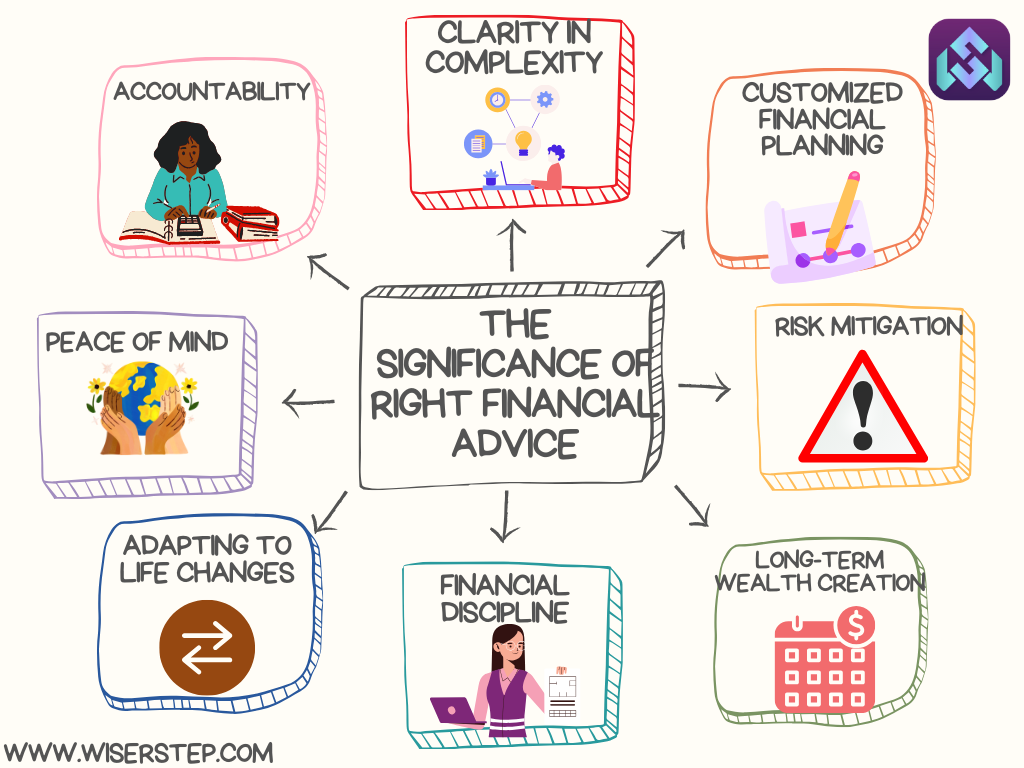

In a world where financial choices are abundant and complex, seeking the right financial advice has never been more crucial. Whether you’re planning for retirement, investing in the stock market, or simply trying to create a budget, the decisions you make today can have a profound impact on your financial future. Here’s why the right financial advice is not just valuable but indispensable.

Clarity in Complexity

Financial matters often involve intricate jargon, diverse investment options, and ever-changing regulations. Navigating this labyrinth without expert guidance can lead to confusion and potentially costly mistakes. The right financial advisor acts as a beacon, simplifying complex concepts and helping you understand your options clearly. With their guidance, you can make informed decisions aligned with your financial goals.

Customized Financial Planning

Each individual or family has unique financial goals, obligations, and aspirations. A one-size-fits-all approach seldom works in finance. A professional financial advisor assesses your specific situation and tailors a financial plan that suits your needs. Whether you’re aiming to buy a house, fund your child’s education, or retire comfortably, personalized advice ensures that your plan is realistic and achievable.

Risk Mitigation

Every financial decision comes with inherent risks. Whether it’s investing in the stock market, real estate, or even choosing an insurance policy, understanding and mitigating these risks is vital. Financial advisors analyze your risk tolerance, aligning your investments accordingly. They help you diversify your portfolio, ensuring that you don’t put all your eggs in one basket, which can shield you from potential financial setbacks.

Long-term Wealth Creation

The right financial advice isn’t just about managing your money for today; it’s about securing your financial future. Advisors help you create a roadmap for long-term wealth creation. By making strategic investments, optimizing tax strategies, and ensuring your money works for you, they pave the way for a secure retirement and financial independence, allowing you to achieve your dreams without constant financial stress.

Financial Discipline and Accountability

Often, the hardest part of financial management is sticking to your plan. Temptations, market fluctuations, and unexpected expenses can derail even the most meticulously crafted financial strategies. A financial advisor not only provides expert advice but also holds you accountable. Regular check-ins and updates ensure you stay on track, fostering financial discipline and reinforcing good financial habits.

Adapting to Life Changes

Life is unpredictable, and your financial needs change with each significant life event – marriage, parenthood, career changes, and even unexpected emergencies. A knowledgeable financial advisor helps you adapt your financial plan to accommodate these changes. They provide guidance on adjusting your investments, insurance coverage, and savings to ensure you’re always prepared for whatever life throws your way.

Peace of Mind

Perhaps one of the most significant benefits of having the right financial advice is the peace of mind it brings. Knowing that your financial future is in capable hands allows you to focus on other aspects of your life. It reduces stress, provides security, and allows you to sleep peacefully at night, knowing that you have a solid financial plan in place.

In conclusion, the importance of seeking the right financial advice cannot be overstated. It is an investment in your future, providing clarity, customization, risk mitigation, long-term wealth creation, financial discipline, adaptability, and, most importantly, peace of mind. Whether you’re just starting your financial journey or you’re well into it, a skilled financial advisor can make a substantial difference. Remember, your financial well-being is not an area where you should ever compromise – seek the guidance you need and take control of your financial destiny today.