according to wishes.

Monitor Health Expenses

Keep track of healthcare expenses and consider supplemental health insurance or Medicare Advantage plans to cover additional medical costs.

Stay Engaged and Informed

Remain active and engaged in financial matters. Stay informed about economic trends, investment opportunities, and tax implications.

At each life stage, financial priorities and responsibilities shift, requiring adjustments in financial planning strategies. By following tailored financial checklists for every life stage, individuals can proactively manage their finances, secure their future, and navigate the various milestones with confidence. Remember, financial planning is not a one-time task but an ongoing process that evolves alongside life’s journey.