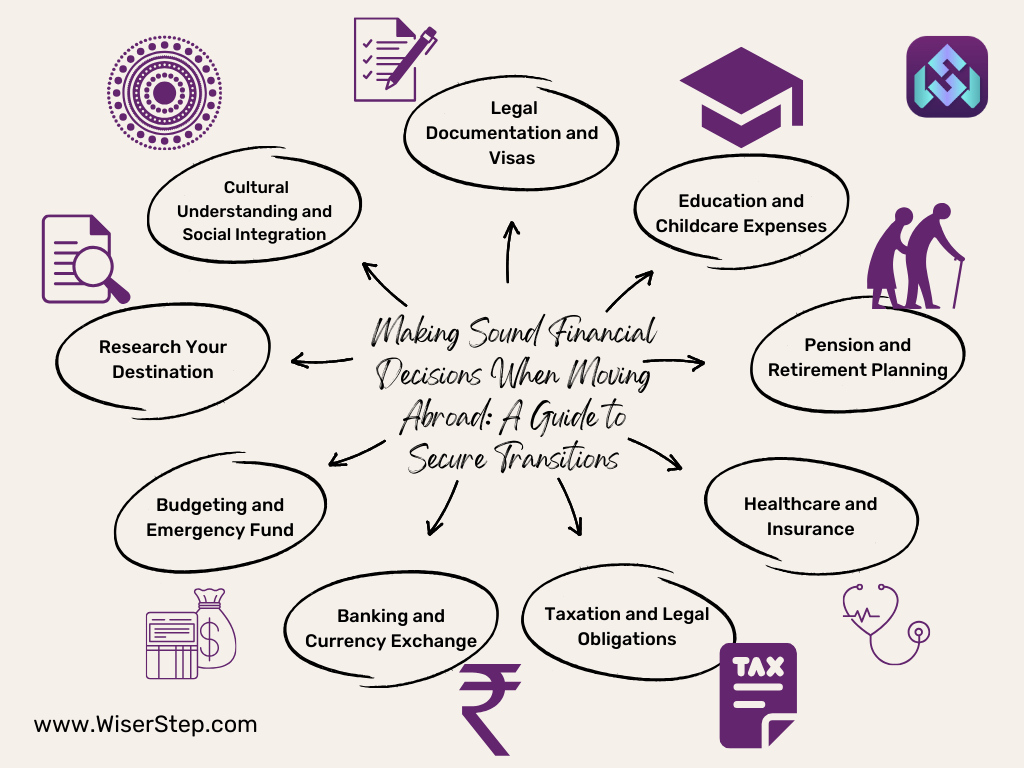

Moving to another country is an exciting venture, filled with new experiences and opportunities. However, amidst the excitement, it’s crucial to make well-informed financial decisions to ensure a smooth transition and a secure future. Planning ahead and understanding the key financial aspects can make a significant difference in your life abroad. In this blog post, we will explore the essential financial decisions you should consider before moving to another country.

Research Your Destination

The first step in making sound financial decisions when moving abroad is to thoroughly research your destination. Understand the cost of living, local taxation policies, healthcare system, and job market. This information will help you create a realistic budget and plan your finances accordingly.

Budgeting and Emergency Fund

Create a comprehensive budget that includes your living expenses, transportation, healthcare, and leisure activities. Factor in currency exchange rates, inflation, and potential fluctuations in income. It’s also crucial to build an emergency fund that can cover at least six months’ worth of expenses. This safety net provides financial security in case of unexpected events like job loss or medical emergencies.

Banking and Currency Exchange

Research local banks and their services for expatriates. Compare account types, fees, and international transaction charges. Additionally, understand the currency exchange rates and fees associated with transferring money between your home country and the destination country. Opt for the most cost-effective methods to minimize unnecessary expenses.

Taxation and Legal Obligations

Understand the tax laws in both your home country and the destination country. Some countries have tax agreements that prevent double taxation. Determine your tax obligations in both countries, including income tax, property tax, and any other applicable taxes. Consulting a tax professional can help you navigate these complexities.

Healthcare and Insurance

Research the healthcare system in your new country. Understand the available healthcare services, insurance options, and associated costs. Some countries provide universal healthcare, while others require private insurance. Ensure you have comprehensive health insurance coverage to protect yourself from unexpected medical expenses.

Pension and Retirement Planning

If you’re moving permanently or for an extended period, consider your pension and retirement planning. Understand the pension system in your new country and assess how it aligns with your retirement goals. Additionally, continue contributing to your retirement funds in your home country, if applicable, to maintain a diversified portfolio.

Education and Childcare Expenses

If you have children, research the education system in your new country. Understand the costs associated with schooling, extracurricular activities, and childcare services. Plan your budget accordingly to ensure your children receive a quality education without compromising your financial stability.

Legal Documentation and Visas

Ensure all your legal documents, including visas, permits, and residency papers, are in order. Research the requirements and timelines for obtaining these documents. Failing to comply with legal obligations can result in fines, deportation, or other legal consequences that can strain your finances.

Cultural Understanding and Social Integration

Lastly, invest time in understanding the local culture, customs, and social norms. Building a social network in your new community can provide valuable support and help you navigate various aspects of your life, including financial matters. Engaging with the local community can also lead to job opportunities and cost-saving initiatives.

In conclusion, moving to another country is a significant life change that requires careful financial planning and decision-making. By researching your destination, creating a realistic budget, understanding legal and tax obligations, and investing in comprehensive insurance coverage, you can pave the way for a successful and financially secure transition. Remember, seeking advice from financial experts and expatriates who have experienced similar transitions can provide valuable insights and guidance. With thorough preparation, you can embark on your international adventure with confidence and peace of mind