In today’s fast-paced digital world, managing personal finances can be a challenging endeavor. Fortunately, technology has empowered us with a wide array of tools and finance apps that help us take control of our money, save, invest, and reach our financial goals. One such remarkable finance management app is WiserStep. In this blog, we’ll explore success stories of individuals who have achieved financial success with the help of WiserStep and other finance apps.

The Power of Financial Planning

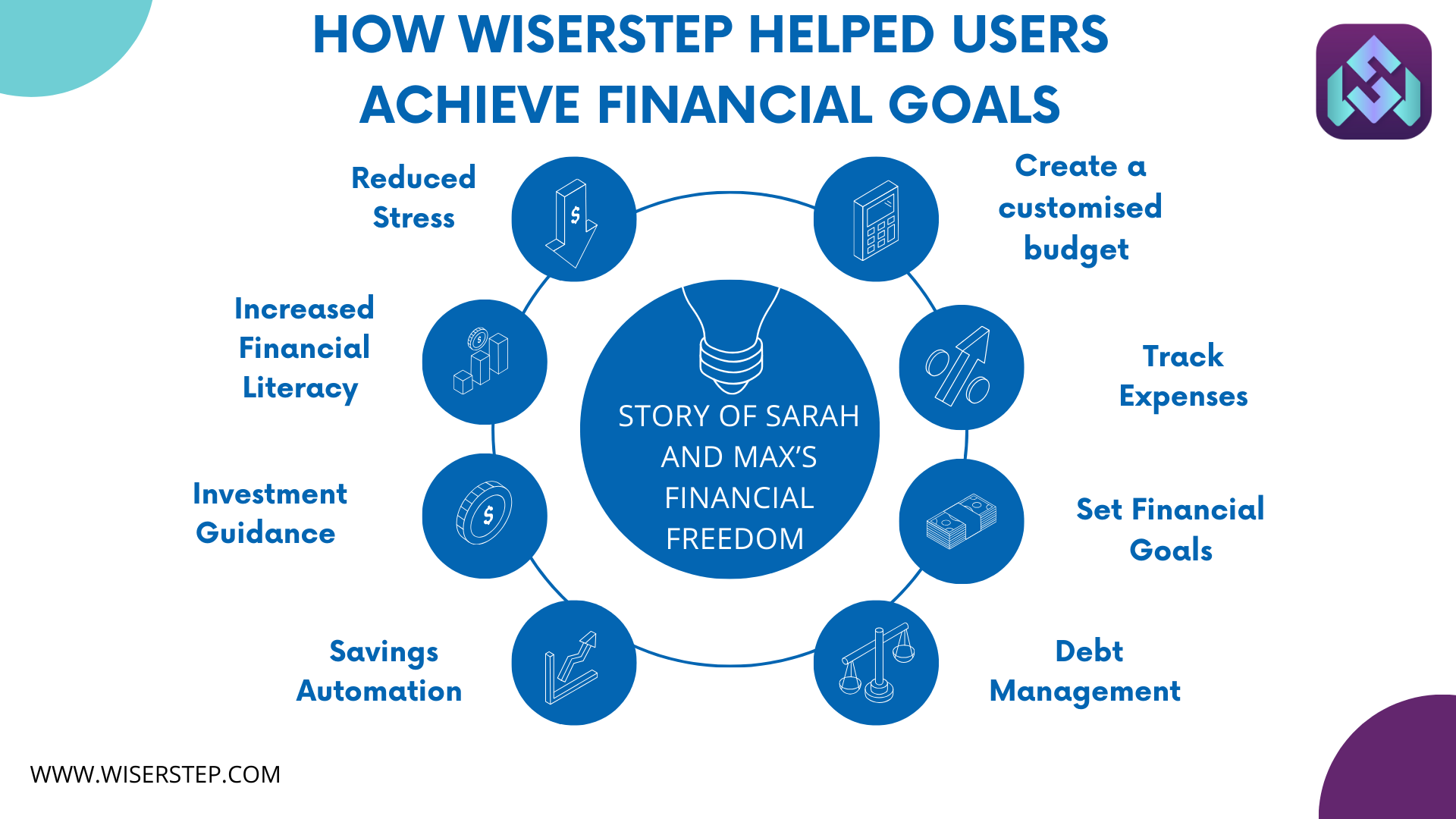

Financial planning is the cornerstone of any successful financial journey. It involves setting clear financial goals, creating a budget, and monitoring your spending. Finance apps like WiserStep make this process more accessible and efficient. Let’s take a look at how they have helped users achieve their financial goals.

Sarah’s Journey to Debt Freedom

Sarah, a recent college graduate, found herself burdened with student loans and credit card debt. She felt overwhelmed and didn’t know where to start. That’s when she discovered WiserStep. Using the app, she created a comprehensive budget and started tracking her expenses. The app’s debt management feature helped her organize her loans and create a plan for repayment.

WiserStep allowed Sarah to visualize her progress as her debt decreased each month. It also provided educational resources on financial literacy, empowering her to make informed decisions. Thanks to her dedication and the support of WiserStep, Sarah became debt-free within three years.

Max’s Path to Homeownership

Max and his wife dreamed of owning a home, but they were struggling to save for a down payment. . The app’s goal tracking feature allowed them to watch their savings grow steadily over time.

In addition to WiserStep, they also used investment apps to grow their savings. They invested in a diversified portfolio and saw their money grow faster than traditional savings accounts. With diligent saving and strategic investing, Max and his wife achieved their goal of homeownership in just four years.

The Role of WiserStep

WiserStep, in particular, played a pivotal role in these success stories. It offers a user-friendly interface that allows individuals to.

Create a Customized Budget

The app helps users create a budget tailored to their income and expenses, ensuring they have a clear financial roadmap.

Track Expenses

It provides expense tracking tools that make it easy to monitor spending and identify areas where savings can be made.

Set Financial Goals

WiserStep allows users to set specific financial goals, whether it’s paying off debt, saving for a vacation, or buying a home. The app then provides actionable steps to achieve these goals.

Debt Management

For those struggling with debt, the app offers features to manage and pay down debt efficiently, such as creating a debt payoff plan.

Investment Guidance

The app provides educational resources and investment advice to help users grow their money wisely.

The Wider Impact

The success stories of Sarah and Max are just two examples of how finance apps, including WiserStep, have helped individuals achieve their financial aspirations. These stories highlight the app’s impact in various aspects of personal finance management:

Increased Financial Literacy

Finance apps often include educational resources and tips, empowering users to make informed financial decisions.

Reduced Stress and Anxiety

By offering a clear financial roadmap and tracking progress, these apps can reduce the stress associated with money management.

Improved Saving and Investment

Automation and guidance provided by finance apps make it easier for users to save and invest, accelerating their progress towards their financial goals.

Debt Elimination

Debt management features in apps like WiserStep help users create strategies to pay off debt, ultimately leading to financial freedom.

Fulfilling Aspirations

Whether it’s buying a home, going on a dream vacation, or retiring comfortably, finance apps like WiserStep help individuals turn their dreams into reality.

In conclusion, finance apps like WiserStep have transformed the way individuals manage their finances. They provide accessible tools and resources that empower users to take control of their money, set financial goals, and work toward achieving them. As seen through the success stories of individuals like Sarah and Max, these apps have the potential to turn dreams into reality, one financial goal at a time. Whether you’re looking to get out of debt, save for a major purchase, or invest for the future, a finance app like WiserStep can be your trusted companion on your financial journey.