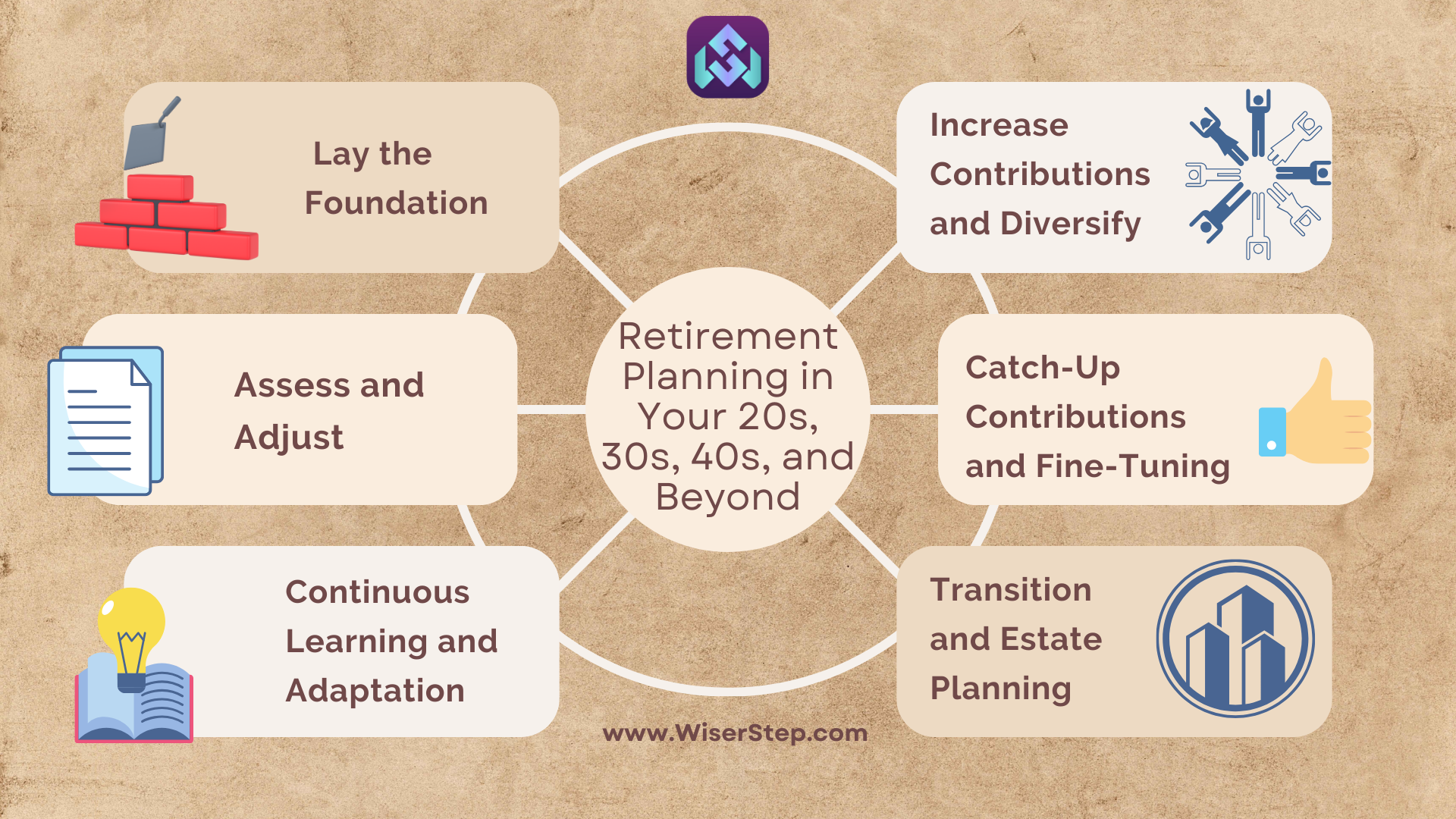

Retirement planning is a journey that evolves with each stage of life. Whether you’re in your 20s, 30s, 40s, or beyond, it’s never too early or too late to start preparing for your retirement. In this step-by-step guide, we will explore the key strategies for retirement planning at different ages, ensuring you have a secure and comfortable retirement ahead.

In Your 20s: Lay the Foundation

Start as early as possible. In your 20s, time is your greatest asset due to the power of compounding interest. Begin by establishing an emergency fund to cover unexpected expenses. Contribute to your employer-sponsored retirement plan, especially if your employer offers a match – it’s essentially free money.

In Your 30s: Increase Contributions and Diversify

By your 30s, you likely have a more stable income. Increase your retirement contributions, aiming to save at least 15% of your annual income. Diversify your investments across different assets to spread the risk. Consider opening a Roth IRA, which offers tax-free withdrawals in retirement, providing you with flexibility and tax advantages.

In Your 40s: Assess and Adjust

Your 40s are a critical period for retirement planning. Take stock of your retirement accounts and assess if you are on track to meet your goals. If needed, increase your contributions further. Pay down high-interest debts to reduce financial burdens in retirement. Additionally, consider long-term care insurance and review your life insurance policies to ensure they align with your family’s needs.

In Your 50s: Catch-Up Contributions and Fine-Tuning

In your 50s, you are eligible for catch-up contributions to retirement accounts, allowing you to contribute more. Maximize these contributions to bolster your savings. Fine-tune your investment portfolio, gradually shifting towards more conservative options to protect your nest egg from market volatility. Review your retirement budget and healthcare plans, factoring in potential medical costs.

In Your 60s and Beyond: Transition and Estate Planning

As retirement nears, create a detailed retirement budget that considers your expected income sources, including Social Security and any pensions. Evaluate your healthcare coverage, especially if you retire before Medicare eligibility at age 65. Consider downsizing your home to reduce living expenses. Develop an estate plan, including a will, power of attorney, and healthcare directives, to protect your assets and ensure your wishes are respected.

Continuous Learning and Adaptation

Retirement planning is not a one-time event but a lifelong process. Stay informed about changes in tax laws, retirement account rules, and investment strategies. Regularly review your portfolio, ensuring it aligns with your risk tolerance and financial goals. Consider working with a financial advisor who can provide personalized guidance based on your unique situation.

Maintain a Healthy Lifestyle

Your health plays a significant role in your retirement years. Adopt a healthy lifestyle that includes regular exercise, a balanced diet, and sufficient sleep. Investing in your health not only improves your quality of life but also reduces healthcare costs in retirement.

Embrace a Purposeful Retirement

Retirement isn’t just about financial planning; it’s also about finding purpose and fulfillment. Consider engaging in activities you are passionate about, volunteering, or pursuing hobbies. Cultivate social connections, as they are crucial for mental and emotional well-being during retirement.

In conclusion, retirement planning is a gradual process that requires diligence, adaptability, and a long-term perspective. Regardless of your age, taking proactive steps today can significantly impact your financial security tomorrow. By following this step-by-step guide, you can build a robust retirement plan tailored to your needs and aspirations, ensuring you enjoy your golden years with peace of mind and financial freedom. Remember, the key is to start early, stay consistent, and continuously adapt your plan to align with your evolving life circumstances.