Debt when left unchecked can become a heavy burden on your financial well-being. However, with a well-defined plan and disciplined approach, you can take control of your debt and work towards a debt-free future. In this blog, we’ll explore essential strategies to manage and eventually eliminate your debt, helping you regain your financial freedom.

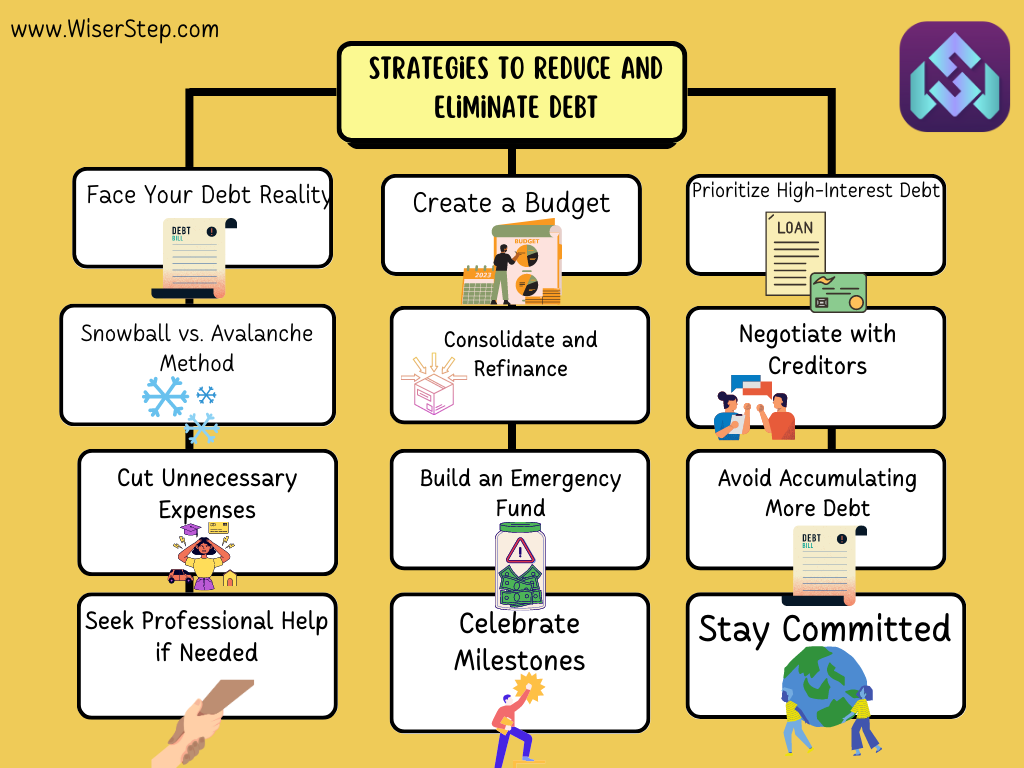

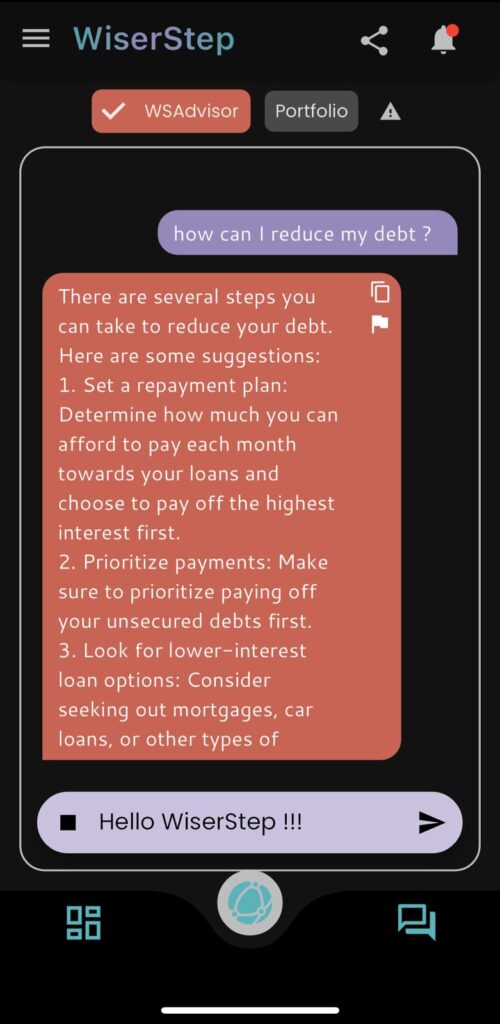

Face Your Debt Reality

The first step in effective debt management is acknowledging your debt and facing it head-on. Collect all your debt information, including balances, interest rates, and monthly payments. This comprehensive view will help you formulate a strategic plan.

