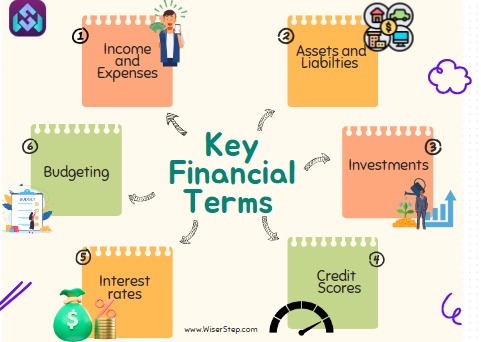

In the vast landscape of finance, understanding the jargon is akin to possessing a map for a challenging journey. Whether you’re planning your budget, investing in stocks, or just trying to comprehend the business section of the newspaper, familiarity with key financial terms is indispensable. Let’s unravel the complexities by exploring some of these fundamental concepts.

Assets and Liabilities

Assets are what you own, such as cash, property, or investments, while liabilities are what you owe, including loans and debts. Your net worth is the difference between your assets and liabilities, providing a snapshot of your financial health.

Income and Expenses

Income refers to the money you earn, whereas expenses are the costs you incur. Managing the balance between your income and expenses is essential for financial stability. This balance forms the basis of budgeting, helping you plan your expenditures effectively.

Budgeting

Budgeting involves creating a plan for your income and expenses. It helps you allocate funds for different purposes, ensuring that you don’t overspend. A well-structured budget is crucial for saving, investing, and achieving your financial goals.

Interest Rates

Interest rates determine the cost of borrowing money or the return on investments. Understanding different types of interest rates, such as fixed and variable, enables you to make informed decisions about loans and savings accounts.

Credit Score

Your credit score reflects your creditworthiness and influences your ability to secure loans and credit cards. Maintaining a good credit score involves paying bills on time, managing debts responsibly, and monitoring your credit report regularly.

Investments

Investments include various assets like stocks, bonds, real estate, and mutual funds. Diversification, the practice of spreading investments across different types of assets, reduces risk and enhances potential returns. Understanding the concept of risk tolerance is vital when investing.

Compound Interest

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. This concept highlights the importance of starting to save and invest early, as it allows your money to grow exponentially over time.

Inflation

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of money. Being aware of inflation helps you make long-term financial plans and investments that outpace the rising cost of living.

Taxation

Understanding the basics of taxation, including income tax, capital gains tax, and deductions, ensures you comply with legal requirements and optimize your tax liabilities. Knowledge of tax-saving instruments can help you minimize your tax burden.

Retirement Planning

Retirement planning involves saving and investing to ensure a financially secure future after you stop working. Pension funds play a vital role in retirement savings.

Emergency Fund

An emergency fund is a reserve of money set aside to cover unexpected expenses like medical emergencies or job loss. Having an adequate emergency fund provides financial security and prevents you from falling into debt during challenging times.

Insurance

Insurance products, including health, life, auto, and home insurance, protect you from financial losses in various situations. Understanding different types of insurance policies helps you choose the right coverage tailored to your needs.

In conclusion, gaining familiarity with these key financial terms empowers you to make informed decisions, plan for the future, and navigate the complex world of finance with confidence. Whether you’re a young professional just starting your career or someone approaching retirement, these concepts serve as the foundation for building a secure and prosperous financial future. By investing time to understand and apply these principles, you pave the way for a stable, stress-free financial life