Financial literacy is a crucial skill that empowers individuals to make informed decisions about their money. Understanding finances goes beyond just managing bills; it involves budgeting, investing, saving, and planning for the future. In this blog, we will explore six best ways to gain a better understanding of your finances and take control of your financial well-being.

Educate Yourself

Financial education is the foundation of understanding your finances. Start by reading books, articles, and online resources about personal finance. Look for reputable sources and authors who can explain complex financial concepts in simple terms. Some classic books that provide valuable financial insights include “The Total Money Makeover” by Dave Ramsey, “Rich Dad Poor Dad” by Robert Kiyosaki, and “Your Money or Your Life” by Vicki Robin and Joe Dominguez.

Additionally, consider taking online courses or attending workshops on personal finance. Many universities and organizations offer free or low-cost courses that cover topics like budgeting, investing, and retirement planning. Investing in your financial education is an investment in your future financial security.

Create a Budget

A budget is a fundamental tool for understanding and managing your finances. It helps you track your income and expenses, providing a clear picture of where your money is going. To create a budget

- List all your sources of income, including your salary, rental income, or any side hustle.

- Record your monthly expenses, categorizing them into essential (e.g., rent/mortgage, utilities, groceries) and discretionary (e.g., dining out, entertainment).

- Calculate the difference between your income and expenses to determine if you have a surplus or deficit.

- Adjust your spending habits to align with your financial goals. Cut unnecessary expenses and allocate funds for savings and investments.

- Save and Invest Wisely

Saving and investing are essential components of financial literacy. Saving money ensures you have a financial safety net for emergencies, while investing allows your money to grow over time. Consider these tips

Build an emergency fund

Aim to save three to six months’ worth of living expenses in a high-yield savings account for unexpected events.

Save consistently

Set up automatic transfers to your savings account each month to make saving a habit.

Invest for the long term

Invest in a diversified portfolio of stocks, bonds, and other assets to achieve your financial goals, such as retirement or buying a home.

Take advantage of employer benefits

Contribute to retirement accounts and take advantage of employer matching contributions if available.

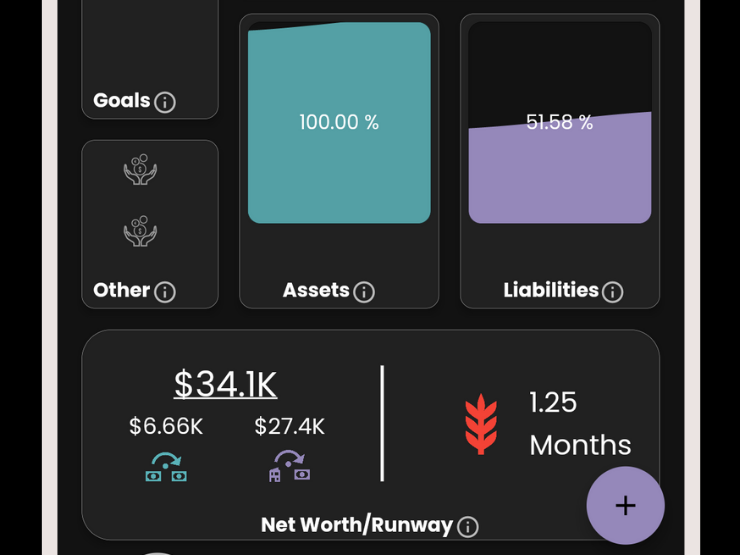

Track Your Net Worth

Your net worth is the difference between your assets (what you own) and your liabilities (what you owe). Monitoring your net worth over time provides a snapshot of your financial health. As you pay off debts and accumulate assets, your net worth should increase.

To calculate your net worth

- List your assets, including savings, investments, real estate, and personal property.

- List your liabilities, such as credit card debt, student loans, and mortgages.

- Subtract your total liabilities from your total assets to determine your net worth.

- Tracking your net worth annually or semi-annually can help you set financial goals and assess your progress toward achieving them.

WiserStep app lets you enter all the entries with assets and liabilities and computes net worth, liquid assets, illiquid assets. The app also smartly computes the runway in number of months by considering the average per-month expenses from past and liquid assets.

Seek Professional Advice

Financial advisors and professionals can provide valuable guidance on complex financial matters. If you have specific financial goals or questions, consider consulting with a certified financial planner or a certified public accountant. These experts can help you create a personalized financial plan, navigate tax strategies, and make informed investment decisions.

Before seeking professional advice, do your research to find a qualified and reputable advisor who aligns with your financial goals and values. Be prepared to discuss your financial situation, goals, and any concerns you may have.

Learn from Your Mistakes

Financial literacy is an ongoing process, and making mistakes is a natural part of the learning curve. Rather than dwelling on past financial missteps, use them as opportunities for growth. Reflect on what went wrong, why it happened, and how you can avoid similar mistakes in the future.

Consider keeping a financial journal to track your financial decisions and their outcomes. This can help you identify patterns and areas for improvement. Remember that financial literacy is a journey, and with each mistake, you gain valuable experience that can lead to better financial choices in the future.

Understanding your finances is essential for achieving financial security and independence. By educating yourself, creating a budget, saving and investing wisely, tracking your net worth, seeking professional advice, and learning from your mistakes, you can gain a comprehensive understanding of your financial situation and make informed decisions that will benefit your financial future. Financial literacy is a lifelong skill that empowers you to take control of your money and work toward your financial goals.