Create a Budget

Developing a budget is essential for managing debt. Calculate your monthly income and allocate specific portions to essential expenses, such as housing, groceries, and utilities. Any remaining funds can be directed towards debt repayment.

Prioritize High-Interest Debt

High-interest debt, such as credit card balances, can quickly accumulate due to compounding interest. Prioritize paying off these debts first, as they often carry the most significant financial cost.

Snowball vs. Avalanche Method

Two popular debt repayment methods are the snowball and avalanche methods. The snowball method involves paying off the smallest debt first, providing a psychological boost and momentum. The avalanche method focuses on the highest-interest debt, minimizing the overall interest paid.

Consolidate and Refinance

Consider consolidating multiple debts into a single loan or refinancing high-interest loans to lower rates. Consolidation can simplify payments, and refinancing can save you money on interest over time.

Negotiate with Creditors

If you’re struggling to meet payments, contact your creditors. They may be willing to negotiate lower interest rates, temporary payment reductions, or even debt settlements.

Cut Unnecessary Expenses

Temporarily cut discretionary spending to free up more money for debt repayment. Sacrifices made now will contribute to a debt-free future.

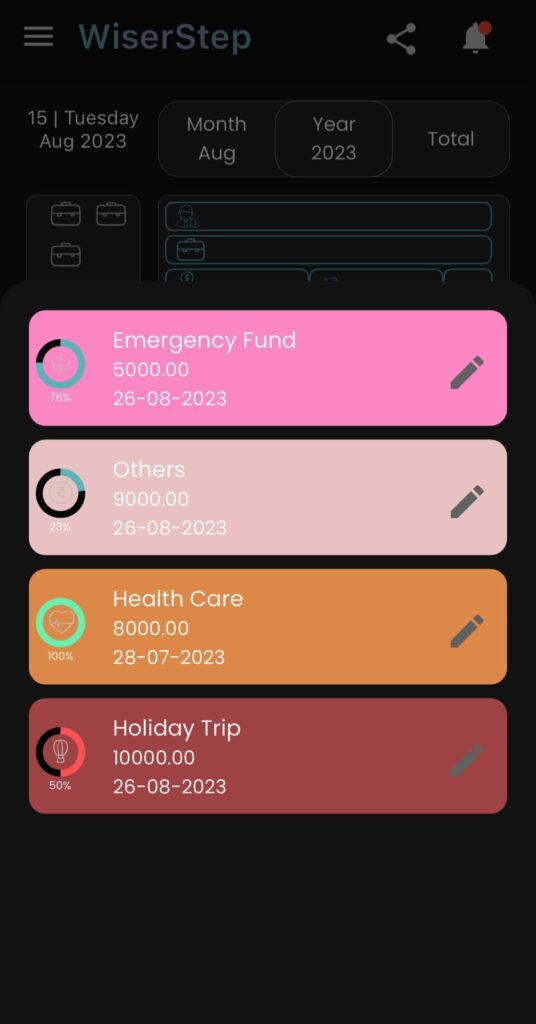

Build an Emergency Fund

While focusing on debt repayment is vital, having an emergency fund is equally crucial. Unexpected expenses can lead to more debt if you’re not financially prepared.

Avoid Accumulating More Debt

While paying off existing debt, avoid accumulating new debt. Pay for expenses with cash or debit to prevent worsening your financial situation.

Seek Professional Help if Needed

If your debt situation feels overwhelming, don’t hesitate to seek professional assistance. Credit counseling agencies and financial advisors can provide guidance tailored to your specific circumstances.

Celebrate Milestones

As you pay off individual debts, celebrate your achievements. These milestones can motivate you to continue on your debt repayment journey.

Stay Committed

Becoming debt-free requires discipline and dedication. Stay committed to your debt management plan, even if progress seems slow at times.

Effectively managing and ultimately eliminating debt is a liberating experience that can significantly improve your financial well-being. By taking proactive steps, creating a solid plan, and remaining disciplined, you can regain control over your finances and work towards a debt-free future. Remember, the journey might be challenging, but the peace of mind and financial freedom that come with it are well worth the effort. Stay focused, stay committed, and envision the debt-free life you’re working tirelessly to achieve.