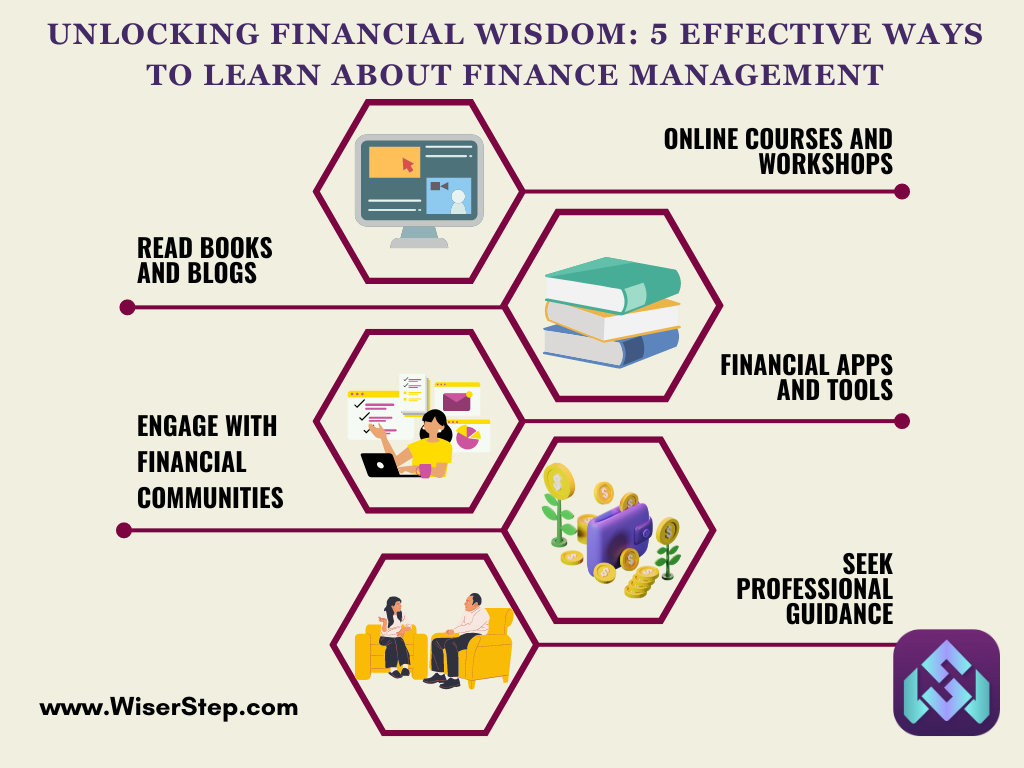

Are you tired of feeling like your finances are a puzzle missing a few crucial pieces? Or maybe you’re eager to take control of your financial destiny but don’t know where to start. Fear not! The world of finance management is vast, but there are plenty of resources and strategies to help you navigate it successfully. In this blog, we’ll explore five effective ways you can learn about finance management and empower yourself to make informed financial decisions.

1. Online Courses and Workshops

In the digital age, knowledge is just a click away. Online platforms like Coursera, Udemy, and Khan Academy offer a plethora of courses on personal finance and financial management. These courses cover everything from budgeting basics to advanced investment strategies. They are often designed to be self-paced, allowing you to learn at your convenience. Many of these platforms also offer workshops and webinars hosted by financial experts, providing you with real-time insights and the opportunity to ask questions.

2. Read Books and Blogs

Books are a treasure trove of financial wisdom. From classics like “The Richest Man in Babylon” by George S. Clason to modern bestsellers like “The Total Money Makeover” by Dave Ramsey, there’s a book for every level of financial literacy. Reading personal finance blogs is another fantastic way to stay informed. Experts and enthusiasts often share their experiences, tips, and advice on topics ranging from saving strategies to retirement planning. Blogs provide practical insights that can resonate with real-life scenarios.

3. Financial Apps and Tools

Technology has revolutionized the way we manage money. Financial apps like WiserStep and Personal Capital offer user-friendly interfaces that help you track expenses, set budgets, and monitor your financial health. These apps provide a hands-on learning experience by visualizing your financial data and helping you identify areas for improvement. WiserStep also offer educational resources within the platform to enhance your financial literacy.

4. Engage with Financial Communities

Networking isn’t just for career growth; it’s essential for financial growth too. Join online forums, social media groups, and communities dedicated to personal finance discussions. Platforms like Reddit and Quora have active communities where individuals share their experiences, seek advice, and exchange financial knowledge. Engaging with these communities can expose you to a wide range of perspectives and strategies, helping you broaden your financial horizons.

5. Seek Professional Guidance

Sometimes, the best way to learn is through one-on-one guidance. Seeking advice from a certified financial advisor or planner can provide you with personalized insights tailored to your unique financial situation and goals. Financial advisors can help you create a comprehensive financial plan, analyze investment options, and navigate complex financial decisions. Remember to choose an advisor with relevant qualifications and a fiduciary duty, meaning they are legally bound to act in your best interest.

Bonus Tip: Learn by Doing

Theory is valuable, but practical application is where true understanding is forged. Apply what you learn to your own financial situation. Create a budget, track your expenses, and experiment with different investment strategies. You can do all this by using app “WiserStep”. Don’t be afraid to make mistakes – they’re valuable learning opportunities that can guide you toward better decisions in the future.

Your Journey to Financial Mastery

Embarking on a journey to learn about finance management is an investment in your future. With the resources available today, there’s no excuse to remain in the dark about your finances. Whether you choose online courses, books, apps, communities, or professional guidance, each avenue offers a unique opportunity to empower yourself with knowledge. Remember, becoming financially savvy is a gradual process, so take your time and enjoy the learning experience. As you unlock the doors of financial wisdom, you’ll find yourself making smarter decisions and taking confident steps toward a brighter financial future.